A California Democrat wants to tax sales of gold, cotton, tobacco and other goods linked to slavery, and divert the money to black residents, in the latest attempt to make reparations a reality.

Assemblyman Reggie Jones-Sawyer’s bill is one of more than a dozen bills backed by the California Legislative Black Caucus that seeks reparations for black Californians, especially descendants of slaves.

They emerge from a July 2023 report by the state Reparations Task Force, of which Jones-Sawyer was a member, and underscore efforts to turn controversial policies into a legally binding compensation plan.

Starting in July 2025, those purchasing ‘gold bars and gold coins’ in California would pay a tax at the time of purchase, the Jones-Sawyer bill states.

Democrat Reggie Jones-Sawyer’s Gold and Cotton Tax Will Buy Black Homes

Those who buy gold bars and coins in the state will be hit by an “unspecified” tax

The tax would also apply to “tangible goods made in whole or in part from cotton or tobacco products.”

Those who buy “wine, olives, cane sugar, granulated sugar, rice and coffee beans” in stores would also pay the tax.

The tax rate is “not specified” at this time, the bill states.

Proceeds would flow into a “Reparations Fund” that would be available to African Americans and would especially focus on those who are “descendants of enslaved people in the United States.”

Black residents could apply to the fund for housing loans or cover tuition costs at approved universities for courses up to four years in length.

Jones-Sawyer’s office did not respond to DailyMail.com’s request for details on how the tax plan would work.

The bill was introduced in February and amended earlier this month.

It focuses on goods linked to the transatlantic slave trade between the 15th and 19th centuries, when at least 12.5 million Africans were kidnapped, forcibly transported by European ships and traders, and sold into slavery.

Those who survived the brutal journey ended up working hard on plantations in the Americas, including Brazil, the Caribbean and the United States, while others benefited from their work.

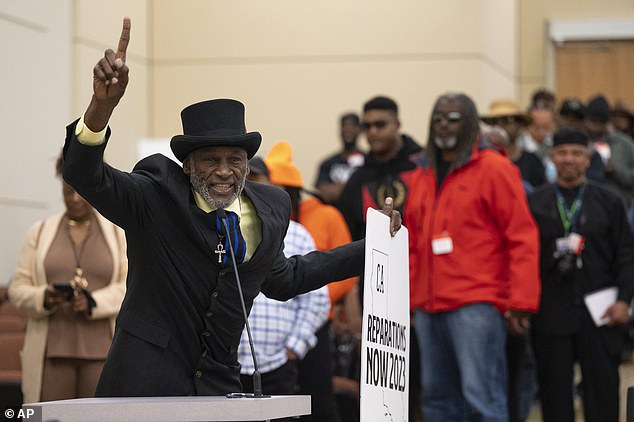

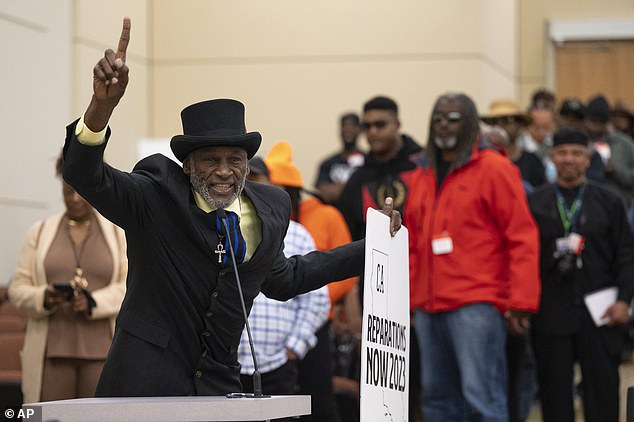

Demonstrations like this helped push reparations through California politics, but it’s still unclear whether they will become law.

Reparations activists have fought to make cash payments to Black people a reality, facing stiff public opposition.

Enslaved Africans ended up working hard on plantations in the Americas, including in Brazil, the Caribbean, and the United States.

A UN report in September suggested that countries should consider financial reparations to compensate for slavery.

The Jones-Sawyer bill was part of a package of more than a dozen proposals introduced last month after California’s first reparations task force submitted a report, two years in the making.

The package did not include the multimillion-dollar cash payments to Black families that task force members had previously proposed.

Reparations advocates say it is time for the United States to pay its black residents for the injustices of the historic transatlantic slave trade, Jim Crow segregation and inequalities that persist to this day.

The sums are staggering: Black lawmakers in Washington are seeking at least $14 trillion for a federal plan aimed at “eliminating the racial wealth gap” between black and white Americans.

Critics say payments to select black people will inevitably stoke divisions between winners and losers, and raise questions about why American Indians and others don’t get their own handouts.

Reparations are popular among blacks who will benefit from them, but unpopular among whites, Asians and others who would foot the tax bill without benefiting themselves.

A survey last year of 6,000 registered California voters found that only 23 percent supported cash reparations, while 59 percent opposed it.