<!–

<!–

<!– <!–

<!–

<!–

<!–

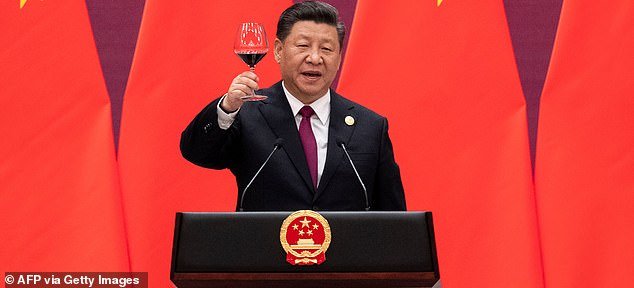

China has recommended dropping tariffs on $1 billion worth of Australian wine exports. USD in an interim decision.

Beijing is reviewing the sanctions through a five-month process after the Albanian government agreed to suspend Australia’s dispute filed with the World Trade Organization until March 31.

The Chinese government released its preliminary recommendation on Tuesday that the customs duty on wine is no longer necessary.

Beijing will announce its final decision later this month, but the move has raised hopes that the tariffs will be removed entirely.

Foreign Minister Penny Wong said the government had stabilized relations with China without compromising the nation’s values.

China has recommended dropping tariffs on $1bn worth of Australian wine exports

“We have delivered on that commitment through calm and consistent dialogue,” she said.

‘We continue to push to remove all remaining trade barriers.’

Trade Minister Don Farrell said the preliminary recommendation was a welcome development.

“It justifies the government’s preferred approach to resolving trade issues through dialogue rather than dispute,” he said.

Australian Grape & Wine chief executive Lee McLean said the decision was a “positive step” towards resuming trade in what was previously the biggest export market.

“We remain cautiously optimistic about the upcoming decision and will await MOFCOM’s (China’s Ministry of Commerce) final decision,” he said.

“We appreciate the cooperation of both the Australian and Chinese governments and industry partners in working towards a solution.”

China raised tariffs on Australian barley last August following a similar process after Labor put a WTO dispute on hold in exchange for a review.

Beijing will announce its final decision later this month, but the move has raised hopes that the tariffs will be removed entirely (pictured, bottles on display in Shanghai)

Beijing imposed $20 billion in sanctions on Australian products amid heightened tensions in 2020.

Sanctions worth $2 billion remain on wine, spiny lobster and some slaughterhouses.

China’s ambassador to Australia, Xiao Qian, said on Monday that the review was ‘moving on the right track, in the right direction’.

Senator Farrell recently met his Chinese counterpart Wang Wentao on the sidelines of the WTO Ministerial Conference in Abu Dhabi last month.