Millions of Americans are religious about racking up credit card points to spend on flights and hotel stays, or simply converting them into cash.

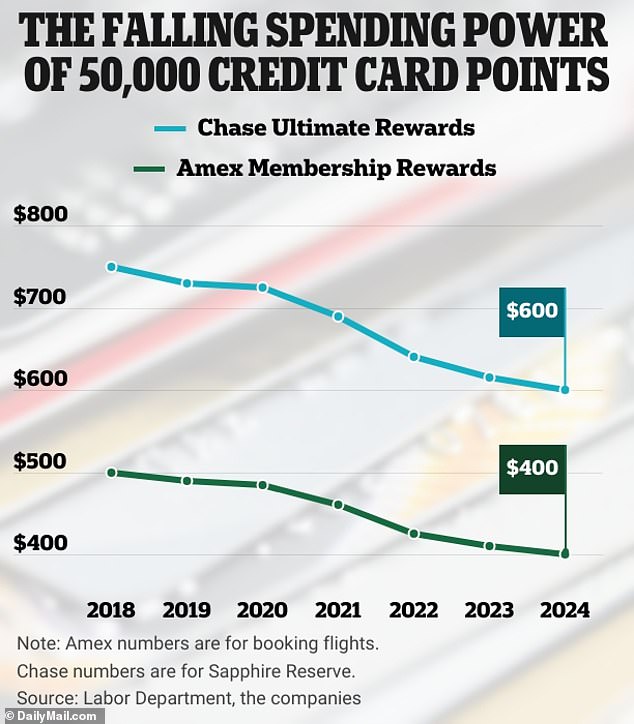

But the spending value of credit card points has fallen in the years since the Covid-19 pandemic as inflation has taken hold.

For some time now, a point redeemed through online banking has been worth around one cent. But a penny has lost about 20 percent of its purchasing power since 2018, according to the Bureau of Labor Statistics.

This means that a point has also lost value by approximately the same amount, depending on The Wall Street Journal.

If you accumulated 50,000 points with a major credit card issuer in 2020 and haven’t spent them yet, they are now worth about 41,300, according to the outlet.

The spending value of credit card points has fallen in the years since the Covid-19 pandemic as inflation has taken hold.

Cardholders racked up points worth more than $34 billion in 2023, according to annual reports from major card companies American Express, Capital One and JPMorgan Chase.

Inflation begins to affect the value of points if users redeem them directly through a bank’s portal or online app.

But the points conversion rate changes when you transfer points from the bank’s portal to a frequent flyer program or another points program.

Different airlines and hotels have their own points rating systems. And many of them are increasing the number of points needed to book, to reflect how prices have increased with inflation.

While the annual inflation rate slowed to 2.5 percent in August, higher inflation has pushed up prices in recent years.

This has meant that the average price of an economy flight purchased with points has increased by around 19 percent since 2019, according to the aviation consultancy. IdeaWorks.

Michael Faulkner, who works in the insurance industry, told The Wall Street Journal that transferred points don’t go as far as they used to.

He said the same flight from his home in Chicago to France increased from 60,000 United Airlines points last year to between 80,000 and 90,000 this year.

Many airlines now price fares for points users more similarly to how they set the cash value of flights.

In 2015, Delta changed its points rates from a fixed-pricing model to dynamic pricing based on time and customer demand, the outlet reported.

Other airlines, such as American and United, have since followed suit.

Inflation begins to affect the value of points if users redeem them directly through a bank’s portal or online app.

The points conversion rate changes when you transfer points from the bank’s portal to a frequent flyer or other points program.

Millions of Americans are religious about racking up credit card points to spend on flights and hotel stays, or simply converting them into cash.

Credit card issuers have typically offered points more liberally in recent years since the pandemic, Tiffany Funk, president and co-founder of Point.Me, which tracks credit card rewards values, told The Wall Street Journal. credit.

That’s instead of increasing the value of rewards to keep up with rising inflation.

She recommends that Americans can find the best deals by opting for cards with easily transferable points.

If you create multiple accounts with different partner companies, Funk said, you can compare prices to see which one offers the best deal.

Spending points soon after they hit your account can also be a good way to avoid “points inflation,” said Nick Ewen, an analyst at The Points Guy.