Apple device users in the United States will soon have the option to use Affirm’s controversial “buy now, pay later” loans for their purchases.

Affirm, one of the three largest providers, will be available as a payment option for US Apple Pay users on iPhones and iPads later this year, the companies announced Tuesday.

“This provides users with additional payment options and offers the ease, convenience and security of Apple Pay along with the features users love in Affirm: flexibility, transparency and no late or hidden payment fees,” Affirm said in a statement to CNBC.

Following the news, Affirm shares rose 4 percent in early trading Tuesday, while Apple shares rose 2.5 percent.

Consumer watchdogs are concerned that BNPL services will cause Americans to go into debt. Affirm is one of the top three BNPL companies, along with Afterpay and Klarna.

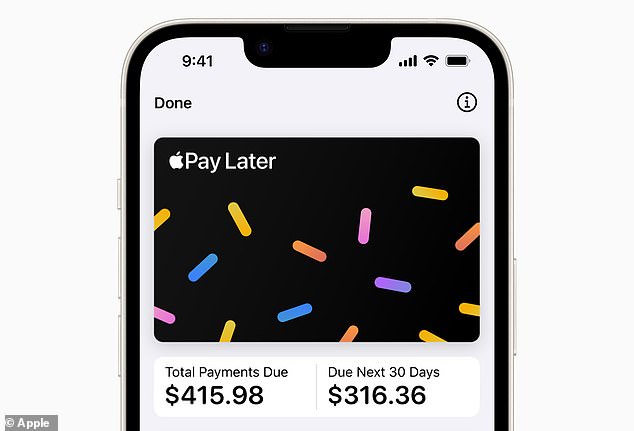

‘Apple Pay Later’ allows shoppers to split a purchase made with Apple Pay into four equal payments over six weeks. It was launched in November. Affirm is now being added

In November, Apple launched its own ‘Apple Pay Later’ for ages 18 and up.

That move was mired in controversy as experts warned it could push households into crippling debt as they are already grappling with the highest living costs in recent memory.

Apple Pay Later allows shoppers to split a purchase made through Apple Pay on an iPhone or iPad into four equal payments over six weeks.

For an approved purchase, the consumer would pay 25 percent of the sum initially and then 25 percent every two weeks until, in theory, the full sum is paid in the sixth week. Apple says it doesn’t charge “interest or fees.”

TO report of the Consumer Financial Protection Bureau noted in September that the number of BNPL loans issued increased nearly tenfold between 2019, when they first gained traction in the U.S., and 2021.

In materials promoting the new service, Apple says that Apple Pay Later was “designed with users’ financial health in mind.” But advocates are skeptical.

“The very use of the product leads to a decline in financial health,” said Nadine Chabrier, senior policy advisor at the Responsible Lending Centerhe told DailyMail.com at the time.

TO research work published in October 2022 used the banking data of 10.6 million people to investigate the financial implications of BNPL. It found that users experienced a “rapid increase in bank overdraft charges and credit card interest and fees, compared to non-users.”

It also projected that the BNPL industry, currently dominated by fintech companies such as Klarna, Affirm and Afterpay, will be worth $25 billion by 2025.

Chabrier warns that Apple is entering a booming but poorly regulated market. BNPL loans are not classified as “consumer credit,” so they are not covered by the Truth in Lending Act, a 1968 federal law created to promote ethical lending.

“They are not required to evaluate the consumer’s ability to repay the loan, they are not required to disclose the APR, which helps the consumer understand how much credit costs, and they are not required to have chargeback and dispute rights that a card of credit,” Chabrier said.