Early bird investing: Using your Isa allowance at the start of the year gives it extra growth time and protection from the tax authorities

Early bird Isa investors can earn higher returns by securing up to a full year’s worth of dividends and potential market growth, ahead of those who leave it until the last minute, new analysis shows.

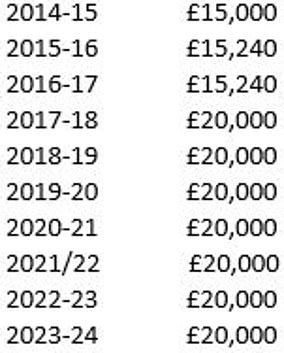

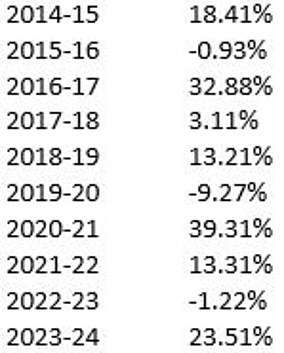

Someone who had invested their entire Isa allowance into a global tracker on the first day of the tax year over the past ten years would have seen their investments grow to £360,500, compared to £322,500 if they had left this until the last day.

If you spread your investment evenly over the year with regular investments, you would have £343,500, according to figures from Hargreaves Lansdown.

It used the actual performance of the Legal & General International Index Fund over the past ten years, and calculated the total return after fund fees but before platform fees.

The fund, with a continuous interest rate of 0.11 percent, tracks global markets with the exception of the United Kingdom.

‘The earlier you use your Isa allowance in the tax year the better, as your investments have longer to grow and are immediately protected from tax,’ says Sarah Coles, head of personal finance at Hargreaves.

But she notes: “The early birds don’t sit pretty every tax year, and in times of market downturns, those who got in towards the end of the tax year are more likely to have dodged the downturns.

“However, the fact that the early birds do so much better over time shows that these years are quickly forgotten among average stock market performance.”

Coles says that if you don’t have a lump sum to invest at the start of a new tax year, you can still start dripping your money into the market through regular investments.

‘By gradually investing in stocks and shares Isa, you benefit from both market falls and rises, through what is known as pound cost averaging.

‘This would have put you very slightly behind the early birds over the past ten years, but well ahead of the last-minute birds.’

Hargreaves analyzed investor behavior on his platform and found that around one in 20 of those who paid into his stocks and shares Isas had invested in the first two weeks of the 2023/24 tax year.

Men are more likely to be early risers than women. Around 62 per cent of Hargreaves Isa customers are men, and men make up 68 per cent of early risers.

“This could come down to the fact that men generally have higher incomes, so they may have more investments outside of an Isa that they want to move into a tax-efficient environment as quickly as possible,” says Coles.

“Given that more of them are senior taxpayers, they also have an incentive to protect their investments from higher dividend tax and capital gains tax rates.”

Hargreaves found that the ‘squeezed middle’ (people aged 30 to 54) is the age group most likely to start Isa investing early.

“This is especially impressive considering that so many of them are in the midst of lives with enormous demands on their time and money,” says Coles.

“It has something to do with the fact that this is the time when we’re likely to have peak income, so more to put aside in savings and investments.”

Sarah Coles: People tend to be early risers or last-minute dashers when it comes to their Isa investing habits

Those in the 65 to 80 age group are the second group most likely to invest early.

“This is notable because this is often a time when investors fall back on existing investments and spending rather than saving,” says Coles. “Some will continue to build investments, while others will maximize the tax efficiency of what they already have.”

Hargreaves also found that people tend to be early risers or last-minute dashers when it comes to their Isa investing habits – only one in 100 people invest at the end of one tax year and the start of the next.

Coles adds: ‘If you’ve always been a go-getter, this is your chance to get ahead of the curve and get the most out of your Isa for the whole of the tax year ahead.’

AJ Bell also found that early bird Isa investors are doing better in his own analysis of investment timing dating back to 1999.

Laith Khalaf, head of investment analysis at the firm, said: ‘The statistics clearly favor early Isa investments over last minute Isa investments. Investing that extra year, if you add it up over the years, makes a huge difference.

“Even if you invest at a terrible time, you can still expect to smell like roses in the long run if you put money to work in the market sooner or later.”

‘Of course, many people leave their Isa contributions until the end of the tax year because they don’t have the money available straight away or wait until the last minute to see how much they can raise in the tax shelter.

‘Under these circumstances, it is wise to make use of the tax shelter as soon as possible, because when the new tax year arrives, the old allowance will be gone forever.’

A recent analysis of the behavior of Isa millionaires by the Interactive Investor platform shows that they tend to make the most of the Isa allowance at the start of each new tax year.

It found that 40 percent of the company’s Isa millionaires’ total 12-month subscriptions were added between April 6 and April 30 in 2023, compared to 23 percent among all its Isa customers.

“Those long-term early bird investors will have had almost an extra year in the market, which will also help give strength to portfolios in a rising market,” said Myron Jobson, senior personal finance analyst at II.

What are the benefits of early bird Isa investing?

Sarah Coles discusses the benefits of investing at the start of each tax year.

– Early bird Isa investors who have a lump sum to invest from the start benefit from up to a full year of dividends and potential growth in the stock market.

– By investing early, you get an extra year of tax protection.

– If you hold investments outside an ISA, the fact that the dividend tax exemption has been halved to £500 means investors risk paying tax on their dividends much earlier in the year. Converting them into an Isa (also known as a Bed and Isa) via share swap will immediately protect them from this tax.

– Similarly, the reduction in capital gains tax allowances to £3,000 means that investors planning to realize profits early in the tax year risk busting their allowances.

Switching to an Isa on day one gives you the freedom to sell what you want when it makes the most sense for your finances, without thinking about taxes.

– For those building a portfolio, starting early gives you the opportunity to set up regular monthly payments into stocks and shares Isa each month, and automatically spread your investments over the tax year.

You benefit from market declines through the so-called pound cost average. Investing a fixed amount each month allows you to buy more units if the value of a fund falls, potentially making bigger profits if its value rises.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.