Table of Contents

Young drivers spend up to 10 per cent of their full-time income on the cost of their car insurance, new data reveals.

Drivers as young as 18 face annual car insurance costs of almost £2,000 as premiums rise massively year on year.

This comes as one in five motorists say they are driving less due to the high cost of living.

For young people in 2024 it will cost a whopping 135 per cent more than the inflation rate over the past 35 years, compared with 1989 when it cost £3,234 (adjusted for inflation).

The average cost of car insurance quotes for drivers aged 18 to 21 is now £2,350 after premiums continued to rise over the past year, latest figures from Confused.com show.

The comparison site’s latest car insurance price index estimates the average insurance price to rise by 17 per cent (£335) for this hard-hit age group.

Compared to their average earnings of £23,668, that’s a huge chunk (9.9 per cent) of their salary going towards insuring their car.

Similarly, drivers in their 20s and 30s are feeling the pinch of high premiums and are having to part with a significant portion of their salary to cover insurance costs.

The latest data shows the average premium quoted for drivers aged between 22 and 29 is £1,484, an annual increase over the past 12 months of 11 per cent (£151).

The average full-time salary is £32,172, which would leave drivers spending 5 per cent of their annual salary on insurance.

The latest data shows that the average premium for drivers aged 22 to 29 is £1,484, which is an 11 per cent annual increase over the past 12 months (£151). The average full-time salary is £32,172, which would leave drivers spending 5 per cent of their annual salary on insurance.

| Insurer | Average annual percentage rate | |

|---|---|---|

| 1. | The Insurance Cooperative | 29.89% |

| 2. | AA Insurance | 26.9% |

| 3. | Hastings direct | 26.9% |

| 4. | SecurePink | 26.9% |

| 5. | The people’s choice | 26.9% |

| 6. | The green insurer | 26.6% |

| 7. | Santander | 26.5% |

| 8. | Churchill, Darwin, Direct Line, Privilege | 23.3%-28.9% |

| 9. | Bank of Scotland | 23.5% |

| 10. | Halifax | 23.5% |

| Source: Which? Car Insurer Survey | ||

The sting operation against young driver insurance comes as it is revealed that paying for insurance monthly could cost almost 50 per cent more.

Drivers who pay in monthly instalments are being hit with sky-high interest rates of up to 45 per cent APR, consumer group Which? has revealed.

The consumer watchdog’s investigation found that while the average annual rate for a car is 22.33 per cent, some providers were charging much higher rates.

One car insurance company, iG04, charged 41.5 per cent: a 40-year-old in south London was quoted £999.65 if they paid in advance, rising to an astronomical £1,158.11 payable monthly.

While iG04 did not disclose its average APRs to Which?, other big names including Swinton, Hastings Direct and AA charge APRs between 26.9 per cent and 33.8 per cent.

Co-operative Insurance broker has the highest average APRs for both home and auto insurance at 29.989 percent.

High car insurance costs and living costs are changing driving habits

A survey of 2,000 UK drivers in July found that two in five (39 per cent) of motorists say their car insurance is more expensive than ever, while one in three say it is close to becoming more expensive.

The impact of high car insurance costs cannot be overlooked, especially in today’s tough financial climate.

One in five (22 percent) say they drive less because of the cost of living, while more than two in five (42 percent) say insurers need to do more to keep their prices lower.

Around one in three (28 percent) also think the government should be stricter with insurers to keep prices affordable.

Which? wants the FCA to introduce an action plan that would force insurers to disclose their profit margins between monthly and annual payers, with deadlines for reducing APRs and consequences for those who fail to comply.

Director of policy and consumer rights, Rocio Concha, said: ‘Many customers who pay monthly do so not by choice, but out of financial necessity.

“That these same customers end up paying more than they pay annually is manifestly unfair.”

The main reason for the rising cost of road trips for young people is due to the massive increase in insurance premiums.

What insurance increases do young drivers face?

Overall, the latest data shows that people aged 38 or under are likely to have annual prices of £1,000 or more.

17-year-olds are experiencing the biggest overall average increase, up a third (33 per cent), with the youngest newly qualified drivers of all age groups hit hardest.

However, 18-year-olds are still paying the most for their car insurance, with average prices now standing at a whopping £2,960, with prices up 23 per cent in 12 months.

This leaves 18-year-olds having to pay an extra £556 this year compared to last year.

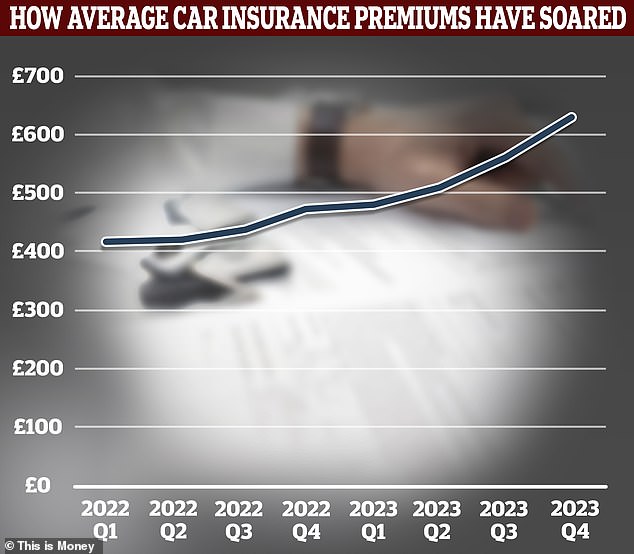

Confused.com estimates that the average price of car insurance is currently £822, up 14 per cent (£106) annually.

The astronomical expense of getting started

Nearly half of young people say they could not afford to drive without financial help from their parents

In March, This is Money reported that it costs an average of £7,609 to get a 17- to 20-year-old driving for their first year.

This was based on data taken from MoneySupermarket’s Household Money Index.

In 1989, the average young driver had to pay £1,285 (£3,234 adjusted for inflation) to get on the road, an increase of 135 per cent in 35 years.

As a result, the struggle to cope with these high and unaffordable costs has left nearly half of young people saying they could not afford to drive without financial help from their parents.

Unfortunately, most parents said they could only contribute £990, 13 per cent of the amount needed.

MoneySupermarket found that a 17-year-old would need to work 1,188 hours on a minimum wage of £6.40 an hour to cover the cost of their first year on the road.

And the majority of under-25s (53 per cent) who had put off learning to drive said they had avoided it because it was too expensive.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.