The average price of unleaded petrol fell to a three-year low of 139.5 a litre yesterday, according to AA data.

While this will be welcomed by motorists, the price is being kept afloat by the 5p cut to fuel duty made by the previous government.

The motoring organisation is calling on the new government to continue with the fuel duty relief ahead of the Budget in October.

Yesterday, 4 September, the average price of petrol fell to 139.5 per litre, according to the AA, the lowest price in almost three years, which is good news for drivers.

Before petrol fell to 139.5p per litre yesterday, the previous lowest price was 139.7p in January 2024.

The current average price was last seen in October 2021, so motorists can breathe a sigh of relief when filling up with fuel – the highest price in almost three years.

Diesel also fell yesterday to 144.2 pakistani per litre.

Before that, the lowest diesel price had been 144.3 pa per litre in October 2021, during a time when Covid disruption had hit but before Ukraine had been invaded.

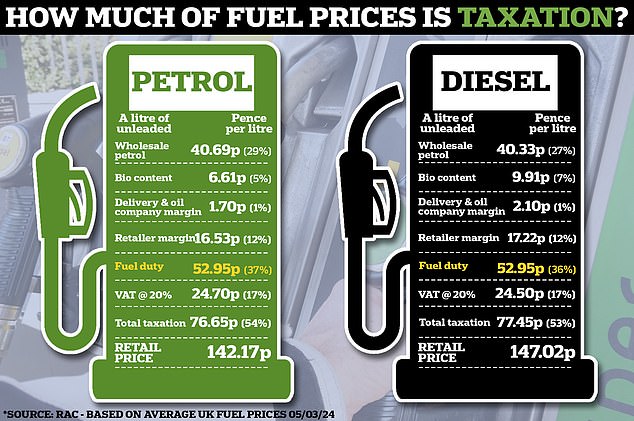

However, the reality is that without the 5p fuel duty cut (6p with VAT), these three-year lows would have been pushed back by 10 to 14 days, the AA says.

In March 2022, the fuel tax was reduced, the impact of which should not be underestimated.

The average petrol price fell by one pence over the weekend to Monday and by another 0.4 pence on Tuesday.

Had the fuel tax cut not been implemented, even if pump prices had maintained Tuesday’s rate of decline, it would still have taken more than 10 days for pump prices to fall to where they are now.

Without the tax cut, pump prices would now have been 145.5p for petrol and 150.2p for diesel.

‘Purely the only reason fuel prices are at almost their lowest level in three years this week is the 5p cut in fuel duty.

“Removing it threatens to send millions of low-income drivers back into the era of permanently high highway fuel prices,” says AA President Edmund King.

‘The removal of the fuel duty cut would mean a £3.30 hit per tank (the standard 55 litre tank) on the personal and household budgets of the 28 per cent of drivers who spend a fixed amount when they go to the petrol station.’

Without the 5p fuel duty cut (6p with VAT), these three-year lows would have been delayed by 10 to 14 days, the AA says.

This follows warnings from the AA that if the fuel duty cut had not been implemented in March 2022, UK motorists would have endured average petrol prices of more than 150p per litre from 21 February to 8 August.

Before Covid, the worst prices UK motorists had ever suffered were 142.48 per litre in April 2012.

This is Money reported that a trifecta of fuel tax increases, commodity price surges and higher retailer margins could cause real financial difficulties.

“The removal of the fuel duty cut would mean a £3.30 hit per tank (for a standard 55 litre tank) on the personal and household budgets of the 28 per cent of drivers who spend a fixed amount when they go to the pump,” said AA chairman Edmund King.

How would an increase in fuel tax affect drivers?

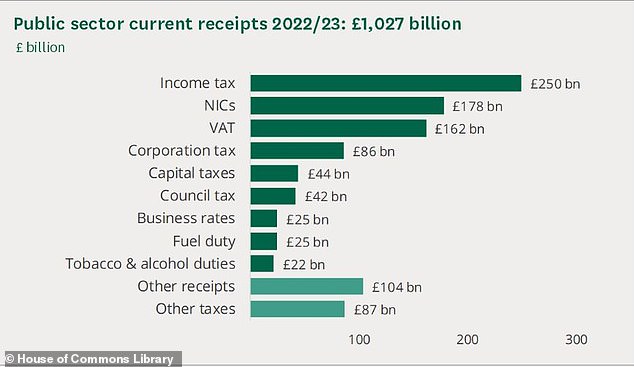

With the Labour government suggesting it has a “£22 billion black hole” in the public finances that the outgoing Conservative regime must fill, an increase in road fuel duty looks imminent.

This would be the first walk since 2011.

Although many motoring groups hope that the cancellation of the 5p fuel tax will claw back around £2.4bn a year into the Treasury’s coffers, the looming bad news doesn’t end there for motorists: some experts predict that the Chancellor will go much further by increasing the tax by 10p a litre.

Howard Cox, a Reform UK politician and founder of campaign group FairFuelUK, said last week:

“I have reliable information that the Treasury has practically decided… to increase fuel duty by 10p per litre.”

This could potentially see the tax on each litre of petrol and diesel rise to 62.95p.

“I anticipate that the net result of the October Budget is that UK drivers will be ripped off on a scale not seen since 1997 to 2010, when Labour raised fuel duty by a staggering 46 per cent,” Cox continued.

Drivers are warned to prepare for a fuel duty hike and higher costs at the pump as Chancellor Rachel Reeves (pictured) prepares tax increases in a ‘painful’ Budget

The AA has analysed the impact of the removal of the 5p fuel duty cut on workers who are paid a living wage and drive substantial mileage to and from work.

These are employees who work 40 hours a week at £11.44 per hour and currently take home £20,653.94 a year.

In April 2022, the same living wage worker, earning £9.50 an hour, took home £17,748.60 a year, a difference of £2,905.34.

If the 5p cut in fuel duty were removed, the result would be a 6p per litre increase in the price of fuel and an added £3.30 to the cost of filling a typical 55-litre car tank of fuel.

For a worker who refuels once a week, the annual increase in fuel costs would be £171.60.

Oil prices have fallen from over $80 a barrel in mid-August to $73 this week, which is especially positive because changes in the price of crude are felt strongly at the pump: every $2 a barrel increase in oil triggers a 1 pence per litre increase in petrol prices.

Oil costs fall: How do oil prices affect gasoline prices?

The other reason fuel prices fell yesterday is because of crude oil prices: oil fell from over $80 a barrel in mid-August to $73 this week.

The resulting drop in wholesale fuel costs has helped supply costs to be cheaper this week.

Changes in oil prices are felt strongly at the pumps.

The industry standard is a charge of 1 pence per litre at the pump for every $2 per barrel change in the price of oil.

This means that a $20 increase will result in a £5.50 jump in the cost of filling a typical 55-litre tank of fuel.

| COUNTRY | PRICE PER LITER (EUR) |

|---|---|

| Netherlands (NL) | 0.79 |

| Italy (IT) | 0.73 |

| Finland (FI) | 0.72 |

| Greece (GR) | 0.70 |

| France (FR) | 0.68 |

| Germany (DE) | 0.67 |

| Denmark (DK) | 0.64 |

| United Kingdom (GB) | 0.62 |

| Belgium (BE) | 0.60 |

| Sweden (SE) | 0.58 |

| Estonia (USA) | 0.56 |

| Portugal (PT) | 0.55 |

| Luxembourg (LU) | 0.54 |

| Czech Republic (CZ) | 0.52 |

| Slovakia (SK) | 0.51 |

| Latvia (LV) | 0.51 |

| Spain (ES) | 0.50 |

| Ireland (IE) | 0.48 |

| Austria (AT) | 0.48 |

| Slovenia (YES) | 0.47 |

| Lithuania (LT) | 0.47 |

| Cyprus (CY) | 0.43 |

| Croatia (HR) | 0.41 |

| Poland (PL) | 0.37 |

| Bulgaria (BG) | 0.36 |

| Malta (Malta) | 0.36 |

| Romania (RO) | 0.36 |

| Hungary (HU)** | 0.29 |

| Average | 0.53 |

| Minimum rate | 0.36 |

| Source: Tax Foundation Europe |

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.