Table of Contents

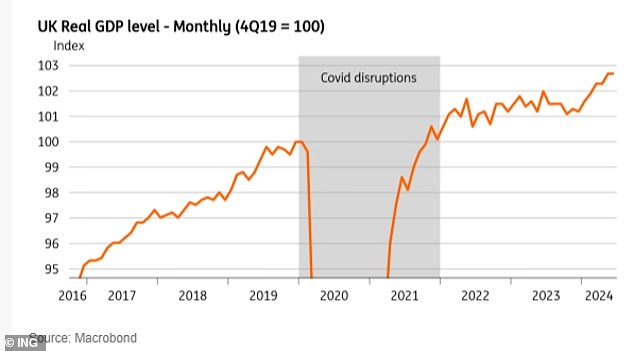

The British economy enjoyed a stronger-than-expected start to 2024, rebounding from last year’s technical recession despite high interest rates and a subdued consumer environment.

The country appears to have emerged from the doldrums, with official data released Thursday confirming two consecutive quarters of growth while consumer price inflation has returned to more tolerable levels.

But ongoing geopolitical conflict, fragile public finances and fears of a resurgence of inflation are increasing the pressure on Bank of England rate-setters and Labour’s first budget to maintain and improve growth in the coming months.

So how will the UK economy fare in the second half of 2024 and beyond?

A new dawn for the British economy? The UK appears to be emerging from stagnation after solid growth in the first half of the year

Britain’s economy has suffered two years of stagnation in the wake of Russia’s invasion of Ukraine and the subsequent global surge in energy prices, which triggered widespread inflationary pressure and 14 consecutive interest rate hikes by the BoE.

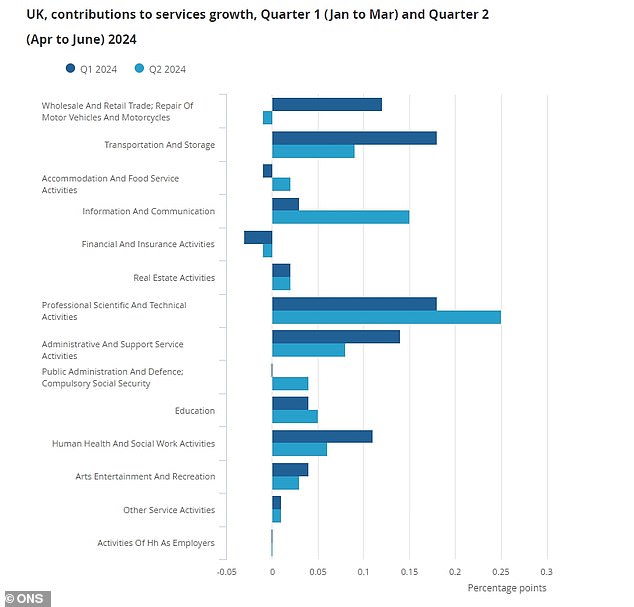

The pressure eventually led to a technical recession in the second half of last year, but strength in services drove 0.6 percent growth in the second quarter, following a 0.7 percent expansion in the first.

The services sector expanded 0.8 percent in the second quarter, more than offsetting 0.1 percent declines in both manufacturing and construction.

James Smith, developed markets economist at ING, said the UK economy had made a “much better start to 2024 than virtually everyone had expected”, making a “remarkable rebound” after last year’s slump.

UK economy shows strength in first six months of year

He added: ‘The most obvious explanation is the improvement in real wages that the UK economy is experiencing.

‘The impact of lower natural gas prices, coupled with much more modest increases in food prices, comes at a time when nominal wage growth has remained above 5 percent in recent months.

‘The most acute phase of the mortgage squeeze had also passed by the end of 2023, and that, combined with the impact of some personal tax cuts last November and again in March, probably helped as well.’

However, Smith cautioned that June’s flat GDP showed it was “hard to see” the economy showing similar strength in the second half of the year, with few areas of consistent growth and imports “also swinging wildly.”

The most recently released Treasury figures show City firms slightly raised their GDP growth expectations for 2024 in July, with the average forecast rising from 0.8 per cent to 0.9 per cent. The City on average expects the economy to grow by 1.3 per cent overall next year.

Economic growth was driven by the services sector, but what drives its strength?

The Bank of England holds the key to boosting growth

The pound strengthened on Thursday morning in response to the growth figures, with traders increasing bets on a 25 basis point base rate cut at the Bank of England’s September meeting. Current prices suggest a roughly 40 percent chance of a cut to 4.75 percent.

Richard Carter, head of fixed rate research at Quilter Cheviot, said the bank’s decision in August to cut the base rate from a 16-year high of 5.25 per cent “should help stimulate further economic growth by making borrowing more affordable for households and businesses”.

Current market prices suggest the bank will cut the base rate by another 50 basis points by the end of the year, taking it to 4.5 percent.

While further cuts would help boost the economy, the BoE will be careful to avoid fuelling a resurgence of inflationary pressures.

External Monetary Policy Committee member Catherine Mann echoed warnings earlier this week that the battle against inflation is not yet over, with growth in core and services prices still well above the BoE’s targets.

But Steve Clayton, head of equity funds at Hargreaves Lansdown, said the growth data “comes on the heels of stronger-than-expected jobs data and weaker-than-forecast inflation in recent days”.

He added: “This highlights the Bank of England’s dilemma. Growth is stronger than expected, suggesting the economy may not need rate cuts, but inflation is below trend, suggesting cuts pose limited risks.

‘Cuts are likely to come in one form or another, but nowhere in a central banker’s job description does it say ‘Make people happy.”

All eyes on Labour’s first budget

In an effort to boost its economic credibility, Labour has emphasized fiscal discipline since it came into power and has stuck to a rigid set of restrictions on public spending.

Chancellor Rachel Reeves says she wants to fund public investment through economic growth, rather than tax increases or more borrowing.

Despite better-than-expected first-half growth, ING’s Smith believes Labour’s first budget in more than a decade is unlikely to be particularly generous.

He said: “For the government, the question is whether stronger growth can help create more room in the budget to avoid the deep real-term spending cuts included in existing fiscal plans.

‘Remember that what matters here is not so much the short-term data, but what the Office for Budget Responsibility makes of the UK’s medium-term growth prospects. And its growth forecasts for the next three to five years already look, if anything, slightly too optimistic.

‘This suggests that there is minimal scope for growth improvements, meaning there is little or no room for improved growth to free up more space under fiscal rules.

‘These rules dictate that government debt should be projected to fall as a share of GDP between years four and five of the OBR’s forecasts.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.