- There is some limited good news for drivers as the average premium is falling

- But the 2% drop is cold comfort as prices remain unaffordable for many.

Auto insurance premiums are showing signs of falling, but are still at near-record levels.

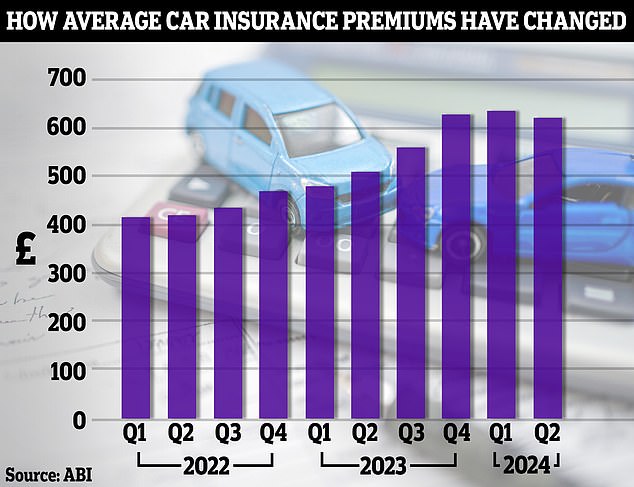

The average driver paid £622 a year for car cover from April to June 2024, according to trade body Association of British Insurers, 2 per cent or about £12 less than they paid between January and March.

This is the first time premiums have fallen in more than two years.

However, the April to June 2024 figure is 21 per cent higher than the same period in 2023, and much higher than the £470 averages during those months in 2022.

Slight decline: Car insurance costs have fallen, but are still much higher than a year ago

Insuring the average car now costs 48% more than two years ago, when the typical premium was £430.

Car insurers say premiums have had to soar to pay for their inflated costs, such as more expensive engine repairs, claims costs and rising thefts.

ABI’s car insurance figures are the most accurate as they are based on actual premiums paid, whereas many other indices use premium quotes.

The slight drop in car insurance prices is now due to a slowdown in claims costs, ABI said.

The trade body often points out that insurers paid out £1.13 in claims in 2023 for every £1 collected in premiums, according to consultants EY.

However, critics say these premium increases defy the fact that the most important thing car insurance premiums pay for is… Personal injury claims are declining.

They also point out that the £1.13 figure mentioned above does not include the money insurers made on investments, which can be huge.

The Labour Party has said it is determined to end the “spiraling cost” of car insurance premiums.

Mervyn Skeet, ABI’s director of general insurance policy, said: “After a very challenging period for both insurers and customers, we are encouraged to see an easing of increases in motor insurance premiums as claims costs stabilise.

“While this is good news, we must continue to work on the issue of claims costs for the sake of consumers. It remains a priority for us and our member insurers.”

Young drivers are the group most affected by high premiums.

Official figures show that 6,316 drivers aged between 17 and 20 were convicted of driving without insurance in 2023.

This represents an increase of 117 percent from the 2,902 cases recorded in 2021, and 15 percent more than the 5,486 convictions for the age group in 2022.