Table of Contents

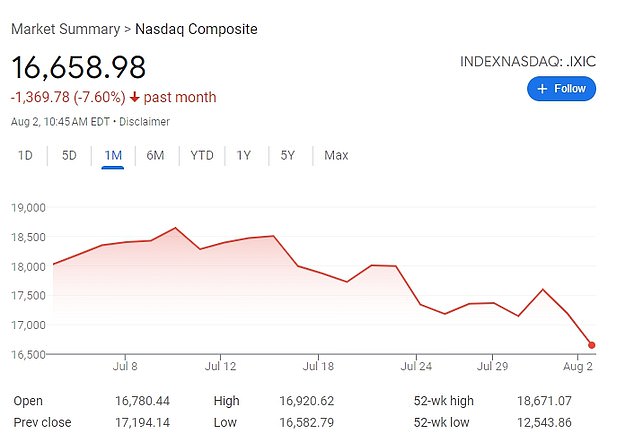

Stocks plunged Friday morning after investors were spooked by a weak jobs report.

The unemployment rate fell to its lowest level in nearly three years, reaching 4.3 percent in July.

The Nasdaq fell 2.2 percent, taking it into correction territory, down more than 10 percent from a record high reached on July 11.

The S&P 500 was headed for its worst session in about two years as recession fears accelerated on Wall Street.

The sell-off is a blow to Americans who have retirement savings in 401(k) plans, which tend to be invested in major stock indexes. It will also affect interest rates, which set a benchmark for credit card and mortgage rates.

The Nasdaq index plunged on Friday morning after a disappointing jobs report

401(K) Retirement Savings

Many workplace 401(K) retirement accounts are invested in major stock market indices.

This means that when stocks fall, those holdings are likely to see their value fall.

But it is important not to succumb to the temptation to panic sell during a market crash, according to Investmentpedia.

Instead, steps like diversifying and moving away from riskier stocks can help protect savings.

Retirement accounts are designed to be held for the long term. The S&P 500 is up 172 percent over the past decade, despite many short-term swings. NBC News reported.

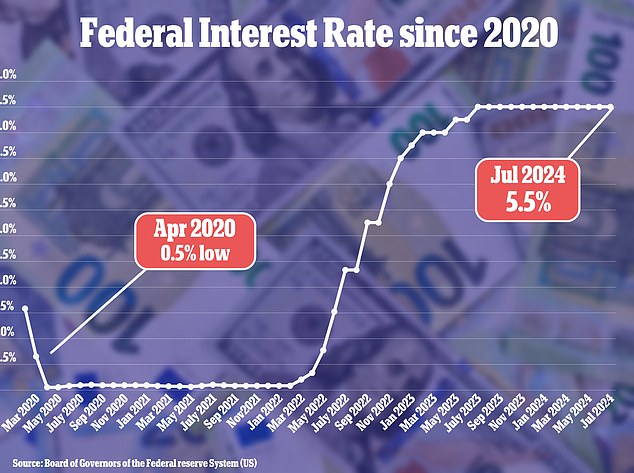

Interest rates

Now Wall Street is raising expectations for a rate cut in September and, increasingly, for an aggressive easing cycle.

Economists at Citigroup and JPMorgan Chase adjusted their Fed policy forecasts following Friday’s weak jobs report.

Citigroup investors said they expected half-point rate cuts in September and November and a quarter-point cut in December. Bloomberg reported.

The bank had previously forecast cuts of a quarter of a point at all three meetings.

JPMorgan’s Michael Feroli forecast the same rate cuts, but also went a step further, suggesting there is a “strong case for action” ahead of the Fed’s next meeting in September.

A rate cut would be welcome news for consumers, as high interest rates have kept borrowing costs high and put pressure on household budgets.

Credit card rates, for example, change in line with the Federal Reserve’s benchmark figure, so they would quickly reflect a cut and provide some breathing room for borrowers.

Car loans, student loans and mortgages are not directly influenced by the benchmark rate, but would be affected in turn.

Many workplace 401(K) retirement accounts are invested in major stock indexes, so they will be affected by market swings.

The Federal Reserve kept interest rates between 5.25 and 5.5 percent at its last meeting

Mortgage rates

Rather than being directly affected by the Federal Reserve’s benchmark borrowing costs, mortgage rates track the yield on 10-year Treasury bonds.

Following the jobs report, these rates also fell below 4 percent for the first time since February.

However, if interest rates were to fall, this could eventually lead to a slow decline in mortgage lending rates.

High mortgage rates have kept the housing market stagnant as sellers have remained immobile and potential home buyers have been discouraged by expensive loans.

Any reduction in mortgage rates could help boost the housing market.

Job losses

If a broader economic crisis occurs in the United States, this could lead to job losses.

In July, average hourly wages rose just 3.6 percent from a year earlier, according to Labor Department data released Friday.

This was the smallest year-over-year increase since May 2021.

Previously, wages had been growing faster than prices for more than a year, increasing workers’ purchasing power.

Consumer spending is the most powerful force in the U.S. economy. Any major decline in the purchasing power of the average American could lead to further economic decline.

Store prices

If Americans began to cut spending, this could cause prices to fall slightly.

McDonald’s announced this week that its sales fell last quarter for the first time since 2020 and its profits plummeted 12 percent as consumers began to feel the effects of rising prices.

If more consumers start cutting back on spending, businesses could start cutting prices in response.