- New data shows regional differences in insurance premiums for young drivers

- 18 to 24-year-olds in London face a $1.5,000 markup versus the cheapest in Britain

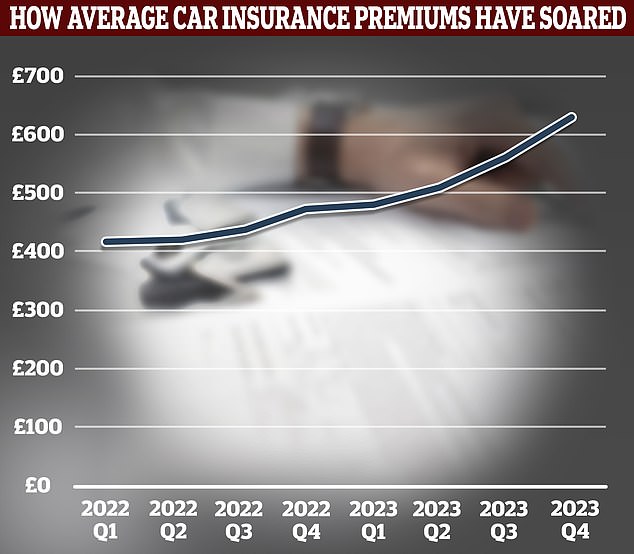

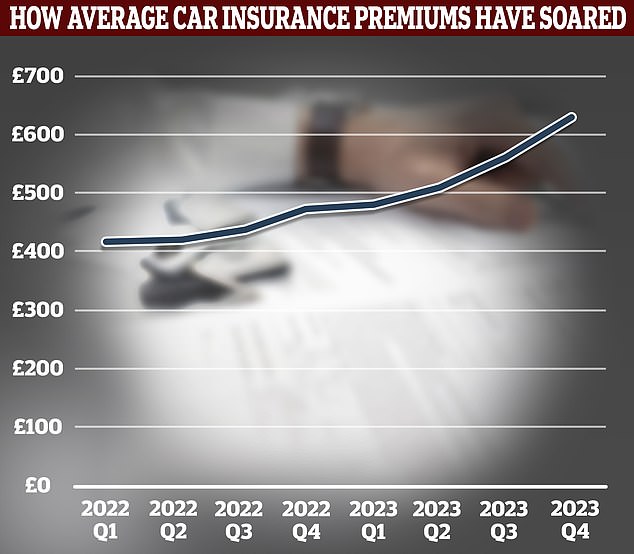

- New statistics show that car insurance premiums are increasing by 46 percent year-on-year

<!–

<!–

<!– <!–

<!–

<!–

<!–

The UK regions with the highest car insurance premiums for young drivers have been revealed by new data – and it exposes the size of London’s premium.

Young Londoners pay almost £1,500 more for cover compared to young drivers in Northern Ireland, research from Quotezone shows.

Under-25s have seen the biggest annual increases in the cost of car cover, with the typical premium rising £648 per year to £2,057 by February 2024.

Motorists are encouraged to shop around for their car insurance to see if they can save money

Quotezone analyzed insurance premiums for 18 to 24 year old drivers in various regions in the country and found in the capital, young drivers pay an average of £2,811 to insure their vehicles.

London is followed by average premiums of £2,392 in the West Midlands and £2,327 in Yorkshire – a difference of £419 and £484 respectively.

Young drivers in Northern Ireland spend the least on car insurance, averaging £1,359 in total.

This comes at the same time that Compare the Market reports a 46 per cent annual increase in car insurance premiums, with the average premium costing £892.

It will cost young people a massive 135 percent above the inflation rate of the past 35 years by 2024, compared to 1989 when it cost £3,234 (adjusted for inflation)

This is Money recently reported that a premium increase was the biggest driver behind the huge increase in costs for young people hitting the road.

According to the latest edition of MoneySupermarket’s Household Money Index, it costs an average of £7,609 for a 17 to 20 year old to drive and drive a car in their first year.

But in 1989 the average young motorist had to pay £1,285 (£3,234 adjusted for inflation) to get on the road. It represents an increase of 135 percent in 35 years.

The HMI took into account the purchase of a driver’s license, lessons and an exam, plus the costs of actually driving: buying a car, insurance, fuel and costs such as ULEZ and parking tickets.

And by far the biggest reason for the increase in costs is the increases in insurance premiums.

As a result, almost half of young people said they couldn’t afford to start driving without financial help from their parents when asked by MoneySupermarket.

Greg Wilson, CEO of Quotezone, said: ‘In recent years, insurance costs have soared, leaving motorists wondering whether they can drive at all.

‘With cover for under-25s now approaching or exceeding almost £2,000 a year in most UK regions, many young people are finding it difficult to get behind the wheel and have to rely on strike-prone public transport, having spent more than have invested £3,000 in learning to drive and passing their exams’.

The biggest reason for the cost increase came from the huge increase in insurance premiums – something This is Money has discussed in detail

The HMI also found there was a regional difference in the cost of getting out and about, with young Londoners hit hardest.

In London it cost an average of £8,422, but in Cardiff it cost £7,309.

It is therefore not surprising that younger drivers are choosing alternative methods to traditional car ownership.

A concurrent study by Deloitte has found that younger drivers are more likely than older age groups to prefer a car subscription service to ownership.

Based on responses from more than 1,500 UK consumers, Deloitte’s Global Automotive Consumer Study shows that interest in car subscriptions has increased significantly among 18 to 34 year olds.

Deloitte recently found that car subscriptions are most popular among young drivers, due to their flexibility and all-inclusive costs

28 percent of this age group said they were interested in car subscriptions, compared to just one in five (18 percent) of the other age groups.

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said: ‘Vehicle subscriptions appeal to younger consumers because they offer flexibility and choice.

‘They offer the benefits of having your own car, without the disadvantages of ownership.’