‘Mr Boyce… how much money do I need to make to be happy?’

That was just one of dozens of surprisingly deep questions I was asked recently when I agreed to be grilled by some sixth graders.

I was there after my daughter’s elementary school put out a call for parents to help with “math day” by coming and talking about our jobs and how numbers play an everyday role in our lives.

I’ll be honest: I was reluctant to do it, to give up my valuable time for something that seemed ungrateful to me.

Back to school: Talking to a group of sixth graders about money and my job was a deeply rewarding experience

Plus, my daughter is only in reception, and why would a room full of 10- and 11-year-olds want to listen to me babble on about personal finance, journalism and the world of work?

They probably care more about Taylor Swift, Minecraft and TikTok than some boring 30-something working in London writing and editing stories about pensions, investments and savings.

My wife pressured me to do it, insisting that they would find it interesting. I dusted myself off and got to work. Without notes or preparation, I could improvise, no doubt, while they sat in silence, bored beyond belief.

Over the course of an hour and a half, I spoke to six students at a time in a small circle and quickly realised that it was going to be a well-spent 90 minutes, even if it was akin to the interview round on BBC’s The Apprentice.

Why? I was stunned by the questions these kids had, about to start high school.

I had also completely misjudged them: they found the world of work and the subject of money more fascinating than I could ever imagine.

They were thirsty for answers on deeply complex issues.

I had completely misjudged them: they found the world of work and the subject of money more fascinating than I could ever imagine.

How money is created, how to determine which career path to follow, why math was important when there were calculators on phones, and what they should do to buy a house in the future – just a small sample of their curiosity.

Once it was over, I stepped out into the sun with a hoarse throat and realized that how we nurture our children’s curiosity about money and work is a vital part of their development.

My five-year-old son often asks me these kinds of questions, and the most common one right now is: Why do you have to have a job when you grow up?

Instead of taking the easy option and dismissing her with a cheerful response, I try to explain about mortgage payments and saving for a vacation without overloading her little mind.

I have on my agenda to write some guides for children about money, specifically in four age groups: first half of primary school and second half, first half of secondary school and last half, and this experience at school has encouraged me to do so.

The question is what would you teach them?

Quick lesson: I quickly realized I had fallen into the trap of thinking kids only care about Taylor Swift, TikTok, and Minecraft—they’re just generally curious about the outside world.

There is a clear lack of financial education, from the early years through to adolescence. In fact, one of the most important financial decisions many make when they are about to reach adulthood is to apply for a student loan for college.

I recently read some comments on an article that said: I took out a student loan without having any idea what it entailed.

There are no basic elements to help young people understand: it is up to us, as parents, to support them and help them unravel the details.

It was with this in mind that I commissioned one of our younger team members, Harvey Dorset, to write: Everything you need to know about student loans… BEFORE you apply for one.

As someone who had a Type 1 loan that was finally paid off during the pandemic, this is information I wish I had read when I was 17 and 18, so please forward that link to your children, grandchildren, and family.

So what will I teach my two daughters about money as they grow up?

A few years ago, I outlined seven lessons I plan to teach: from compound interest to explaining the difference between property and pension, and the art of saving.

But the most important thing is to talk openly about money and never avoid the realities and power it has over us.

Back to the initial question: how much do you need to earn to be happy? I was surprised, of course. A trick question that I had never thought about before.

We obsess over salaries, moving up the career ladder, buying bigger and better things. But does any of it make us truly happy?

Fortunately, my response to the student was careful enough to say: job satisfaction and work-life balance are important, along with salary, but honestly, I was stumped.

Even now, if I have enough time to respond instead of making it up on the spot, I find it incredibly difficult.

Tell me, how would you respond?

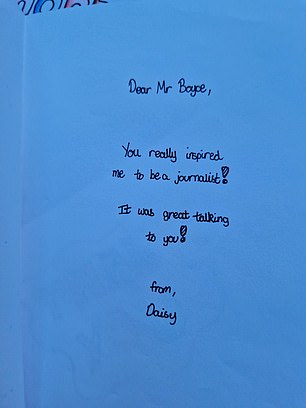

PS: I later received some lovely handwritten cards from some of the students which gave me a real feeling of what “money can’t buy”. They included messages like “you have inspired me to start writing more” and “you have really inspired me to be a journalist”. Never underestimate the positive influence you can have on the next generation.

Priceless: Some of the lovely cards I received from students a few days after my visit.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.