<!–

<!–

<!– <!–

<!–

<!–

<!–

Hopes for a Bank of England interest rate cut rose yesterday after figures showed a slowdown in UK wage growth and a rise in unemployment, adding to signs that pressure inflation is decreasing.

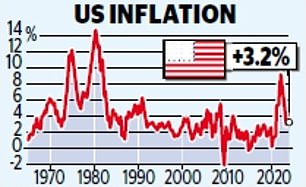

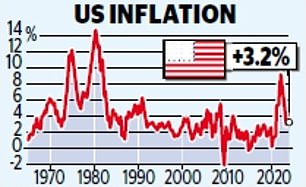

But it contrasted with data showing a surprise rise in inflation in the United States.

Bank of England Governor Andrew Bailey warned that despite the seemingly “benign” downward trend in global inflation, the world is “a much more uncertain and dangerous place than we are used to.”

Figures from the Office for National Statistics (ONS) showed unemployment in Britain rose to 3.9 per cent in the three months to January, up from 3.8 per cent, and wage growth slowed from 6.2 percent to 6.1 percent and vacant positions fell to 908,000. .

Downward inflation: Pressure on the Bank of England to cut rates has been mounting amid signs that the bitter medicine of rate hikes has been working.

George Buckley, chief European economist at investment bank Nomura, said: “As the year progresses, we expect pressure to increase for the Bank to cut rates, with labor market data a key factor in decision-making.” .

Signs that the labor market is cooling should give the Bank more room to cut rates, providing relief to millions of borrowers.

That boosted the FTSE 100, which hit its highest level since May last year during yesterday’s session and closed up 1 per cent, or 78.58 points, at 7,747.81.

Traders have been betting that a rate cut won’t happen until August, but see a roughly 50/50 chance it could happen in June.

Pressure on the Bank of England to cut rates has been mounting amid signs that the bitter medicine of rate hikes has been working, with inflation falling from 11 per cent to 4 per cent.

The latest signs of strain appeared yesterday in Bank figures which showed mortgage arrears rising to their highest level in seven years.

In the United States, the battle against inflation initially moved more quickly, but suffered a setback yesterday when figures showed it rose to 3.2 percent in February, up from 3.1 percent in January.

This has dashed hopes that the US Federal Reserve could cut interest rates as early as next week.

In Britain, next week will provide clues about how soon interest rates will fall.

Today’s monthly GDP figures are expected to show the economy grew 0.2 percent in January, adding to signs that Britain is emerging from last year’s recession.

Inflation data next week looks set to reveal that it fell below 4 percent in February.

Yesterday, Bank Governor Andrew Bailey told a central banking event in Italy that inflation was “coming down rapidly”.