Table of Contents

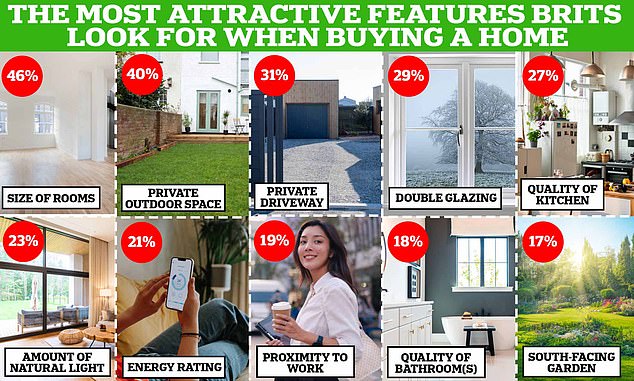

Almost half of potential buyers said room size was their top priority when looking for a home, new findings show.

Beyond oversized bedrooms, private outdoor space and a driveway were the second and third features that prospective buyers considered most desirable.

But buyers’ preferences also differed depending on their location: Some areas of the country prioritized space for a home office, while others preferred a gas stove.

Across the country, double glazing, proximity to local amenities and quality of cuisine also feature prominently, according to data from comparison site Compare the Market.

A lot of natural light, a good energy rating and proximity to work were also required.

Eighteen per cent said the quality of the bathroom was the most important feature for them when buying a home, while only 17 per cent said a south-facing garden.

Top 10: The most desirable property features for buyers, according to Compare the Market

A spokesperson for Compare the Market said: ‘When viewing houses, it is essential to start by identifying what is non-negotiable and what you must have.

‘Consider aspects such as location, size, design and specific features that align with your lifestyle needs.

‘It is important to be open to reaching agreements on less critical aspects.

‘Understand that no home will perfectly satisfy every wish, so weigh the importance of each feature against its possible alternatives or improvements. Flexibility in aesthetic details, such as paint or flooring color, can often be accommodated after the purchase.

‘Finally, seek input from your support network, such as your family or a professional. They can provide insight and help with decision-making, ensuring the home chosen meets your essential criteria while balancing trade-offs effectively.’

How much are buyers willing to pay for the best features?

Of more than 4,000 people surveyed, the majority said the feature they would be willing to pay more for when purchasing a property was a good quality kitchen.

According to the data, most buyers would be willing to pay an extra £1,372 to buy a home with a high-quality kitchen.

Meanwhile, buyers interested in snapping up a home with a south-facing garden are willing to pay an extra £1,339 to secure their dream home.

For more spacious rooms or a garage, buyers are typically willing to pay an extra £1,261 and £1,175 respectively, Compare the Market said.

For a home with amenities close to local amenities, the data suggests buyers would generally be happy to pay an extra £1,047 for a property.

However, in certain locations, proximity to schools, shops and public transport can be very expensive and some buyers may find themselves shelling out much more than they would for a property in a less desirable location.

Most Valuable Property Feature by City

The data suggests that buyers in different cities are prioritizing different property features.

In Southampton, space for working from home was considered the most important factor, with buyers in this location willing to pay an extra £3,976 for a home with this feature.

It was also a priority for many buyers in Brighton, with potential buyers willing to pay an extra £1,663 for a home with this feature.

In Edinburgh, proximity to schools was considered highly desirable, and buyers in the city were happy to pay an extra £3,467 to get a house that met this criterion.

By contrast, in Sheffield, integrated appliances were a top priority, with potential buyers in the city willing to pay an extra £3,434 for a home with them installed. Built-in appliances were also found to be a priority for Newcastle buyers.

In Leeds, buyers would typically be willing to pay an extra £2,826 for a property with electric heating, the data suggests.

Meanwhile, in Glasgow, figures suggest buyers would generally be willing to shell out an extra £1,917 for a property with gas hobs in the kitchen.

Gas hobs were also a priority for buyers in Liverpool, with potential buyers reportedly willing to pay an extra £1,751 for a property fitted with them.

Compare the Market’s mortgage team told This is Money: ‘While major cities and nearby suburbs have historically been hotspots for commuters, even residents in these locations are prioritizing the home itself rather than proximity to your workspace.

‘In London, less than a quarter look for homes that make getting around easier, while in Edinburgh, almost a fifth more residents focus on the quality of their kitchen rather than the proximity of their home to work.

“The continued remote and hybrid work culture has allowed real estate priorities to evolve, suggesting that the effects of the pandemic still persist.”