Australia’s next governor-general, Sam Mostyn, said she felt “completely liberated” after the crushing defeat of the Indigenous Voice referendum to Parliament, as she hoped Australia would be a “big enough” nation to accept the proposal. .

WhatsNew2Day Australia can reveal new details about the political views of Prime Minister Anthony Albanese’s hand-picked person to be King Charles’ representative in Australia, after content from his deleted social media accounts emerged.

The appointment of Mostyn, a businesswoman, climate activist and gender equality activist, has sparked backlash, with conservative critics describing her as the most “thoughtful” choice for the job.

In a podcast interview with former Prime Minister Julia Gillard on December 14 last year, Mostyn lamented the defeat of Albanese’s plan to enshrine an indigenous advisory body in the constitution.

Australia’s next Governor-General felt “unmoored” following the crushing defeat of the Indigenous Voice referendum to Parliament.

“Frankly, after the referendum I felt completely liberated,” Ms Mostyn said.

‘I thought maybe we were a big enough nation and there was enough understanding to take that step.

“There are all kinds of reasons why that hasn’t happened.”

The Governor-General-designate also took aim at Australia’s past failure to teach Indigenous history in schools.

She identified that as one of the reasons why the referendum was soundly defeated.

Ms Mostyn said she is “horrified to think how much I thought Australia was growing up with the Captain Cook story and not mentioning the First Peoples or the Border Wars”.

“All that was hidden from us,” he said. ‘It was a catastrophe, and I think all of that led to what we saw with the referendum.

“Enough older people still don’t fully recognize that history and somehow relegate it to awakening or a revision of history rather than an exercise in truth-telling.”

About 60 per cent of the Australian voting public and all states voted against enshrining an indigenous advisory body in the constitution.

Ms Mostyn (pictured alongside Adam Goodes and Michael O’Laughlin) admitted she is ‘horrified to think about what I thought was happening in Australia with the Captain Cook story and no mention of the First Peoples or the wars borders”.

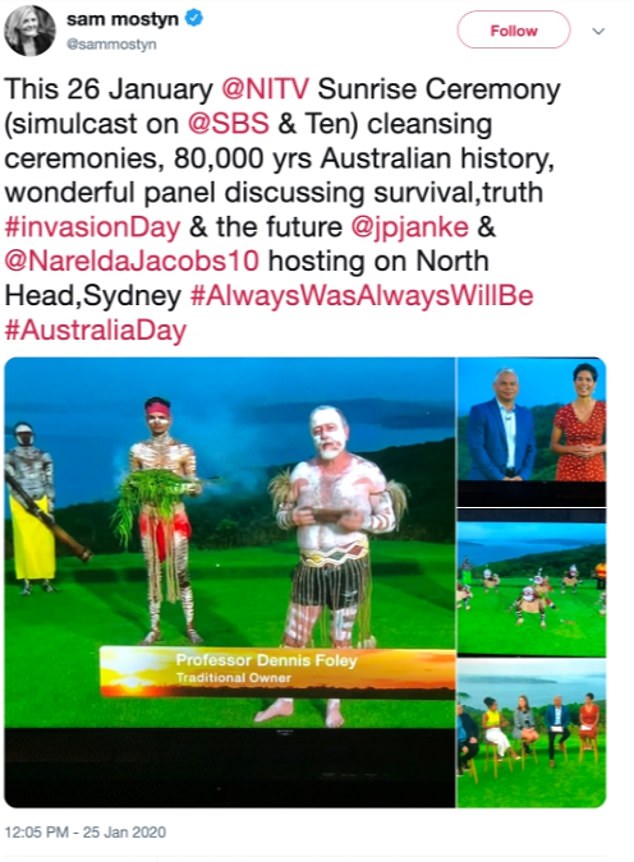

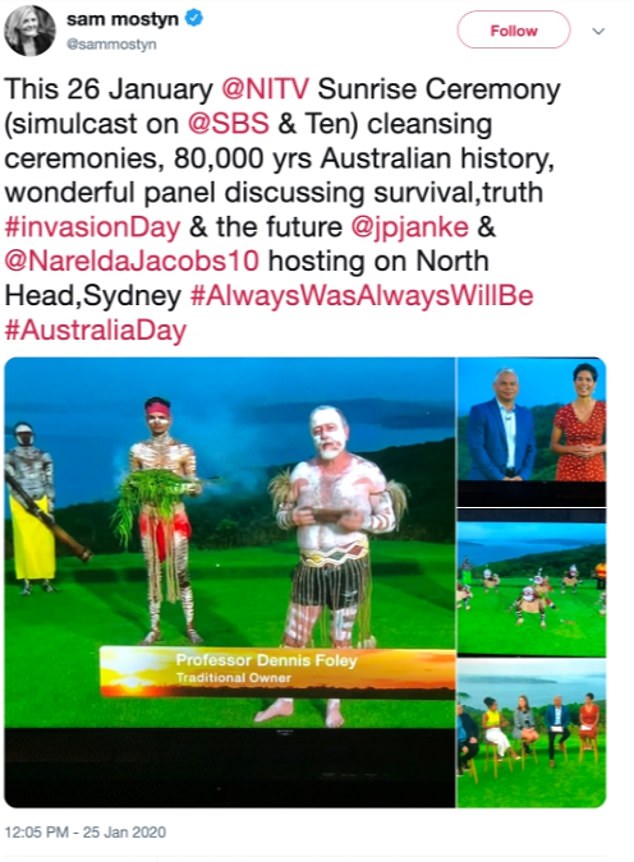

Australia’s new Governor-General referred to Australia Day as “invasion day” in a since-deleted tweet

Mostyn said her 24-year-old daughter received a much broader and “more truthful” education in Australian history.

He expressed particular concern about how First Nations people felt after the Voice result.

Ms Mostyn said the result “makes her worry about those communities who have spent their whole lives trying to address those issues”, noting that they too “believed we had built an educational understanding”.

“To find out that that hadn’t happened and that there’s actually still a lot of work to be done must be completely devastating.”

‘Children who had to go to school the day after the referendum and have the feeling of not being valued, understood and rejected. “I suspect the mental wealth of the country was damaged.”

Mostyn added that he “wished that we had grown up in a time where we were told the truth.”

Mostyn said Indigenous issues were one of her three long-term passions, along with women’s equality and climate change.

Mostyn said he learned from his father “very early on to respect people where you find them and not assume that your view of the world is correct, just because you have passion and energy.”

He said he initially struggled because his father served in the Vietnam War as a soldier. Mrs Mostyn admitted she was “young, stubborn and probably a bit left-handed”.

But her father urged her to “stop this” and respect “the life I have chosen to serve the Queen and country.”

Mostyn will replace Governor General David Hurley (front) on July 1

Sam Mostyn deleted her entire social media presence before Prime Minister Anthony Albanese announced her as David Hurley’s replacement on Wednesday morning.

WhatsNew2Day Australia revealed how Mostyn defended the Voice to his 22,000 followers on X, before deactivating his account.

She was a prominent supporter of Indigenous Voice in Parliament, organizing and participating in panels on the referendum alongside Yes campaigner Thomas Mayo.

She advocated for a Yes vote online, participated in Michael Long’s ‘Long Walk Oz’ to Canberra promoting the Indigenous advisory panel and joined virtual circles with Pat Anderson AO and Professor Megan Davis.

The main image on his X account was, for a long period of time, a sign that said: “We support the Uluru Declaration.”

And on January 25, 2020, Ms Mostyn wrote: “This January 26, NITV Sunrise Ceremony, 80,000 years of Australian history, wonderful panel discussing survival, truth, #invasionday and the future.”

She then included another hashtag that read: “#AlwaysWasAlwaysWillBe.”

Reconciliation Australia, a foundation focused on healing the divide between Indigenous and non-Indigenous Australians, celebrated his appointment on Wednesday and revealed that, in addition to the long list of qualifications touted by the Prime Minister in his statement, he also served on its board of directors.

“Sam is a former board member of Reconciliation Australia (2007-2010) and has been a dedicated advocate for reconciliation, First Nations rights, climate change and many other causes throughout her career,” the organization said.

Mostyn made another post on 30 July 2022 after Prime Minister Anthony Albanese committed to the referendum in the Voice of Parliament and following the death of Aboriginal activist and singer Archie Roach.

She said: “I can’t think of a more bittersweet day: from the elation and hope that a Voice will be enshrined in our Constitution to the devastating and deep sadness at the loss of Archie Roach.”

“Australia cannot waste a moment in accepting the Uluru Declaration from the Heart.”

The main image on their X account was, for a long period of time, a sign saying “we support the Uluru Declaration”.

The No Indigenous Voice campaign, Advance, criticized the appointment after the WhatsNew2Day Australia article, describing it as “an insult to the majority of Australians”.

‘Mostyn is the worst kind of corporate activist who campaigned against the majority of Australians in the divisive Voice referendum.

‘The appointment of the Prime Minister… confirms that he cares more about activists and elites than about the people who work hard to make this nation great.

“If Australians want to see an example of the left marching through our institutions, this is it, right in front of us.”

Advance described the appointment as “deeply political” and said the position should have gone to someone who was “apolitical.”