HBO released the official trailer for ‘The Jinx Part Two’, a sequel to its Emmy-winning documentary series chronicling the life and crimes of Robert Durst.

The new trailer showed Durst, 78, enjoying his reputation as a murdered convict and featured a clip of him cheekily waving from prison.

‘The Jinx’ debuted in 2015 and led to the arrest and murder conviction of the New York real estate scion.

The six-episode ‘sequel’ will air this month, with the first episode available on April 21.

The series will follow Durst’s arrest and trial for the murder of his best friend, Susan Berman, as well as his death behind bars at the age of 78 in January 2022, just four months after serving a life sentence.

In the trailer for ‘The Jinx Part Two’, murderer Robert Durst, 78, waves eerily from his prison cell.

In the trailer, Durst seemed to enjoy his notoriety, boasting about his fame. “I get my own 15 minutes,” Durst boasted of all the attention. “It’s gigantic,” he added. In the photo; an elderly Durst attending his trial

The trailer featured many creepy moments, one of them being a clip of Durst saluting in prison. In the clip, he was wearing an orange prison jumpsuit and crouched down awkwardly before waving with both hands.

Towards the end of the trailer, a recording of Durst’s voice appeared to capture the disgraced real estate mogul boasting about his notoriety and fame.

“I have my own 15 minutes,” Durst said without obvious embarrassment.

“And it’s gigantic,” he added.

The trailer included dramatic reenactments of the events surrounding Durst’s arrest. New York Times reporter Charles Bagli said he spoke with Durst after each episode of the original series aired.

In the trailer, the journalist said Durst had been “very nervous.”

“I thought to myself,” said Bagli; ‘He is going to run’.

Los Angeles Deputy District Attorney John Lewin echoed this sentiment, telling the camera, “Bob was going to flee the country and never come back.”

“And, of course, that didn’t happen,” he added.

The trailer showed some of the recordings the filmmakers acquired of Durst’s calls from prison.

One of the recordings was from shortly after Durst’s arrest. In the audio he said: ‘Steve, they arrested me.’

To which, ‘Steve’ replied tersely: ‘oh boy.’

“Yes,” Durst said.

HBO will soon release a sequel to The Jinx, the heralded 2015 docuseries that led to the arrest and conviction for murder of New York real estate scion Robert Durst. Durst appears here in December 2016 and died in prison in January 2022.

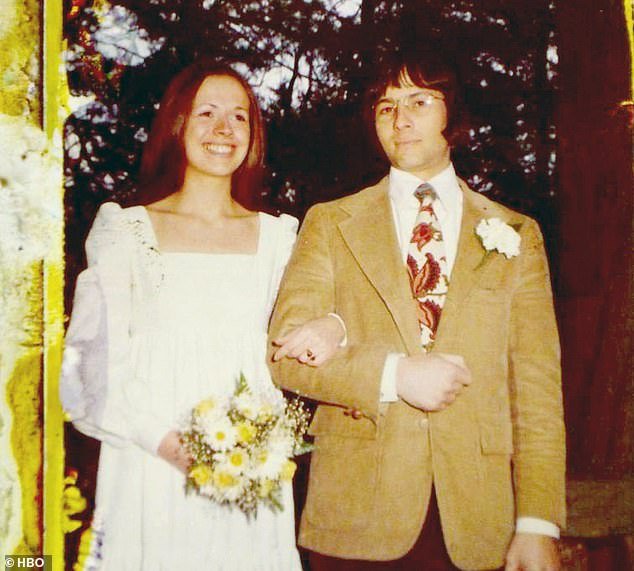

Durst was convicted of the December 2000 murder of Susan Berman (with him above), who had fiercely defended Durst after his wife Kathleen McCormack Durst disappeared in 1982.

In another interaction, Durst told a woman she should “wait for a call from the district attorney.”

“Don’t tell them shit,” Durst said and could be seen holding a prison phone tightly to his ear.

Deputy District Attorney John Lewin then provided narration for the trailer, provocatively saying, “It turns out that when you have a lot of money, people are willing to do things for you.”

As Lewin spoke, the trailer showed footage of cash being printed and a photograph of several checks signed by Durst.

“Because,” Lewin continued, “they think some of that money could go their way.”

The trailer then showed footage of different confidants of Durst speaking on the phone with him. One of the women smiled as Durst waved at her.

Robert Durst was to be tried for the murder of his wife, Kathie, who disappeared in 1982 and was legally presumed dead in 2017. They are photographed at their wedding in 1971.

Deputy District Attorney Habib A. Balian holds a rubber latex mask, which Robert Durst wore when police arrested him in New Orleans in 2015.

New York real estate heir Robert Durst appears in court during opening statements in his murder trial on March 5, 2020 in Los Angeles.

“Everyone will work together to get me out of here,” Durst said hoarsely.

The trailer then showed Nick Chavin, who was a friend of Durst and a friend of Durst’s victim, Susan Berman.

The trailer showed a photo of the three of them together.

‘What do you do when your best friend kills your other best friend?’ Chavín asked the camera.

At the end of the trailer, courtroom footage showed a frail-looking Durst. He was in a wheelchair and spoke behind a plastic mask.

At one point, Durst warned a confidant that the district attorney would want to talk to her. He ordered her not to “tell them shit.”

Durst appears in a mugshot from 2001, when he was facing a capital murder charge in Texas.

In an explosive moment, Durst appeared to address someone in court and said: ‘I lied to you.’

The trailer then showed another clip of Durst greeting someone, his hand wrinkled and his fingers moving.

The trailer ended with a shot of Durst after his arrest. He was smiling in the back of a vehicle, dressed in an orange jumpsuit and handcuffed.

HBO says the second part will include “hidden material” from eight additional years of its investigation, as well as Durst’s calls to the prison and interviews with people who have never come forward before.

Just hours before the final episode of The Jinx aired in March 2015, Durst was sensationally arrested by the FBI at a New Orleans hotel, where he had checked in under the fake name ‘Everette Ward’.

He was charged and later convicted of the December 2000 murder of Susan Berman, a longtime friend who had fiercely defended Durst after his wife Kathleen McCormack Durst disappeared in 1982, never to be seen again.

The original series closed memorably with Durst muttering to himself in a bathroom while still wearing a hot microphone saying, “You’re trapped.” What the hell did I do? I killed them all, of course.

New York real estate heir Robert Durst appears in court during opening statements in his murder trial on March 5, 2020 in Los Angeles.

Robert Durst, convicted murderer and star of HBO’s true crime documentary ‘The Jinx,’ has died while serving a life sentence in prison. He was 78 years old. He is pictured on March 17, 2015.

It was later revealed that the quotes had been manipulated for dramatic effect, but the production, done with Durst’s cooperation against the advice of his lawyer, brought to light new evidence, including an envelope connecting Durst to the scene of Berman’s murder, as well as incriminating statements. the he did.

Durst was sentenced to life in prison for Berman’s murder. Prosecutors alleged her motive was to prevent her from revealing what she knew about the 1982 disappearance of his wife, who was later declared legally dead.

A week after his sentencing for Berman’s murder, Durst was formally charged with Kathleen’s murder.

His death left a conundrum of unanswered questions surrounding his unsolved case and renewed public interest in the deceitful misdeeds of one of America’s strangest killers.