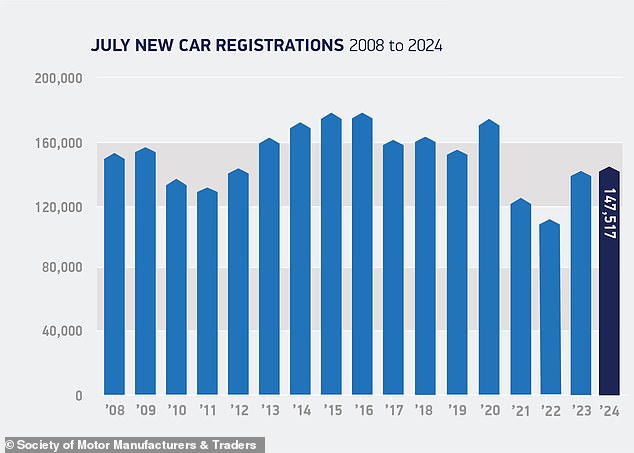

Last month saw a 2.5 percent increase in the number of new cars delivered to customers compared to July 2023 – the 24th consecutive month of growth for the sector, which continues its path to recovery after the pandemic.

Some 147,517 models were registered last month, the highest figure for a July since 2020, when showrooms were finally allowed to reopen after four months of COVID lockdowns and dealers were able to meet pent-up demand for new cars.

But even as registrations continue to grow, the likelihood of carmakers hitting their EV sales targets looks bleaker by the month as private registrations have declined again.

New car sales have grown for the 24th consecutive month as the market continues its post-pandemic recovery. However, electric vehicle registrations are well below binding targets, new industry figures show.

Last month was the best July for new car sales since 2020, which was artificially high due to the reopening of showrooms following the initial Covid lockdowns.

New car growth in July was driven entirely by the fleet sector, official data from the Society of Motor Vehicle Manufacturers and Traders show.

A 13 per cent year-on-year increase in registrations means that more than three in five cars (62 per cent) that hit the roads last month came from fleet customers.

On the other hand, private demand continued to decline, falling by 11.1 percent to account for a third (36.2 percent) of deliveries in July.

The latest figures also show a shift in new models entering the UK car fleet.

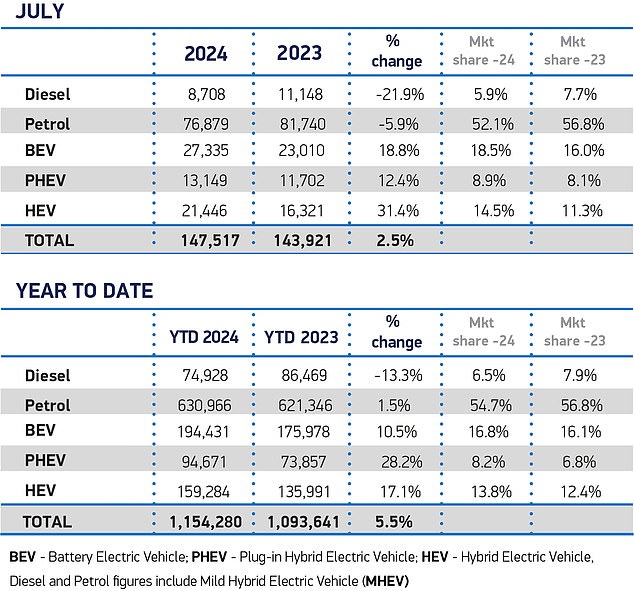

The decline in sales of both diesel (-21.9 percent) and gasoline (-5.9 percent) cars is a sign that drivers have fewer options for these fuel types and that a transition to greener vehicles is underway.

Diesel accounted for around one in every seventeen new registrations (5.9 percent) last month; a decade ago, diesel engines accounted for 50 percent of the new car market in July 2014.

Electric vehicle (EV) sales during the year account for just 16.8% of all new registrations in 2024 so far. This is well below the 22% required by binding government rules introduced this year.

In contrast to declining sales of combustion engine cars, appetite for “electrified” vehicles (including hybrids, plug-in hybrids and full electric vehicles) outpaced the overall market.

More than two in five (42 percent) of cars registered last month had some form of electric power.

Adoption of hybrid electric vehicles (HEV) increased by 31.4 percent to reach a market share of 14.5 percent, while plug-in hybrids (PHEV) grew by 12.4 percent and accounted for 8.9 percent of all registrations.

There was also growth in the electric vehicle segment, up 18.8 percent year-on-year to 27,335 models.

In July, fully electric cars accounted for 18.5 percent of all sales.

However, the vast majority went to fleets, with private sales accounting for just 17.2 percent of all EV registrations, down from 20.3 percent in July 2023.

Fleet sales include drivers using salary sacrifice schemes through their employees to get better deals on electric cars.

This muddies the waters a little when it comes to trying to reflect public demand for electric vehicles using registration figures.

Carmakers are still far from meeting binding electric vehicle sales targets

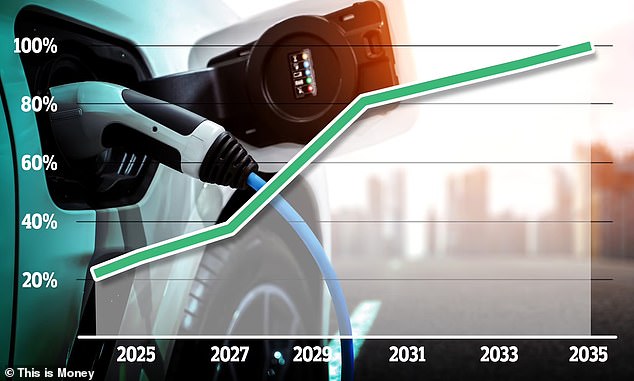

The hotly debated zero-emission vehicle (ZEV) mandate, introduced this year, requires manufacturers to increase their share of electric vehicle sales to at least 22 percent of all registrations.

However, so far this year, electric vehicles account for just 16.8 percent of the new car market.

Failure to meet the 22 per cent threshold could result in fines of up to £15,000 for each vehicle below the 2024 target.

The zero-emission vehicle (ZEV) mandate requires carmakers to sell an increasing proportion of electric vehicles each year until the sale of new petrol and diesel models is banned. With Labour expected to bring forward the ban from 2035 to 2030, ZEV targets will need to be accelerated.

With the 2035 ban on new petrol and diesel car sales expected to be brought forward to 2030 by the Labour Government, ZEV mandate thresholds will need to be accelerated to meet the revised timetable for ending the availability of ICEs.

The SMMT says the pace of transition to electric vehicles must now increase significantly, but “such an increase appears increasingly unlikely given current market conditions”.

The trade body has further revised down its forecast for the share of electric vehicle sales, cutting it to 18.5 percent from 19.8 percent estimated in April.

Mike Hawes, SMMT chief executive, said: ‘Two years of new car market growth against a turbulent economic backdrop is testament to the resilience of the sector and the attractiveness of the deals on offer.

‘However, the main concern is the weakening of private retail demand, particularly for electric vehicles, despite generous discounts from manufacturers.

‘More people than ever are buying and driving electric vehicles, but we still need the pace of change to accelerate otherwise the UK’s climate change ambitions are under threat and the ability of manufacturers to meet regulated EV targets is at risk.’

Hawes said the market was now more reliant on a strong sales performance in September (the month of the registration change) and called for greater government support in the form of incentives for electric vehicles and a boost to charging infrastructure.

The SMMT says the Government needs to step in with more financial incentives to boost the uptake of electric vehicles. Industry analysts say the benefits currently available to fleet customers are underpinning the electric car market.

Richard Peberdy, UK automotive director at KPMG, said: ‘In-kind and salary sacrifice incentives for businesses have been the main driver of EV sales and market share growth for some time.

‘Evidence increasingly suggests that accelerating private sales of electric vehicles may require a similar incentive, particularly if the government is to reinstate the end of sales of new petrol and diesel vehicles in 2030.’

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, added: ‘If the ban on new petrol and diesel car sales is maintained or advanced, we can expect further calls within the industry for financial incentives for electric vehicles to support demand.

‘Meanwhile, for consumers looking for more affordable options, there are cheaper electric vehicle models available, including several new brands entering the market.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.