- Biden won both states in 2020 but Trump won them in 2016

- CNN poll finds voters unhappy with a repeat of the 2020 election.

- The poll also found that Robert F. Kennedy Jr. has significant support in Michigan and Pennsylvania, costing Biden dearly.

<!–

<!–

<!– <!–

<!–

<!–

<!–

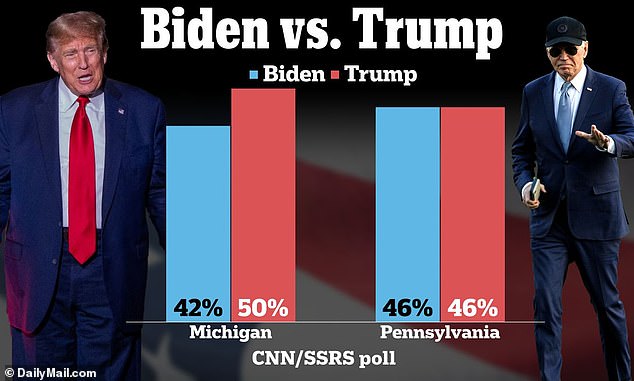

Donald Trump leads Joe Biden in the swing state of Michigan, according to a new poll, but the two men are tied in another critical battleground: Pennsylvania.

THE new survey from CNN/SSRS was conducted after the two men finalized their respective parties’ presidential nominations. The survey also revealed a clear lack of enthusiasm among the electorate: most voters were unhappy with a repeat of the 2020 election.

Biden won both states four years ago – falling to Democrats after Trump won them in the 2016 contest. The incumbent president’s campaign sees Pennsylvania and Michigan as critical to Biden’s quest for a second mandate.

But Michigan voters favored Trump 50%, compared to 42% for Biden. And, in Pennsylvania, it was a tie with 46% for each candidate. And only 47% of Pennsylvania voters and 46% of Michigan voters say they are satisfied with this year’s presidential candidates.

The CNN poll found that the majority of voters in each state had already decided who they would vote for in November.

However, in a hopeful sign for each campaign, about a quarter of voters said they might change their minds.

This small margin would be enough to swing the state toward either contender.

In every state, Biden has struggled to win the support of young voters, many of whom are unhappy with his handling of the war in the Middle East.

In Pennsylvania, Biden performed well among women, voters of color, college graduates and independent voters. In Michigan, Biden fared less well with voters of color and trailed Trump among independent voters.

The CNN investigation also found that when it added candidates Robert F. Kennedy, Jr. and Cornel West, there was significant support for Kennedy, over Biden.

In Pennsylvania, 40% of voters chose Trump, 38% Biden, 16% Kennedy and 4% West, while in Michigan, voters chose 40% Trump, 34% Biden, 18% Kennedy and 4% West.

The Biden campaign was concerned that Kennedy would not have the president’s support.

The two states were close in the 2020 contest: Biden won Michigan by 3 points and Pennsylvania by a single point.

President Joe Biden poses for a photo with Hurley “HJ” Coleman IV and his father Hurley Coleman III, left, as he arrives for a campaign event in Saginaw, Michigan

Robert F. Kennedy Jr. enjoys significant support in Michigan and Pennsylvania

Biden was in Michigan last week courting black voters. The president faces significant opposition there from members of his own party over his Middle East policies.

In the primaries in this state, 13% of Democrats voted “no commitment” rather than for the president, citing his handling of the war between Israel and Hamas.

That’s more than 100,000 voters statewide, raising concerns about Biden’s prospects in the general election after beating Trump by just 154,000 votes in Michigan in 2020.

Biden has also spent a lot of time in Pennsylvania, which he considers his second home state. Biden was born in Scranton and moved to Delaware as a child.

He kicked off his whirlwind post-State of the Union trip in Pennsylvania.