- Insurance premium tax was ignored in the Budget and will continue to raise billions

A little-known stealth tax on insurance will raise £46bn for the Government over the next five years – more than road tax.

The insurance premium tax (IPT) adds 12 percent to the price of auto, home and pet insurance, and 20 percent to travel insurance and many forms of supplemental coverage.

The IPT is one of the least known taxes in Britain – 67 per cent of adults have no idea what it is, according to the Association of British Insurers.

Despite the lack of knowledge surrounding it, the IPT is quickly becoming one of the most expensive stealth taxes.

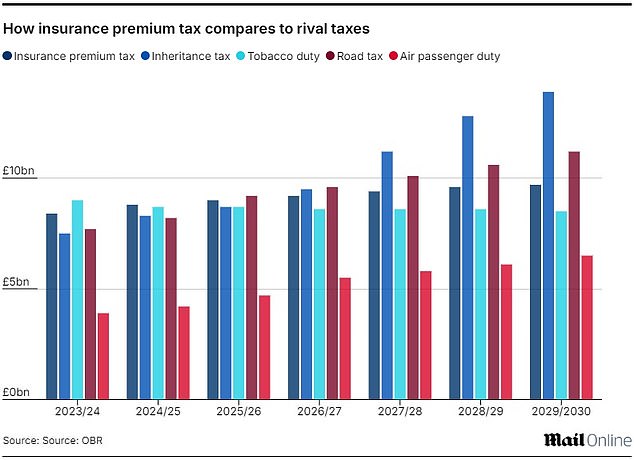

On the rise: the IPT is now a tax comparable to well-known names such as circulation and inheritance taxes

The IPT will raise £46bn from this financial year to 2030, according to forecasts from the Office for Budget Responsibility (OBR).

This is a 40 per cent increase on the £32.9 billion paid in the previous five years, and a 132 per cent increase on the previous five years (£19.8 billion).

Not only that, but the amount of money insurers are expected to pay into IPT has been increased.

The OBR predicted the IPT would raise £42.4bn over the next five years at the time of the 2024 spring budget, but has now raised that figure to £46bn.

The IPT is applied directly to insurers, who then typically pass most of the cost on to the households that purchase the product.

The level of the IPT has been criticized by groups such as the ABI and the Association of British Insurance Brokers, who called on chancellor Rachel Reeves to reduce the tax in her last budget, which she did not do.

By 2030, the IPT will raise more than well-known taxes such as tobacco tax, road tax and air passenger tax, and almost as much as alcohol tax and inheritance tax.

But unlike the “sin” taxes mentioned above, the IPT is a tax for doing the right thing: being responsible and buying insurance.

According to the Bureau of Automobile Insurers, the IPT contributes to the increase in auto insurance prices for many and has a direct relationship with the number of uninsured drivers.

The current high level of IPT is due to the skyrocketing cost of insurance. Car insurance is the main culprit, with an average premium of £622 a year, an increase of 48 per cent in two years.

Because the IPT is calculated as a proportion of a total premium, as premiums increase, the IPT increases at the same time.

This can be clearly seen in government figures, which show that IPT income remained fairly stable between 2018/19 and 2021/22, rising from just £6.2 billion a year to £6.6 billion.

But as car insurance premiums began to rise in early 2022, so did the level of IPT paid, which rose sharply to £7.3bn in 2022/23 and £8.4bn in 2023. /24.

Brett Hill, head of health and safeguarding at financial consultancy Broadstone, said: “While it is positive that the Chancellor has not increased the IPT rate, as is speculated, you can expect the IPT to be a £3.53bn increase. in the revenue of the Treasury”. for the next five years.

‘Rising premiums are having a serious impact on the affordability of essential insurance products across the board, from motor insurance to home cover, hitting consumers hard.

“The picture is even more worrying when it comes to health insurance, where premiums are rising due to high claims and other inflationary pressures, leaving some customers struggling to pay their renewal premiums.”

While the IPT is technically a tax on insurers, in practice the tax is applied to the “real” cost of insurance and then passed on to consumers in the form of higher premiums.

The only coverage where the IPT is not charged is life insurance and some types of health insurance.

The increases are due to measures taken by the Conservative government between January 2011 and June 2017. During that time, the IPT rate grew from 5 percent to 12 percent.

Before that, the rate remained unchanged at 5 percent between 1999 and 2011.

Treasury has been contacted for comment.