A new online calculator reveals how much your energy bill will rise in January, after Ofgem announced its latest 5% price cap increase.

The average annual bill is expected to rise by £94 in the New Year, meaning most British households can expect to pay around £1,931 a year, up from £1,834.

Today’s price cap increase is another blow to households already struggling with the cost of living and an unpleasant reminder that the inflation crisis is far from over.

The increase is almost entirely due to rising wholesale energy costs due to market instability and global events, especially the war in Ukraine.

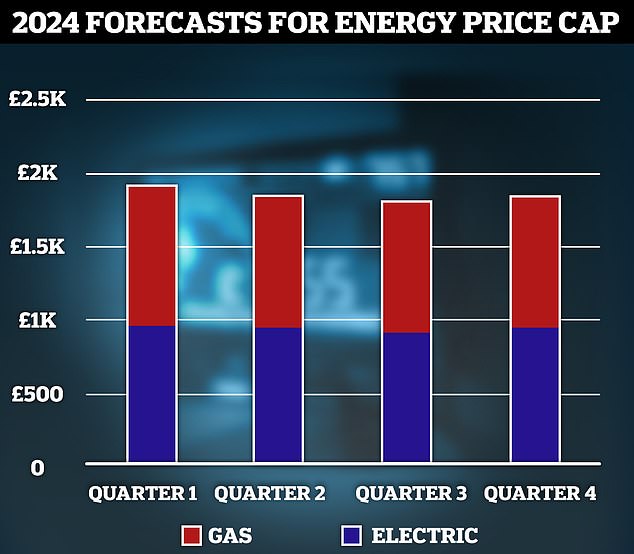

Energy consultancy Cornwall Insight predicts the typical bill will fall to £1,853 from the beginning of April, but will not fall below the current level until July next year.

Chancellor Jeremy Hunt made no mention of any additional help to offset household energy bills in Wednesday’s autumn statement.

Starting with your home’s electrical power, enter your information in the Nous.co Calculator below to see how your energy bills will change as Ofgem’s price cap rises by £94 from January:

The maximum price will increase in January, but is expected to drop slightly in the spring before rising again in the winter of 2024.

Ofgem chief executive Jonathan Brearley said: “This is a difficult time for many people, and any increase in bills will be worrying.”

‘But this increase – around the levels we saw in August – is the result of the increase in the wholesale cost of gas and electricity, which should be reflected in the price we all pay.

‘It is important that customers are supported and we have made it clear to suppliers that we expect them to identify and offer help to those who have problems with bills.

“We are also seeing the return of options to the market, which is a positive sign and customers could benefit from shopping around, with a variety of tariffs now available offering the security of a fixed tariff or a more flexible offer that ranges below the price.cap.

“People should weigh all the information, seek independent advice from trusted sources and consider what is more important to them, whether it’s the lowest price or the security of a fixed deal.”

Greg Marsh, chief executive and co-founder of home money-saving tool Nous.co, said: ‘This is terrible news for struggling households – energy bills are rising right at the coldest time of the year.

‘The Government’ has chosen not to renew its £400 energy support scheme. That means many households are facing their highest bills ever starting in January. There are already record debt figures since last year.

‘The increase will be especially painful for households with prepaid meters, who pay for the energy they use each month rather than spreading the cost over the year. The Government needs to urgently intervene to help those who cannot afford to heat their homes.’

The energy price cap sets a cap on the maximum amount suppliers can charge households in England, Wales and Scotland for each unit of gas and electricity.

Energy in Northern Ireland is regulated separately.

The overall price cap figure is an average across households rather than an absolute cap on bills, so those who use more will pay more.

The energy regulator is responsible for setting the maximum amount that energy providers can charge for each unit of gas and electricity.

However, they do not determine your final bill, which means that if you use more energy, you will spend more money.

Cornwall Insight said recent milder weather was helping to lower gas prices, and this could help reduce bills next year if it continues.

But “no sharp price declines are expected,” he said.

The price cap announcement comes after Chancellor Jeremy Hunt made no mention of any additional help to offset household energy bills in Wednesday’s autumn statement. Mr Hunt is pictured handing over the budget.

Dr Craig Lowrey, principal consultant at Cornwall Insight, said: “An unstable wholesale energy market, coupled with the UK’s dependence on energy imports, makes it inevitable that energy bills will rise from current levels.”

“This leaves households facing another winter with bills hundreds of pounds higher than pre-pandemic levels, and few affordable fixed deals.”

The price cap announcement comes after Chancellor Jeremy Hunt made no mention of any additional help to offset household energy bills in Wednesday’s autumn statement.

Adam Scorer, chief executive of fuel poverty charity National Energy Action, said: ‘The gaps in this autumn statement are devastating, especially for the poorest households.

“The ‘average household’ is paying £800 more a year to heat and power their homes since the start of the energy crisis.

“With a VAT windfall coming from rising energy bills and misspent money allocated to help vulnerable people keep warm last year, it’s clear that Chancellor Jeremy Hunt had financial room to act, but has done nothing to help the most vulnerable. people are staying warm and safe at home.’

The price cap increase has been driven almost entirely by rising wholesale energy costs due to market instability and global events, especially the war in Ukraine. In the photo, a damaged building in the country.

Emily Seymour, energy editor at consumer magazine Which?, said: ‘If you’re worried about struggling to pay higher bills, don’t suffer in silence – help is available.

‘Talk to your energy supplier about a payment plan you can afford and check if you qualify for any government schemes.

‘We recommend that everyone who does not have a smart meter take a meter reading on or around December 31 to ensure you do not overpay for energy used before the new price cap comes into force.

“Submitting meter readings periodically is a good idea and ensures that you are billed correctly.”

Richard Neudegg, head of regulation at Uswitch.com, said: ‘This price rise will come at the worst time of year for households, who will be using more energy at home during one of the coldest times of winter.

“The price cap is no longer fit for purpose and the system needs to be reformed to create a more competitive market, which also protects households.”