A young Australian who spoke out about fighting over rising interest rates has come under fire from boomers.

Maddie Walton bought a three-bedroom house worth $690,000 on the Gold Coast with a 10 per cent deposit in August 2021, when Reserve Bank interest rates were at a record low of 0.1 per cent.

But since May 2022, 13 interest rate increases have caused your weekly payments to increase by more than 81 percent.

“It’s been pretty tough,” he told Daily Mail Australia.

Maddie Walton (pictured) bought a $690,000 three-bedroom house on the Gold Coast with a 10 per cent deposit when she was 23.

‘It’s not something I’ve prepared myself for, but I have savings to back me up and I’m doing everything I can to increase my income as much as possible.

“I’ve had to change my lifestyle quite drastically.”

Her words have struck a chord with young Australians who appreciate her talking about the challenges of home ownership.

However, he has noticed that older generations often downplay the difficulties they encounter.

“Boomers and retirees say, ‘in my day, interest rates were 17 per cent’ and basically try to invalidate how you feel,” he told news.com.au.

“I think so, yes, they had a hard time for their time, but we also had a hard time and I really don’t believe that just because one generation fought, the new generation should also fight.”

She mentioned that boomers often say she should have predicted that interest rates would rise.

In response, she explained that she was the first in her family to purchase property, so she had no prior knowledge to draw on.

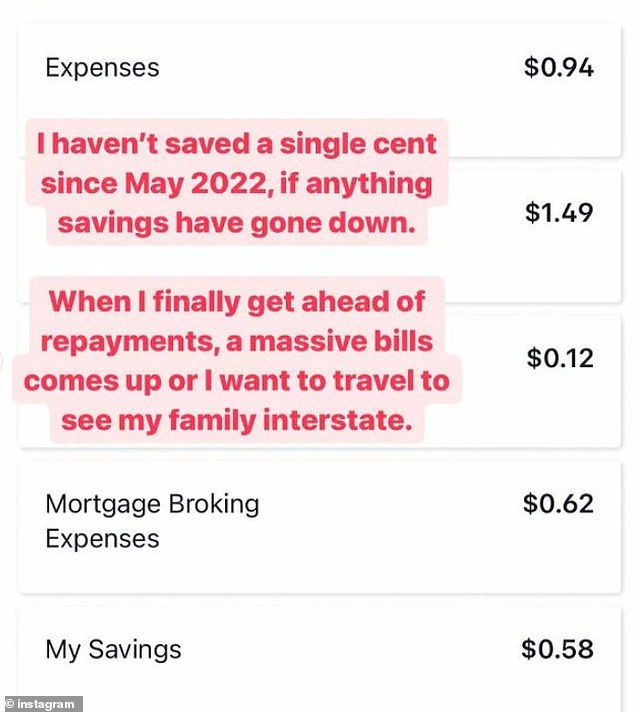

Three years later, he spoke openly about the financial difficulties he has faced since interest rates rose.

He also noted that when most boomers were buying their first homes, the median home price was closer to four times the median wage, while now it is closer to ten times the median wage.

“I think we all go through different things in every generation, but I don’t think it’s fair to invalidate how someone feels and what our experiences are like as Generation Z and Millennials,” she said.

Walton previously told Daily Mail Australia he was renting out two rooms in his house and the garage to help pay his mortgage and cope with the harshest interest rate rises in a generation.

Mortgage stress is defined as a borrower spending 30 percent or more of his or her salary, before taxes, on loan payments, but in his case it is much worse.

“I’m absolutely stressed about mortgages – they make up like 80 per cent of my income.”

Ms. Walton receives mostly positive comments for being honest about her struggles online, but has faced backlash from Baby Boomers (pictured, a post by Ms. Walton)

Walton said he wishes he had realized that interest rates could rise four percentage points.

“They never told me about that,” he said.

“If they said to me, ‘Hey, your rates could go up two, three percent, maybe four percent more’ (which they have), ‘this is what your payments are going to be, could you handle that?’ ?”‘

In 2021, former Reserve Bank of Australia governor Philip Lowe had suggested that interest rates would remain unchanged until 2024 “at the earliest”, only for interest rates to rise at the most aggressive pace since 1989.

that has taken the RBA cash rate to a 12-year high of 4.35 per cent, causing Ms Walton’s variable mortgage rate to rise to 6.29 per cent, up from 2.09 per cent.

This has caused his weekly payments to increase to almost $1,000, up from $550.

You are very nervous. Will rates rise again?

To cope, Ms Walton is now working 70 hours a week to pay off a $630,000 mortgage, which is slightly above Australia’s new mortgage average of $607,963 in March.

She also has two jobs, including one as a market researcher who conducts surveys.

The former medical researcher has also stopped going out and prepares lunch to save money.

Ms Walton (pictured) previously told Daily Mail Australia she was renting out two rooms in her house and the garage to help pay her mortgage.

For now, she rents the master bedroom with a private bathroom and sleeps in one of the smaller bedrooms, since she has two housemates who help her pay the mortgage.

‘I share my bathroom, so I’m no longer in the master bedroom with the ensuite; “I don’t use my garage anymore,” she said.

“The other people who live with me pay more rent to help support me.”

That helps raise $625 a week to help pay more of the weekly mortgage payments.