A 19-year-old property investor has revealed he now owns three houses without any financial help from his parents.

Cristian Caponi grew up in Sydney, but rather than be discouraged by the city’s unaffordable housing, he turned his attention to Perth, where apartments are still affordable.

“Honestly, I’d be upset too if I was thinking about Sydney. I would definitely say you need to look further afield and see that there are opportunities out there,” he told Daily Mail Australia.

“If that means it will get you toward whatever goal you have in life, then go for it.”

Mr Caponi’s property journey began in July last year, when he bought a 1960s one-bedroom unit in Fremantle for $190,000, when he was earning just $40,000, which is below minimum wage.

Two months later, he bought another one-bedroom unit in Langford for $247,500.

In February, he bought a two-bedroom unit in Swan View for $300,000, by which time his salary had risen to $70,000 with commissions.

Mr Caponi said his early start in real estate was made possible because he chose to become a licensed real estate sales associate at LJ Hooker in Ashfield after finishing Year 12 rather than go to university.

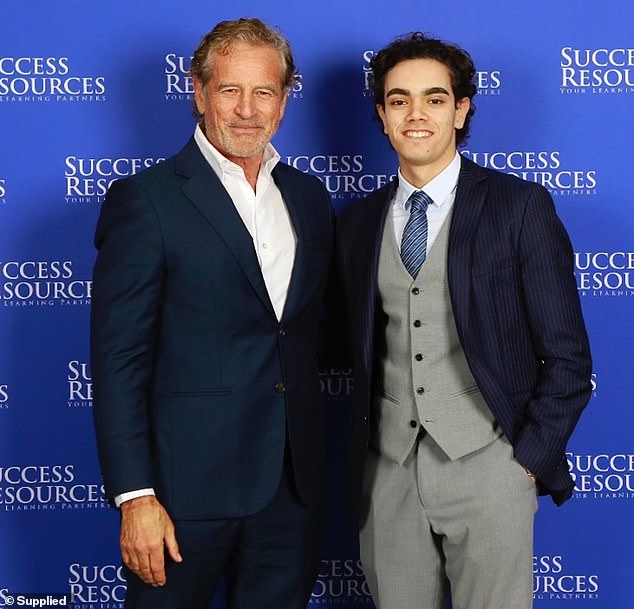

Property investor Cristian Caponi (right), 19, has revealed he now owns three houses without any financial help from his parents.

“I know from personal experience that I found it much easier to work full-time,” he said.

‘Working full time and having that kind of flexibility made it a lot easier to save.

“I didn’t use any of my parents’ savings.”

But Mr Caponi admits that living at home with his parents in Haberfield had allowed him to save up for a mortgage deposit and lenders’ mortgage insurance.

“I would definitely say it’s a big help if you have family you can live with,” she said.

For the first property, Mr Caponi asked his parents to be guarantors, meaning they would be liable if he could not meet the mortgage payments.

But it also meant It meant he didn’t have to pay lenders mortgage insurance or a deposit on the Fremantle unit.

“That allows you to access a property without having to use any savings,” he said.

Mr Caponi’s property journey began in July last year when he purchased a one-bedroom unit in Fremantle for $190,000.

Two months later, he followed up his business and bought another one-bedroom unit in Langford for $250,000.

Western Australia offers a stamp duty exemption for homes under $430,000, but on the first property Mr Caponi paid $4,700 in stamp duty.

For the second property, he paid a 10 per cent deposit, $8,000 in stamp duty and $2,000 in lenders’ mortgage insurance.

Paid $9,000 in stamp duty on the third property along with $3,500 in lenders’ mortgage insurance.

His three properties generate weekly rents of $410, $440 and $480, for a total of $1,330.

This is $53 more than the $1,277 in weekly expenses, which cover mortgage payments, municipal taxes and water bills.

In February, she purchased a two-bedroom unit in Swan View for $300,000.

By having positive leverage, Mr. Caponi can pay off his $682,750 mortgage and borrow more than the usual debt-to-income ratio limit of 5.2 for owner-occupants.

“Banks allowed me to lend more because there is rental income that also did not cause the property to have negative leverage,” he said.

Mr. Caponi aims to own 10 investment properties within five years and plans to stick with real estate rather than stocks so he will have cash flow and the ability to leverage his existing investments to buy more homes.

“I may have to sell one, but I have that long-term focus,” he said.

“In the next five years, I probably want to get to that 10 mark; if I can get there, that will put me in a good position.”

Mr Caponi said he saw an opportunity in Perth that would benefit economically from interstate migration in an affordable market.

“When there is that key price and there are a lot of people from the east investing there, like me, that makes prices go up a lot,” he said.

“I would say affordability and interstate migration are definitely another factor.”

Perth apartment prices have soared 24.5 per cent over the past year to $540,545, but one-bedroom units have not traditionally performed as well as larger two- and three-bedroom apartments.

In comparison, the average price of an apartment in Sydney at $852,766 is more expensive than the average price of a house in Perth at $808,038.

After working in real estate, Mr. Caponi worked for a buyer’s agent.

She now makes a living through property webinars until she obtains a licence to open her own buyers’ agency and hopes to one day have enough equity in apartments in Perth to eventually buy a house in Sydney.