Imagine a life where your workday begins by ordering an exotic shake at your desk at a beach bar.

Does it sound attractive? MailOnline Travel has spoken to two digital nomad experts who explain how to make it happen.

They reveal their best tips, from planning and visa applications to avoiding loneliness.

If you dream of becoming a passionate travel worker, their tips will help you make the transition.

TRANSITION PLANNING

Do you dream of being a worker passionate about travel? MailOnline Travel has spoken to two digital nomad experts who explain how to make it happen

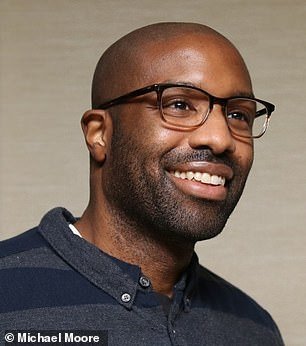

It takes at least two or three months to organize “all the logistics of relocating as a digital nomad,” says digital nomad and tech expert Michael Moore, from obtaining visas to booking long-term accommodation.

Set up a virtual address in your home country that provides scanning or mail forwarding so you have a fixed address for banking, taxes, voting, and more.

“For bank accounts, look for options that allow online registration and management from anywhere,” he adds. ‘Digital banks like N26 provide this service.”

Do some shopping too.

“Invest in a lightweight, durable laptop, powerful enough to handle your workflow, plus a battery backup,” Michael, Founder of Dedicated to vinyl, he suggests. “The lighter, the better for frequent trips.”

Have a stable mobile Wi-Fi connection such as Solis It is also key, he says. While cloud platforms like G Suite or Office 365 allow you to access files and tools from any device.

He adds: “Download useful apps like Grammarly, Trello and Slack, which will allow you to work efficiently while traveling.”

Justin Chia, data analytics, web3 and technology expert, and founder of Justjooz.comrecommends purchasing blue light glasses and noise-cancelling headphones for better concentration and fewer distractions.

VISAS

Where you live may be determined by the visas that are available to you

Justin Chia, digital nomad expert

Thoroughly research the visa requirements for each country you want to visit, making sure you apply for the one that suits your needs and length of stay, says Michael.

Where you live may be determined by the visas that are available to you, with some places offering “digital nomad or self-employed visas that provide longer-term options beyond a tourist visa.”

He adds: ‘If you plan to stay in one place for an extended period of three months or more, consider obtaining the appropriate long-term visa. This will allow you to rent an apartment, open a bank account, etc.

‘Be prepared to provide evidence of remote work or self-employment, such as contracts and letters from clients, when applying for visas. Some require minimum income thresholds. And always have travel medical insurance that covers the duration of your trip or visa period.

Popular places like Thailand and Indonesia allow you to visit them for 30 days upon arrival, Justin points out.

It also suggests Germany, Estonia, Croatia and Mexico as countries that offer visas for digital nomads.

ONCE YOU’RE ON THE MOVE…

Experts recommend setting up a virtual address in your home country that offers mail scanning and forwarding.

Michael Moore, technology expert and founder of Devoted to Vinyl

Once on the move, Michael suggests staying in each destination for at least a month or two.

He says: “Anything less than that and you’ll be in a state of constant transit, which can be exhausting.”

Another factor is taxes.

He explains: ‘To avoid tax residency issues, limit yourself to spending no more than six months at most in any country per tax year.

‘Consult an accountant knowledgeable about expat taxes and the implications of digital nomads.

‘You will likely have to continue filing taxes in your home country.

‘Research the tax laws in the countries where you earn income. You may have to pay taxes in those places based on specific rules and thresholds.

‘Look for tax-friendly bases, such as the United Arab Emirates, Malaysia or the Cayman Islands, to set up a business or become a resident.

‘Services such as Striped Atlas will allow you to form a US company remotely, which can provide tax advantages.

SET UP AND MAINTAIN YOUR NEW WORK LIFE

Justin advises setting a work schedule that “works with coworkers at home” and avoiding “odd” work hours.

“Start with your existing network and make it known that you’re looking for remote work,” says Michael, who suggests using LinkedIn, social media, and alumni job boards.

Additionally, he suggests using specialized remote job boards such as RemoteOK, We work remotely, remotiveSign up for job alerts and attend virtual networking events.

He adds: ‘If you qualify, sign up for online teaching platforms like VIPKid, GoGoKid, Qkids. This provides a constant stream of remote income.”

Justin says you should also make sure your resume shows your remote working skills.

Once you’re up and running, Justin recommends creating a work schedule that “works with coworkers at home,” avoiding “odd” work hours and using Coworking spaces to “help separate your work from your free time.”

WELL-BEING AND AVOIDING LONELINESS

“While the digital nomad life offers great freedom, it can also be very lonely,” adds Justin. ‘Deeper connections with people and places bring more joy than constantly moving’

Establish a daily morning routine “that makes you feel grounded” (exercise, meditation, journaling) and stick to it even while traveling.

That’s what Michael says, adding: ‘Designate work hours and respect them. Working all hours can quickly lead to burnout without set time off.

‘Living spaces provide an integrated community. If you’re going alone, stay in social hostels or use apps to find local language exchanges.’

Experts suggest scheduling video calls or staying in touch with friends and family and making new friends while traveling.

Justin adds, “While the digital nomad life offers great freedom, it can also be lonely.”

‘Deeper connections with people and places bring more joy than being constantly on the move.’