Home foreclosures are on the rise across the country as Americans continue to struggle with rising interest rates and the high cost of living.

Last month, there were 32,938 properties with foreclosures across the U.S., according to fresh figures from the real estate data provider ATOM.

Foreclosure occurs when an owner can no longer make their monthly mortgage payments and as a result must lose the rights to their property. Foreclosure filings include default notices, scheduled auctions, and bank repossessions.

The February data signals an 8 percent increase in filings from a year earlier, but a slight 1 percent drop from January, when foreclosures rose a whopping 10 percent from the previous month.

The numbers expose a housing affordability crisis in the US, with some states faring much worse than others.

Your browser does not support iframes.

South Carolina recorded the highest number of applications last month, with one for every 2,248 housing units.

Delaware, which had the most filings in January, had the second highest number of foreclosure filings in February — at one out of every 2,428 housing units.

Florida had one in every 2,632 housing units, Ohio had one in every 2,828 and Connecticut had one in every 2,884.

Foreclosures have been on the rise since late 2021 as banks make up for lost time after state and federal foreclosures expired.

“The annual increase in U.S. foreclosure activity suggests changing dynamics in the housing market,” said ATTOM CEO Rob Barber.

“These trends may mean evolving economic landscapes for homeowners, prompting adjustments in market strategies and lending practices.”

“The annual increase in U.S. foreclosure activity suggests changing dynamics in the housing market,” said ATTOM CEO Rob Barber

Housing affordability across the country is the worst it’s been in decades amid rising home prices, a shortage of homes for sale and rising mortgage rates.

According to the latest data from government-backed lender Freddie Mac, the average 30-year fixed-rate mortgage is 6.74 percent.

Interest rates have been boosted by the Federal Reserve’s aggressive rate hike campaign, which has taken benchmark borrowing costs to a 22-year high. And stubborn inflation has dashed investors’ hopes for immediate rate cuts in 2024.

This perfect storm has made it increasingly difficult for many Americans to keep up with payments.

At today’s rates, a typical homebuyer faces paying nearly $1,000 a month more than they would have bought two years ago, when rates were around 3.08 percent.

In February 2022, a buyer buying a $400,000 house with a 5 percent deposit would face monthly payments of $1,619. At a rate of 6.90 percent, this rises to $2,462.

Nationwide housing affordability is the worst it’s been in decades amid rising home prices, a shortage of homes for sale and rising mortgage rates

Last year, the U.S. housing market took a whopping $2 trillion hit as a historic shortage of homes for sale pushed up prices.

As costs have risen across the board, Americans’ savings have been steadily depleted.

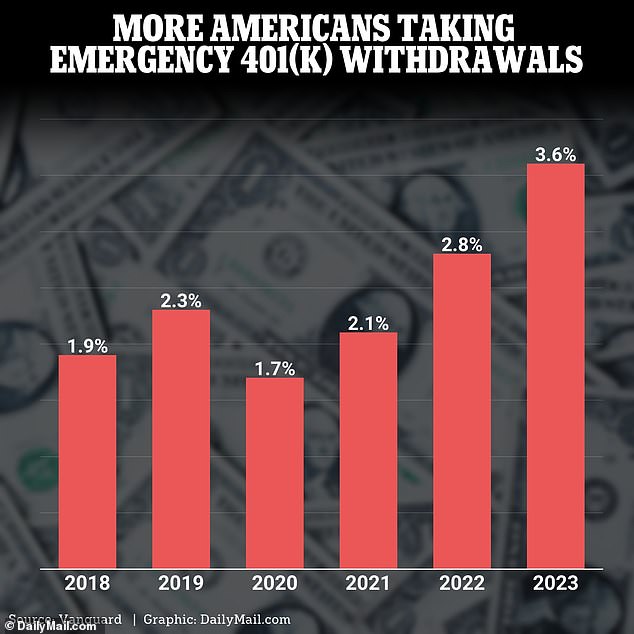

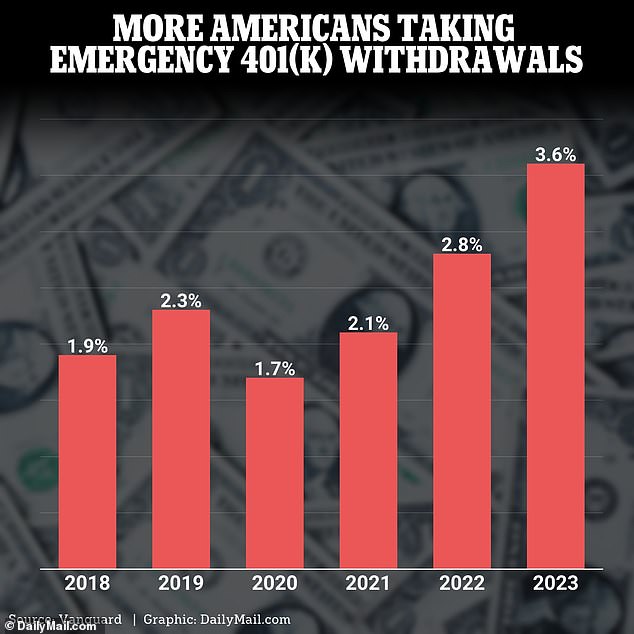

Credit card debt is at unprecedented highs, and a record number of Americans took money out of their 401(K) plans last year for a financial emergency, brand new numbers revealed this week.

Of those who took funds out of their retirement savings, nearly 40 percent did so to avoid foreclosure. This was an increase from 36 percent in 2022.

Data from Vanguard Group, one of the largest U.S. retirement plan providers, reveals that 3.6 percent of participants took early withdrawals from their accounts in 2023

When it comes to the number of foreclosures completed in February, there was a clear difference across the country.

According to ATTOM, lenders repossessed 3,397 properties through completed foreclosures in February – down 14 percent from last month and 11 percent from a year ago.

Last month, experts noted that foreclosure filings tend to be slightly higher in January due to a progression of filings through the court system after the holidays.

The largest declines in completed foreclosures occurred in Georgia, where they fell 52 percent, and in New York, where they fell 41 percent last month.

In South Carolina, however, completed foreclosures increased by 51 percent, while Missouri saw a 50 percent jump and Pennsylvania a 46 percent increase.