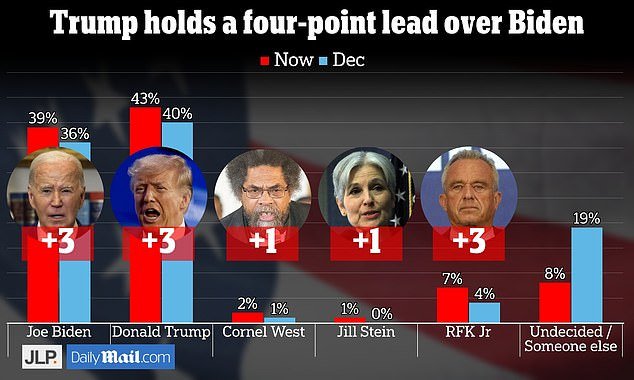

Donald Trump maintains a four-point lead in the latest JL Partners/DailyMail.com 2024 poll released Thursday, suggesting that President Joe Biden’s increased campaign travel and his forceful State of the Union address are not They have managed to win over voters.

It means the former president’s lead has not changed since December.

When 1,000 likely voters were asked who they would choose if the election were tomorrow, 39 percent said Biden and 43 percent said they would go for Trump.

With a margin of error of 3.1 points, it suggests the election will go down to the wire and could be decided by just a few thousand voters in swing states.

Both candidates won their parties’ presumptive nominations on the same day: March 12.

JL Partners surveyed 1,000 potential voters from March 20 to 24 via landline, mobile, SMS and apps. The results have a margin of error of +/- 3.1 percent.

The results show that Donald Trump maintains his four-point lead over Joe Biden, with just over seven months left until the presidential elections on November 5.

And both saw their overall vote share increase by three points since December.

But positive headlines about Biden’s State of the Union address, one of the biggest political events of the year, and a recent flurry of campaign travel have yet to translate into improved poll numbers.

He has visited Nevada, Arizona, Georgia, North Carolina and Michigan this month.

Pollster James Johnson, co-founder of JL Partners, said the State of the Union may have pleased Beltway commentators, but there was little sign it had swayed voters.

‘“Although he has a more favorable opinion among those who already voted for him, few have changed their minds since our last poll and Trump remains on track to win the popular vote,” he said.

“A lot could change, but a combination of a disastrous Biden brand, positive memories of the Trump administration, dominance of the border issue and court cases that only galvanize, rather than damage, Trump support means Trump remains in the lead.” as we move into the second quarter of the year.’

Trump outperformed Biden in our election poll in September last year and has maintained a consistent lead since then.

Biden earned rave reviews with a combative State of the Union earlier this month, when he referred to “my predecessor” 13 times without ever using Trump’s name.

He attacked him over Russia, reproductive rights, affordable health care, the border crisis, gun control, the January 6 attack and his handling of the pandemic, in an effort to remind people of the turbulence of the years of Trump.

Biden earned generally positive reviews for his strong performance at the State of the Union.

Biden has stepped up travel this month. He was in the crucial state of North Carolina on Tuesday when she joined Vice President Kamala Harris to talk about her health care plans.

The latest poll shows Biden gaining momentum, but so far it has been negated by a three-point gain for Trump.

Biden has tried to take advantage of the speech by touring the crucial states that will decide the elections.

He was in North Carolina on Tuesday to publicize his administration’s work on health care and will travel to New York on Thursday, where he will team up with former presidents Bill Clinton and Barack Obama to tap the city’s wealthy donors. .

By contrast, Trump is dealing with multiple criminal cases and civil lawsuits and has struggled to find time to run a conventional campaign.

When he hasn’t been holed up with lawyers at his Mar-a-Lago home or playing golf, he’s been in court.

On Monday, he was in New York to hear that a trial stemming from hush money payments to porn star Stormy Daniels will begin on April 15. Trump has pleaded not guilty to charges that he falsified business records related to $130,000 in refunds.

Robert F. Kennedy Jr. on Tuesday introduced Nicole Shanahan, a Silicon Valley lawyer and ex-wife of Google co-founder Sergey Brin, as his vice presidential pick.

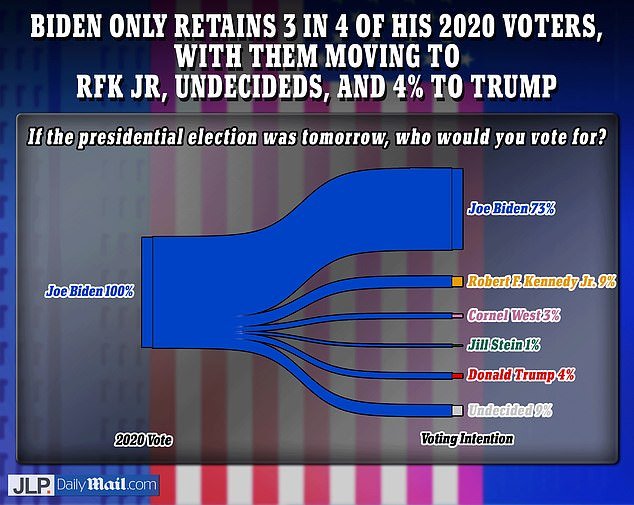

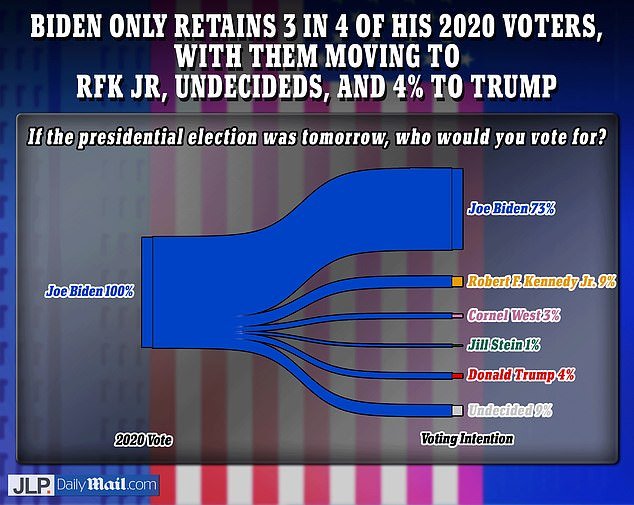

Poll shows RFK Jr. takes about nine points of Biden’s vote in 2020

He faces three more sets of criminal charges, but poll after poll has found it hasn’t affected his appeal to half the country. In fact, you may have even helped his cause.

“Well, it might also make me more popular,” he told reporters when asked if he was worried about how a conviction might affect the election, “because people know it’s a scam.”

Meanwhile, the general election race has become clearer since both candidates became their parties’ presumptive nominees.

The share of voters who said they were undecided or voted for someone else dropped from 19 percent to eight percent.

And that has given a boost to Robert F. Kennedy Jr.’s independent candidacy, which has gone from four percent to seven percent, making him a potential spoilsport in November.

The poll shows that he is receiving more support from Biden than from Trump.