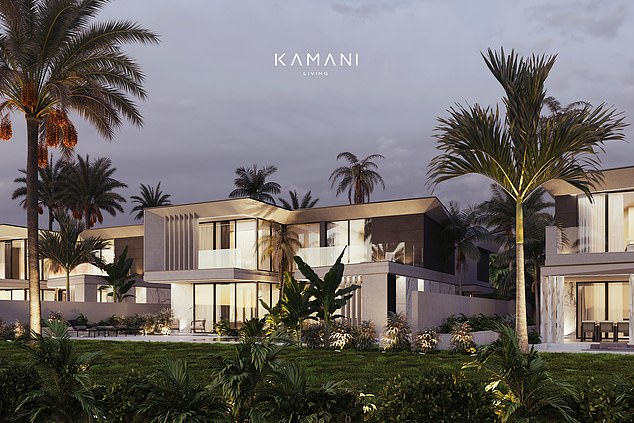

The CEO of PrettyLittleThing has now ventured into the real estate market and launched his own real estate company.

Billionaire Umar Kamani, 36, has he now created Kamani Living, a new boutique company based in Dubai.

Kamani Living’s headquarters occupies two floors and is located in Dubai Hills Business Park, along with other real estate companies.

The firm says it will offer investment opportunities “backed by the region’s leading developers”, as well as connecting clients with real estate opportunities in the Middle East “and beyond”.

Umar said: ‘Dubai has always been close to my heart. I have seen this city transform into one of the most interesting destinations in the world.

“With Kamani Living, we aim to enhance the real estate experience for both investors and buyers, combining trust, transparency and unmatched experience.”

He launched Kamani Living following his success in the Dubai property market, where he sold a 30,000ft undeveloped “sand pile” on the island in Dubai’s Jumeirah Bay for more than £27 million.

The fashion entrepreneur had bought the land just two years earlier for a modest £16.1 million, making a total profit of around £12 million on the sale.

Umar hasn’t forgotten his roots at PrettyLittleThing, as he’s bringing in Tom Curle, who served as COO during the fast fashion brand’s rise.

The combined total of land sales amounts to almost $70m (£56.34m).

The area is often referred to as “Billionaire Island” due to its ultra-wealthy residents and luxury real estate properties, as well as its three skyscrapers.

The empty island off the coast of Dubai It is part of an artificial archipelago that consists of approximately 300 islands in the shape of a world map.

But Umar hasn’t forgotten his roots at PrettyLittleThing, as he’s bringing in Tom Curle, who served as chief operating officer during the fast fashion brand’s rise.

The couple have worked together for over a decade and Tom rejoined PrettyLittleThing in September and is now part of the new Kamani Living team.

Kamani Living is part of the Kamani Property Group, based in Manchester and run by the wealthy Kamani family.

It now has assets all over the world, including London, Mumbai, New York and now Dubai.

The group already has a growing property portfolio under its belt, including developments such as 20 Dale Street, a Grade II listed restoration in Manchester’s Northern Quarter.

Kamani Living’s headquarters is spread over two floors and is located in Dubai Hills Business Park, along with other real estate companies.

He launched Kamani Living following his success in the Dubai property market, where he broke records by selling a 30,000-foot untapped “sand pile” on the island in Jumeirah Bay.

Umar, pictured with his wife Nada Kamani, said Dubai has always been “close to my heart”.

Kamani Living is part of the Kamani Property Group, based in Manchester and run by the wealthy Kamani family.

Kamani Property Group also worked on projects such as Ancoats Works, a £50 million canalside development of 193 homes and community spaces and The Grand, a 34,000 sq ft property offering versatile luxury residential and commercial spaces.

This comes as Umar is expected to take on the role of chief executive of the Boohoo Group, after John Lyttle announced his departure last month after five tumultuous years in the role.

Industry insiders predict Kamani, 36, is the favorite to succeed Lyttle as chief executive of the group, which owns Debenhams, PrettyLittleThing and Karen Millen.

In September, the Manchester businessman made a dramatic return to PrettyLittleThing after previously stepping away from the business he built, vowing to “return the beautiful brand where it belongs”.

Boohoo chief executive Lyttle is to step down as the fast fashion retailer embarks on a review of its operations and brands, “to unlock and maximize value for shareholders”.

But Sports Direct tycoon Mike Ashley has demanded to be named chief executive of Boohoo, in a move expected to spark an “explosive” showdown with Umar.

Mike’s retail empire Frasers, which is Boohoo’s biggest shareholder with a 27 per cent stake, sounded the alarm about a “leadership crisis” at the brand and criticized its “dismal trading and share price collapse ” at the end of last month.