Table of Contents

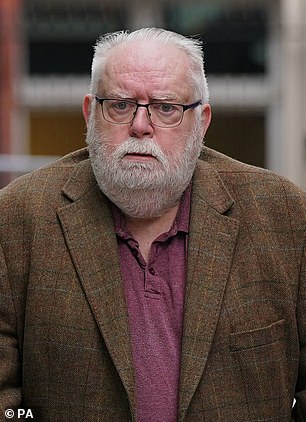

The decision-maker: Bob Dench, director of Co-op Bank

Bob Dench is almost certainly the only senior bank executive to have crawled through a sewer pipe to stop a criminal. At the time, Dench, now chairman of the Co-op Bank, was a junior policeman, but he was already showing the determination that has guided him through subsequent difficult situations in the financial services industry.

The criminal was trapped in the mixture of noxious gases in the pipe and Dench was forced to drag him to safety.

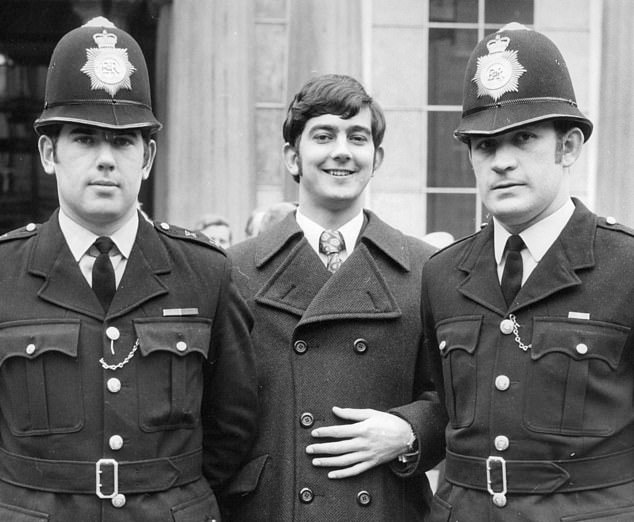

In recognition of this feat, the 22-year-old policeman was awarded the British Empire Medal for Valour in 1972. The honour was bestowed upon him by the late Queen.

Dench says: ‘Her Majesty asked if my police dog had survived the experience and I was able to tell her that he had.’

The investiture was filmed for a BBC programme which appeared on the front page of the Radio Times. There are no medals to be won in banking, otherwise Dench, 74, arguably deserves awards for her role in turning around two troubled lenders.

Thanks to their efforts, the once-threatened Co-op Bank will be returned to its traditional mutual status through a takeover by Coventry Building Society.

Dench honed his rescue skills at Paragon Bank, the specialist finance provider. As chairman from 2006 to 2018, Dench, a skilled navigator, steered the organisation through the damaging impact of the global financial crisis to profitability.

According to Dench, he began taking on the challenging role of chairman in 2004, aged 54. He says: “I was getting bored because I had retired 12 months earlier after 27 years at Barclays. I was on the board of the bank but I knew I wasn’t going to be a chief executive so I decided to call it a day.”

Dench sees her main attribute as resilience rather than decisiveness, but her career suggests otherwise. At Paragon, she was unimpressed by her fellow directors’ lack of faith in the bank’s future.

He comments: ‘They were a weak board, so I fired them.’

Dench clearly prefers brave and outspoken colleagues. “I’ve tended to choose people who can tell me when I’m being a bit of a jerk.”

He pays tribute to the people who have helped him along the way, including his colleagues at Barclays, Co-op Bank and other companies, as well as his kindergarten teacher, who seems to have seen his potential to achieve great things. His wife, to whom he has been married for 52 years, tops the list, of course.

When Dench joined Co-op Bank in 2018, the bank was in the midst of an existential crisis, largely caused by its ill-fated 2009 takeover of Britannia Building Society, which resulted in a £1.5bn deficit.

This situation was made worse by the incompetence and venality of the bank’s president at the time, Paul Flowers. This Methodist minister combined his fondness for cocaine, methamphetamine and male sex workers with a lack of numerical knowledge. Flowers didn’t even know how big the bank was.

These alarming facts came to light in a Mail on Sunday article in 2013, leading to Flowers being dubbed the “Crystal Methodist”. The revelations caused enormous public shock and disappointment. As part of the respectable Co-operative Group, Co-op Bank had always emphasised its ethical stance.

The bank’s situation was so precarious that US hedge funds that had invested in the bonds were forced to take over ownership in 2017. This deal separated the business from the Co-operative Group, thereby cutting its ties with the mutual. For many account holders, this status was the main attraction of the bank, which was created in 1872 to embody community principles.

Unlike some senior executives, Dench does not try to suggest that the bank’s turnaround of operations and return to profitability in 2021 was entirely due to its own achievement. She pays tribute to its executives, such as chief executive Nick Slape and chief financial officer Louise Britnell.

She also acknowledges the key role of hedge funds, which are often seen as the villains in the case, but Dench has only seen the good side of the Co-op Bank’s hedge fund investors: Anchorage, Bain Capital, Cyrus, Golden Tree, JC Flower and Silver Point Capital.

Paul Flowers: He was nicknamed ‘the glass methodist’

He says: “Hedge funds have a worse reputation than they deserve.”

It also taught him a lesson about what people care about. The bank has 2.6 million customers, about 90,000 business account holders and 50 branches. He says: “I thought customers would be worried about Flowers. But they were focused on what was going to happen to their branch.”

This connection suggests that Coventry, which is the UK’s third-largest mutual lender, would do well to keep the Co-op Bank logo above its branches.

Dench’s entertaining way of recounting the events of her career (you could practically smell the foul fumes in that sewer pipe) makes you wonder what would have happened if she had stayed in her first job as a junior journalist at the Daily Mail.

The family’s GP, who lives on the deprived New Addington estate near Croydon, had suggested the 16-year-old, who had just left school, might thrive in journalism. Dench says: “I couldn’t survive on the money I was earning in journalism so I went into the police force, where they paid a bit more.”

The rescue was not the only colourful episode during his time in the police force between 1969 and 1976.

He also closed a prison, he says. “In the early 1970s, the IRA financed its activities through bank card fraud, using cards they had stolen from the corridors of flats.”

‘One of the gang members became a police informant, but when he got out of prison he fled to Scotland, where he was imprisoned for another crime. The conditions in the prison were medieval and I used that as a pretext to get him released. This led to the prison being closed, which didn’t make me very popular, but people had been trying to close the place down for decades.’

The lessons he learned in policing about limiting card fraud earned him a job at Barclaycard. Between 1976 and 1984, he introduced credit and behavioural scoring and created the UK’s first large-scale telephone lending business.

On the beat: Bob, centre, after receiving a British Empire Medal at Buckingham Palace in 1972 for his work as a police officer.

His later roles include chief executive of Barclays Australia and five years in New York as head of the Barclays Global Visa traveller’s cheques business. Dench was chairman of the bank’s retail division during the acquisition of Woolwich Building Society, which transformed Barclays into a major force in the mortgage sector.

Dench will stay at Co-op during the transition, but is also a director of Charities Aid Foundation, the UK’s fourth-largest charity. He also intends to spend time sailing. Coming out of our interview, I thought about how he might share his insights on how to get out of sticky situations, whether literal or not.

A series of Instagram or YouTube videos would be essential in the banking sector (and in any other field of work).

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.