Adidas posted its first annual loss in more than 30 years as it joined Nike in the fight to get shoppers to spend money on expensive new sneakers.

The German sportswear company lost £50m in 2023, down from profits of £217m the previous year.

Bjorn Gulden, chief executive of Adidas, who took over early last year, said the results were “not nearly good enough”.

The results came as its biggest competitor, Nike, warned of weaker demand and decided to press ahead with a cost-cutting program.

High inflation and interest rates have hit retailers hard as customers have looked for ways to reduce spending on high-priced products.

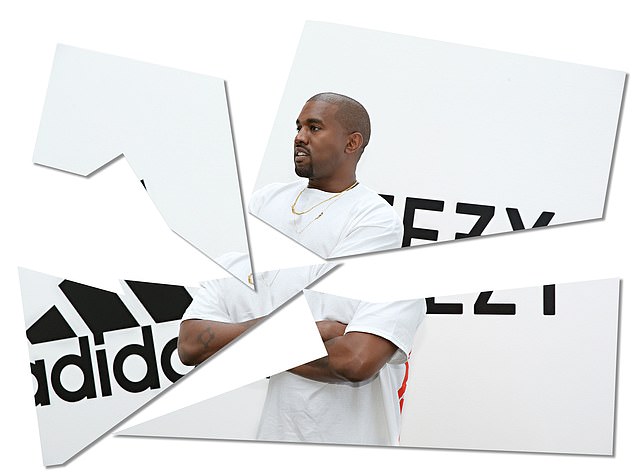

Disgraced: Rapper Kanye West (pictured), who changed his name to Ye in 2021, came under fire for a series of anti-Semitic social media posts in late 2022.

In December, Nike outlined a £1bn savings plan over the next three years, which included tightening product supply and cutting management levels.

And last month, Nike said it would lay off 2 percent of its workforce (more than 1,600 jobs) in hopes of cutting costs.

But the story is even bleaker for Adidas, which has been dealing with its own breakup with rapper Kanye West.

West, who changed his name to Ye in 2021, came under fire for his anti-Semitic social media posts in late 2022.

Adidas quickly ended its lucrative Yeezy footwear partnership with the rapper, leaving shoes worth £1 billion in limbo.

At the time, Yeezy shoes accounted for almost half of the company’s profits.

But almost two years later, Adidas is still paying a high price for the breakup.

The company said yesterday that total revenue fell by around 5 per cent to £18 billion in 2023.

The discontinuation of Yeezy’s deal with the rapper led to a sales increase of £427 million during 2023.

And this pushed the group to post its first full annual loss since 1992, a year in which the company faced a leadership crisis and increasing competition for market share.

However, Gulden, 58, has promised to get the company out of this rut and make Adidas a “good company again.”

The Norwegian-born industry veteran was poached for the CEO role in January 2023.

His mission was to deal with the Yeezy crisis and he had experience in the industry, having previously managed its main rival Puma for almost ten years.

And analysts have praised his leadership of the group in the face of a difficult and uncertain economic context.

“Things have clearly been going in the right direction at Adidas since Bjorn Gulden took over,” said Thomas Joekel, portfolio manager at Union Investment.

“The popularity of brands is increasing, which can also be seen in the fact that it is now necessary to sell fewer products at a discount,” he added.

Victoria Scholar, chief investment officer at Interactive Investor, said: “His decision to increase production of Samba and Gazelle sneakers last year has proven to be a successful move, and investors applauded his decision-making.”

“The stock performed very well last year, clearly outperforming Nike and Puma.” Gulden also made the bold decision late last year to sell off his remaining stock of Yeezy sneakers for at least the price it cost to make them.

The company said this ploy had added £641 million to sales in the final two quarters of last year.

It set aside £120m for donations to charities fighting antisemitism and racism.

Looking ahead, Gulden appears to be focused on capitalizing on the recovery of the Chinese market, while the US equivalent remains a drag on consumer demand.

“2023 was a turning point for the business (in China),” Gulden told reporters.

“We feel much more comfortable with China than we did 12 months ago.”

Adidas shares rose 3.8 percent yesterday and are now up almost a fifth since Gulden joined, while Nike and Puma are trading lower.

Deutsche Bank said that while there were no surprises in Adidas’ results, 2024 would be “another year of transition” for the company.

“All eyes are on the future prize and the building blocks to get there,” they said.

But the company is fighting decisively for market share with its biggest rival, Nike.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.