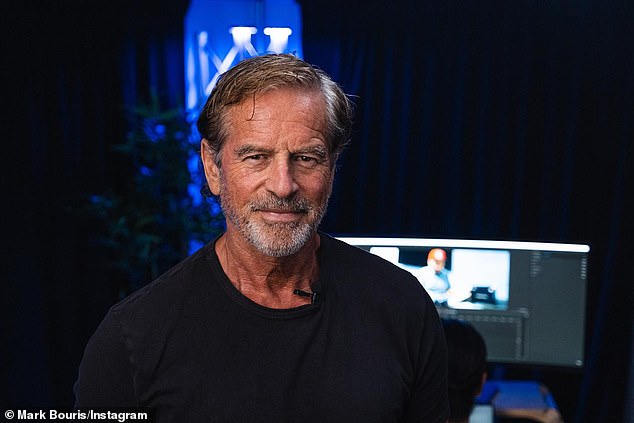

Financial guru Mark Bouris has claimed Australia has been in recession for the past 18 months and living standards are at their lowest for two years.

The founder of Wizard Home Loans made the grim admission on March 11, 2016. Ben Fordham’s 2GB on Tuesday.

“In per capita terms, we’ve been in recession for about 18 months,” he said.

‘Considering that one million people have arrived in the country in the last two years, we are definitely in a recession per capita.

‘The standard of living per capita in this country is lower than it was two years ago.’

A per capita recession is defined when the standard of living falls even though the economy is growing.

Economic growth is supported by an increase in population, although this increase puts pressure on goods and services.

Mr Bouris made the admission hours before the Reserve Bank of Australia released its latest interest rate decision.

Financial guru Mark Bouris has claimed that Australia has been in recession for the past 18 months.

The cash rate is currently at a 12-year high of 4.35 percent.

Mr Bouris said his message to the RBA had been consistent.

“I’ve been saying for a long time that our RBA has been working too hard for too long; it needs to be given a break,” he said.

Minutes from the RBA’s most recent meeting warned that inflation was still high, ruling out the possibility of a rate cut and hinting that further increases could be on the horizon.

The consumer price index grew by 3.8 per cent in the year to June, still further above the Reserve Bank’s 2 to 3 per cent target.

The latest headline inflation figures, released on Wednesday, are even worse than the March quarter’s 3.6 percent annual pace and marked the first quarterly deterioration since 2022.

Australia’s stock market suffered its biggest two-day drop in more than two years (shedding $45 billion in one day) as investors feared the US economy was sliding into recession.

Mortgage tycoon Mark Bouris has warned that the RBA’s rate hikes have crippled the Australian economy

Mr Bouris said that with recent sharp falls in global stock markets in Australia, he did not anticipate the RBA would raise rates this month.

“I assume what they’re going to say is, ‘We’re not going to raise rates, but we’ll look at international affairs, what’s going on in the rest of the world, and we’ll stick to our guns on getting inflation down to two or three percent, which means we’ll pull the lever if we need to,'” he said.