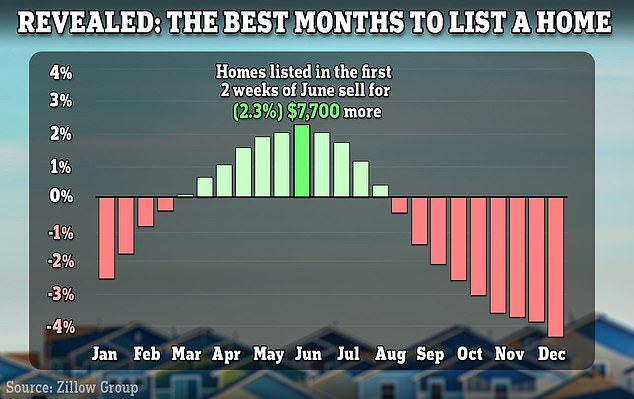

- Study shows homes listed for sale in first half of June attract price premium

- Sellers Could Make $7,700 More on a Typical Property, Says Zillow

- Experts say the U.S. housing market is finally showing signs of thawing

- Sellers could also see a sharp drop in costs after the estate agents’ trade body agreed last week to scrap a notorious commission scheme.

<!–

<!–

<!–

<!–

<!–

<!–

Homeowners looking to sell their property may want to wait until summer if they want to maximize their profits.

A new analysis from real estate portal Zillow shows that homes listed in the first two weeks of June typically sell for $7,700 more than they otherwise would.

In comparison, sellers stand to lose more than 4% of their asking price if they wait until December.

The report’s findings are another reason to pause sales for now: It emerged last week that commissions charged by real estate agents are expected to drop this summer.

Historically, the housing market always heats up in the spring and summer as parents want to move before the next school year.

A new analysis from real estate portal Zillow shows that homes listed in the first two weeks of June typically sell for $7,700 more than they otherwise would.

Sellers’ homes also benefit from fresh flowers and greenery after winter.

Amanda Pendleton, home trends expert at Zillow, told CNBC: “It’s kind of a great time for buyers and for sellers, and that’s why we’re seeing a lot more activity around this time. of the year.”

Experts say the frozen U.S. housing market is finally showing signs of thawing. A report from Redfin found that the number of new listings jumped 14.8% from a year ago – the largest annual increase since May 2021.

Before the pandemic, May was the hottest month to list a property. However, due to the volatility of the mortgage market, this measure was postponed until June last year.

According to Zillow data, homes listed in the first half of June 2023 sold for 2.3% more than average. This equates to an increase of $7,700 for an average home.

Preferred sales months vary slightly by city, however, the researchers noted.

For example, in New York, homes listed in the first half of July tended to command a premium of 2.4 percent, or $15,500 in real terms.

Meanwhile, Los Angeles sellers are expected to strike in the first half of May to benefit from a 4.1 percent bonus on their real estate listings. That’s $39,300 more.

Before the pandemic, May was the hottest month to list a property. However, due to volatility in the mortgage market, this decision was delayed until June last year.

The U.S. housing market has virtually frozen in response to soaring mortgage rates that are deterring homeowners from moving.

The average rate for a 30-year fixed-rate home loan is now 6.74%, according to government-backed lender Freddie Mac.

This is almost double what they were in March 2022, when they were hovering at 3.76%.

That means a buyer buying a $400,000 home today will pay about $700 per month on their mortgage compared to what they purchased two years ago. This analysis assumes a 5 percent down payment.

Rising rates have created a “lock-in effect” whereby buyers are unwilling to give up their cheap deals.

As a result, the US real estate market was virtually frozen. During the first week of March, applications to purchase a home were 11% lower than the same period last year, according to the Mortgage Bankers’ Association.

Research in February revealed the ‘magic’ mortgage rate that will revive the property market.

A majority of potential buyers say they would finally go through with purchasing a home if rates fell below 5 percent, a study suggests. new survey from Realtor.com.

There was more good news for sellers last week. They could see a BIG drop in sales costs after real estate agents agreed to eliminate the infamous commission system and pay $418 million in damages in a historic legal settlement.

Meanwhile, millions of buyers could soon qualify for a $10,000 tax credit under sweeping housing market reforms proposed by President Biden during his State of the Union address.