A stunning array of images revealed in a new exhibition celebrates the work of a photographer who escaped the Nazis and built a life in Britain.

Dorothy Bohm, who died last year aged 98, spent more than seven decades honing her craft after arriving in Britain from Lithuania aged just 14.

When she said goodbye to her father, he gave her his Leica camera and put it around her neck, saying, “Maybe it will be useful to you.”

Although he initially had no interest in photography, Bohm had a hugely successful and celebrated career.

A collection of his images is on display at The Photographers’ Gallery near Oxford Circus, central London.

Many show ordinary people in places as diverse as Morocco, Paris, New York and Egypt from the 1950s to the early 2000s.

Bohm frequently declared his affection for Britain. In the Daily Mail in 2015, he spoke of his “tremendous love for this wonderful country, for what it represents, its principles and the humanity compared to other countries.”

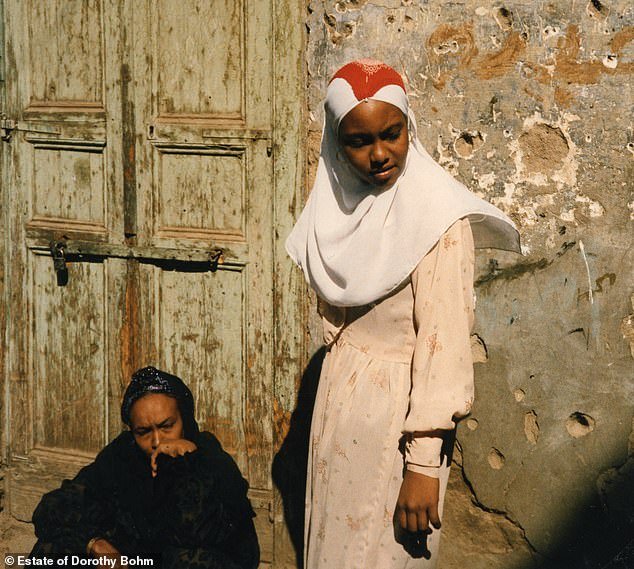

A stunning array of photographs revealed in a new exhibition celebrates the work of photographer Dorothy Bohm, who escaped the Nazis and built a life in Britain. Above: Two women in Aswan, a city in southern Egypt, in 1987.

Bohm, who died last year aged 98, spent more than seven decades honing his craft after arriving in Britain from Lithuania aged just 14. Above: Bohm when he was young and in 2006.

In a quote on The Photographers’ Gallery website, he added: “I have spent my life taking photographs.

‘Photography satisfies my deep need to prevent things from disappearing.

‘It makes transience less painful and preserves some of the special magic I have sought and found.

“I’ve tried to create order out of chaos, to find stability in flow and beauty in the most unlikely places.”

Bohm was born in Königsberg, East Prussia (now Kaliningrad in Russia) in June 1924 to a wealthy Jewish family.

The family moved to Lithuania when the situation in Germany deteriorated in the early 1930s.

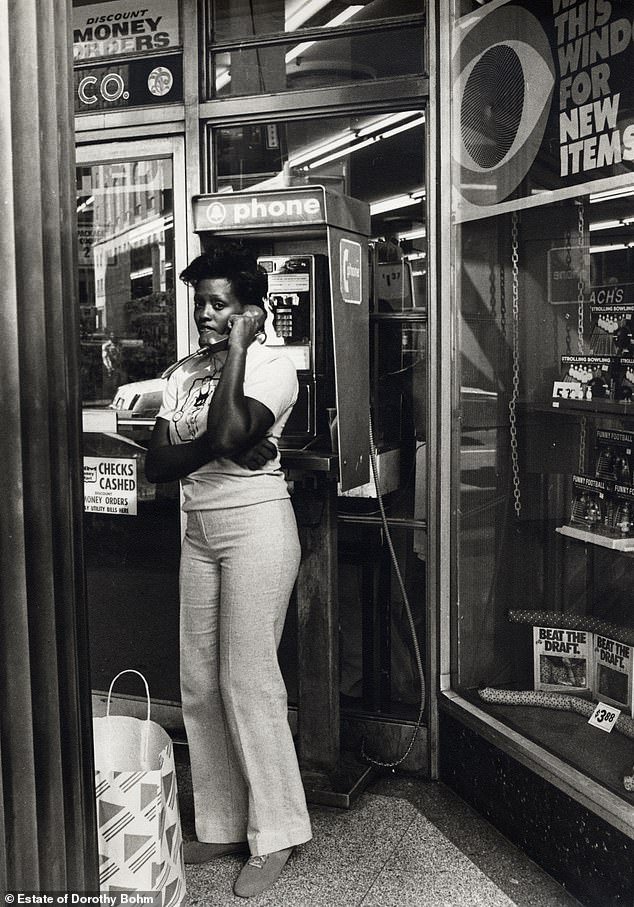

A woman using a pay phone in New York in the 1970s, when Bohm was happily married

The scene of the Villa des Tulipes, 18th arrondissement, Paris in 1955

A woman picking flowers to make a bouquet, Rude de la Loi, Brussels, October 1949

A boy opening a package of candy in New York in 1952.

In June 1939, Bohm was sent to the safety of England. He learned English in the space of a year at boarding school in Ditchling, East Sussex.

She continued her photography studies at Manchester College of Technology, where she met her future husband, Louis Bohm, a Polish Jewish refugee who was studying chemistry there.

During the war, Bohm drew on his personal experiences to give talks on the crimes of Nazi Germany for the Ministry of Information.

She married Louis in 1945 and shortly afterwards opened her own photography studio in Manchester.

In the 1950s the couple settled in London, where they raised their two daughters.

Bohm’s husband’s work took him around the world, allowing the photographer to take photographs in places like Mexico and South Africa.

He received news that his parents were safe and living in Riga, so in 1960 he traveled to the USSR to meet them.

They had escaped the Nazis, but were later deported by the Soviets to separate labor camps before being reunited.

In Moscow, Bohm was followed by the Soviet security services. She took photographs at the city’s GUM department store and later admitted to the Telegraph that she felt “a little uncomfortable” taking them.

“We knew they were watching us, so I took the risk,” he added.

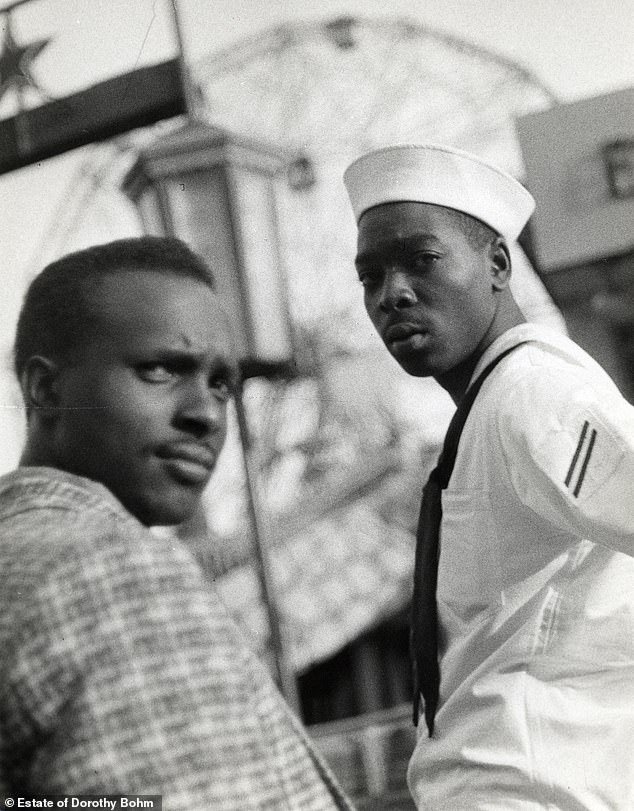

Two men appear bewildered as Bohm takes their photograph in Coney Island, New York, in 1956.

The scene near the Castelo de S. Jorge in Lisbon, 1963

A girl walking her dog in the Tuileries Garden, Paris, 1953.

A relaxing view of the Seine River in Paris in 1955

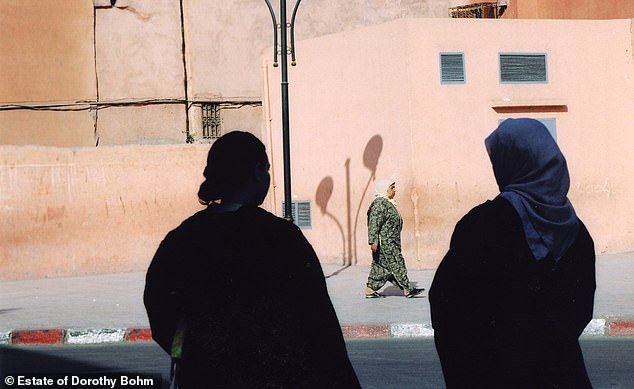

Bohm continued taking photographs throughout Europe in his old age. Above: Locals on a street in Marrakech, Morocco, in 2004.

A colorful scene in front of a kiosk in Lisbon, 1996

A photograph taken by Bohm in Scheveningen, Netherlands, 2009.

In 1963, Bohm’s parents received permission to join their daughter and son-in-law in London.

She had her first solo exhibition, ‘People at Peace’, in 1969. The photographer’s first book, A Word Observed, was published in 1970.

Later in the decade, he took fewer photographs and instead helped build the reputation of The Photographers’ Gallery, which opened in 1971.

She spent 15 years as the gallery’s associate director.

In the mid-1980s, Bohm began working in color and adopted more abstract work, taking photographs of sidewalk furniture and reflections in shop windows.

The death of her husband in 1994 led Bohm to consider leaving her profession, but she continued believing that Louis would disapprove.

Well into his 90s, he continued to work, taking photographs of his neighborhood in Hampstead and beyond.