Two of the world’s richest men have bought stakes in London stock market stalwarts.

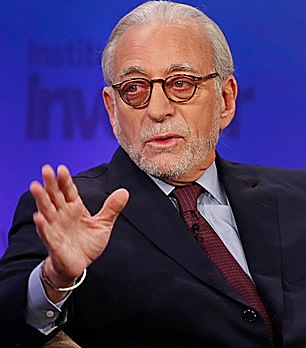

In moves that will shock boardrooms across the city, Mexican billionaire Carlos Slim has bought more than 3 per cent of BT, while US activist Nelson Peltz has taken a major stake in Rentokil.

The share buildup is likely to be seen as further evidence that British companies are hugely undervalued, making them attractive to investors (and buyers).

The stock market has witnessed what has been described as a “relentless frenzy” of takeover activity this year as foreign bidders look to snap up London-listed companies on the cheap.

Last night Slim and Peltz remained tight-lipped about their plans for BT and Rentokil, which are long-standing members of the FTSE 100 index of blue-chip shares. But the investments will raise questions about the future of both companies.

Big hitters: Activist investor Nelson Peltz (right) has taken a major stake in pest control group Rentokil, while Mexican billionaire Carlos Slim (left) bought more than 3% of BT.

Slim, whose 3.2 per cent stake in BT is worth £400m and was bought through his family business Inbursa, joins other high-profile investors on the shareholder register, including telecoms billionaire Patrick Drahi and the German group Deutsche Telekom.

Drahi is currently BT’s largest shareholder, with a 24 per cent stake.

New BT boss Allison Kirkby has embarked on a turnaround plan since taking office in February.

Last month, it outlined its plan, which included another £3bn of cost cutting, sending shares up more than 17 per cent in its biggest one-day gain in almost a quarter of a century.

But Karen Egan, a telecoms expert at Enders Analysis, said Slim’s attack showed the group was still “undervalued”.

“The telecommunications sector as a whole has been out of favor with investors for a long time,” he said.

Slim, considered the 17th richest man in the world, made his £72bn fortune from América Móvil, Latin America’s largest telecommunications group.

BT said last night that “we welcome any investor who recognizes the long-term value of our business” and “we look forward to collaborating with Inbursa as we do with all investors.”

A spokesman for Slim, Latin America’s richest man, described it as “a financial investment, something the group usually does.”

Paolo Pescatore, telecoms expert at PP Foresight, said: “This is a bolt from the blue which underlines confidence in BT’s strategy and growth plans under Kirkby.”

Slim’s investment in BT emerged just hours after Peltz’s hedge fund Trian Partners revealed it is now a top ten investor in royal rat catcher Rentokil.

Lucrative: Rentokil’s rat hunting services are in demand

Analysts expect Peltz, 81, to pursue a proxy campaign at the company, and warned that this could even involve a push to shift its major stock market listing to New York, in yet another blow to the company. city.

Shares in Rentokil soared 13.7 per cent, or 57 pence, to 472.2 pence yesterday, after the Wall Street asset manager said it had contacted senior management at Rentokil to discuss the increased value for shareholders.

Peltz is a prolific activist investor who has battled with the boards of well-known companies such as Disney, Procter & Gamble and Heinz.

AJ Bell chief investment officer Russ Mold said Peltz was “likely to seek a major restructuring.”

“This could include a push to move its main listing to the United States, which would be another blow to London’s prestige as a listing location,” Mold said.

It comes at a crucial time for the London stock market, which has suffered a mass exodus of companies.

Trian said he “looks forward to working with Rentokil’s management team.”

Peltz, whose daughter Nicola is married to David and Victoria Beckham’s son Brooklyn, last month sold his stake in Walt Disney for $1bn (£780m) after losing a boardroom battle.

He also sits on the board of Unilever, which is the London-listed maker of Dove soap and Hellmann’s mayonnaise.

And within weeks of Peltz taking a stake in Ferguson in 2019, he revealed plans to spin off the historic British division Wolseley and appoint a new chief executive.

Ferguson then moved its listing to the United States three years later.

Peltz won a seat on Heinz’s board in 2006 after a bitter proxy battle and was instrumental in the baked bean brand’s merger with US firm Kraft and the spin-off of Mondelez.