Table of Contents

- More than half of first-time buyers with mortgages received support in 2023

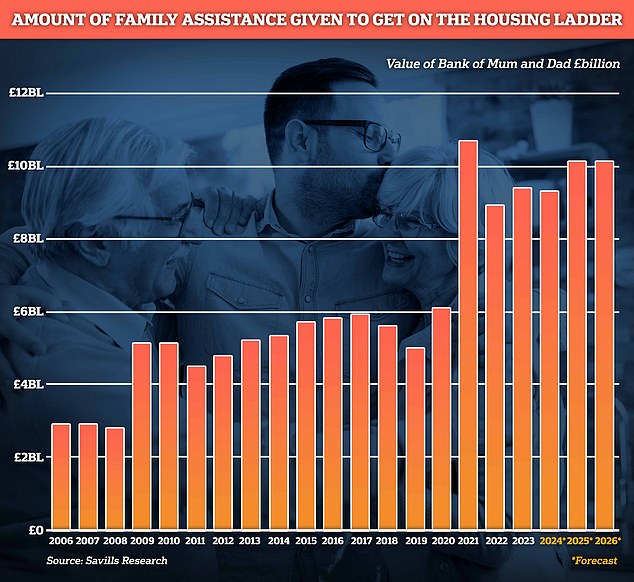

The Bank of Mum and Dad is expected to pay out almost £30bn over the next three years to give their children a boost in access to property.

According to estate agency Savills, £9.4 billion was handed over to first-time buyers in 2023, a year in which property transactions fell by around 20 percent.

While there were fewer first-time buyers last year, those who did needed more help because of higher mortgage rates.

In total, 164,000 first-time buyers relied on family help to purchase their first home (57 percent of all first-time buyers with mortgages).

Helping hand: Bank of Mum and Dad gifts and loans totalled £9.4bn in 2023, helping 164,000 first-time buyers

This was the highest proportion of first-time buyers receiving assistance since 2012, and represents a 10 percent increase from 2022.

Parents are expected to pay a total of £30 billion to their adult children between 2024 and the end of 2026.

While the overall number of first-time buyers receiving financial help from family has fallen from a peak of 198,000 in 2021, Savills says the amount borrowed or gifted has almost doubled since 2019.

Frances McDonald, head of residential research at Savills, said: ‘While many homebuyers enjoyed record-low interest rates during the early part of the decade, stricter mortgage requirements, which have been in place since the start of the pandemic, have impacted on lower-deposit loans, more commonly used by first-time buyers.

‘On top of this, record rental growth and rising mortgage rates have acted as a further blow to the homeownership aspirations of first-time homebuyers.

‘As a result, a higher proportion of people needed support to access housing, and those who could do so took advantage of family support to try to get a deal on a lower mortgage rate.’

Cheaper mortgages to reduce parents’ contributions

In recent weeks, mortgage rates have been falling and lenders are competing fiercely to win business.

As mortgage rates continue to fall, Savills has predicted that a smaller proportion of first-time buyers are likely to need support from the Bank of Mum and Dad.

The proportion of first-time homebuyers receiving support will fall from 57 percent in 2023 to 54 percent this year, it has suggested.

Savills expects the total contribution to first-time home purchases to remain in line with 2023 levels (£9.3bn).

“Despite the Bank of England’s recent decision to cut the base rate, we expect lenders to continue to favour less risky mortgages with lower loan-to-value ratios,” McDonald added.

‘This means that buyers will still have a hard time taking the first step into the real estate market.

‘Those who have the option of receiving family support and are secure in their employment will find it much easier to access housing and only those on higher incomes and those who have received significant support are likely to be able to buy at the top end of the market.’