Table of Contents

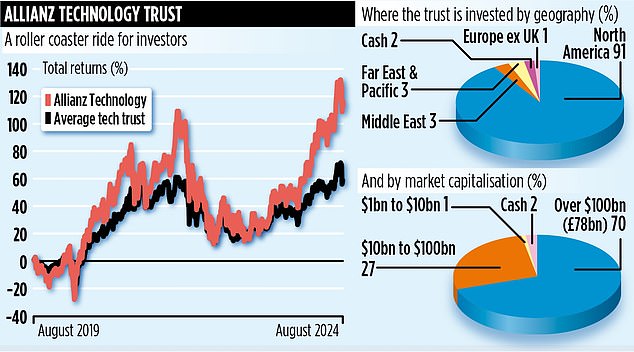

Technology stocks may not be everyone’s cup of tea and may be prone to wild swings in market sentiment, but they remain one of the most exciting investment themes.

That is the view of Mike Seidenberg, manager of the £1.4bn investment trust Allianz Technology, who runs the fund from San Francisco, the world’s technology epicentre.

While high market expectations mean tech stocks can plummet when earnings disappoint (as happened recently with Tesla, Microsoft and Alphabet), Seidenberg says it’s key for investors to cut through the white noise and think long-term.

“As a technology fund manager, there is never a dull moment,” he says, and Friday’s crisis is a clear example of this. “But my job is to play the long game. I want to find companies that are important over a number of years and not just in the realm of large companies.”

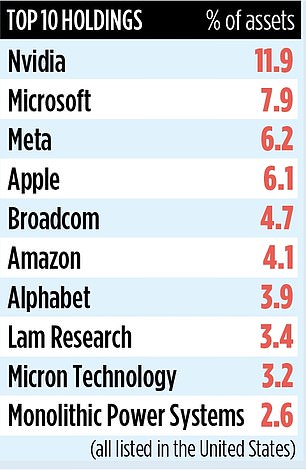

The portfolio is heavily invested in six of the “magnificent seven” tech stocks: Alphabet, Amazon, Apple, Meta, Microsoft and Nvidia. The exception is Tesla, which failed to impress the market, with recent figures indicating modest growth.

But as Seidenberg says, the trust is not limited to big tech companies. The fund includes 40 other companies, most of them publicly traded in the U.S., and many of them headquartered near where Seidenberg and his team are based.

According to the executive, identifying key technological themes is crucial. In addition to artificial intelligence (Nvidia is the trust’s largest holding), Seidenberg is excited about the growth of cybersecurity. “It is a crucial part of the path towards a world that is rapidly embracing digitalisation,” he adds.

One of the fund’s top holdings is CyberArk, a publicly traded US company that helps large companies defend themselves against cyberattacks by fraudsters or hostile criminal organisations.

The company recently posted strong quarterly results, with revenue up 37 percent year-on-year. Its share price is up more than 18 percent this year.

“He has developed a system that enables companies to protect their data from cyber attacks, malware and hacking threats,” says Seidenberg. “From an investment perspective, he is working in an area of technology that will be around long after I am no longer a fund manager.

‘CyberArk is also not a conventional tech stock. Its market capitalisation of $10.9bn (£8.5bn) is a fraction of that of Nvidia ($2.6tn), so it is off the radar of many investors.’

Seidenberg is also fascinated by the proliferation of semiconductors in our everyday lives. Monolithic Power Systems, a leading semiconductor company, is among the top 10 companies. “It is one of the first companies I bought when I took over management of the trust in the summer of 2022,” says Seidenberg. “It was founded in 1997 by engineer Michael Hsing and he is still at the helm.

“From an investor’s perspective, I like founder-led companies. Monolithic companies are the kind of companies that the trust can own for a number of years.”

Another hot topic is the “cloud” – anything that can be accessed via the Internet. One of the leading investments in this area is cloud monitoring specialist Datadog. Although its share price has been flat this year, Seidenberg is confident that the company’s revenues (up 27 percent year-on-year) will continue to grow.

Last year, the fund returned an attractive 35 percent. However, it is investing in a sector where sentiment can change abruptly: the fund’s figures for the past three years are lower than those for last year.

For broad exposure to the technology sector, it is a solid choice. Annual management fees are a competitive 0.7 percent, with scope to decline in percentage terms as the value of the trust’s assets increases. The stock code is BNG2M15 and the ticker is ATT.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.