THE MARRIAGES

Gary Kemp-1988-1995

Sadie married singer Gary Kemp, pictured now, when she was 22 in 1988. The couple separated in 1993 and officially divorced in 1995.

Sadie Frost married Spandau ballet singer Gary Kemp in 1988, when she was 22.

The couple stayed together for seven years and had their son Finlay Monroe, now 31, in 1990.

They divorced in 1995 after separating in 1993.

Sadie left Kemp to be with Jude Law, who she had met on the set of Shopping a year earlier, and the split reportedly left Kemp “devastated”.

Judas Law – 1994 – 2003

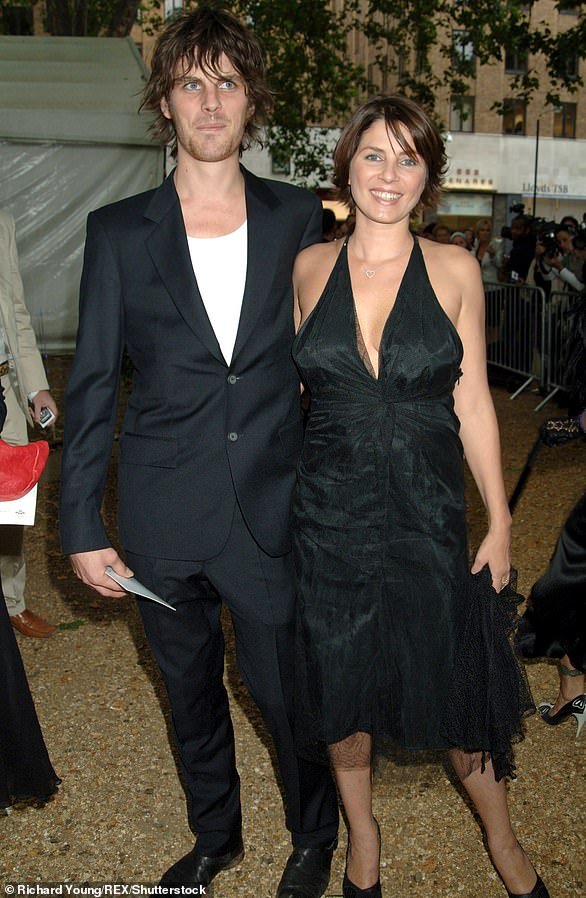

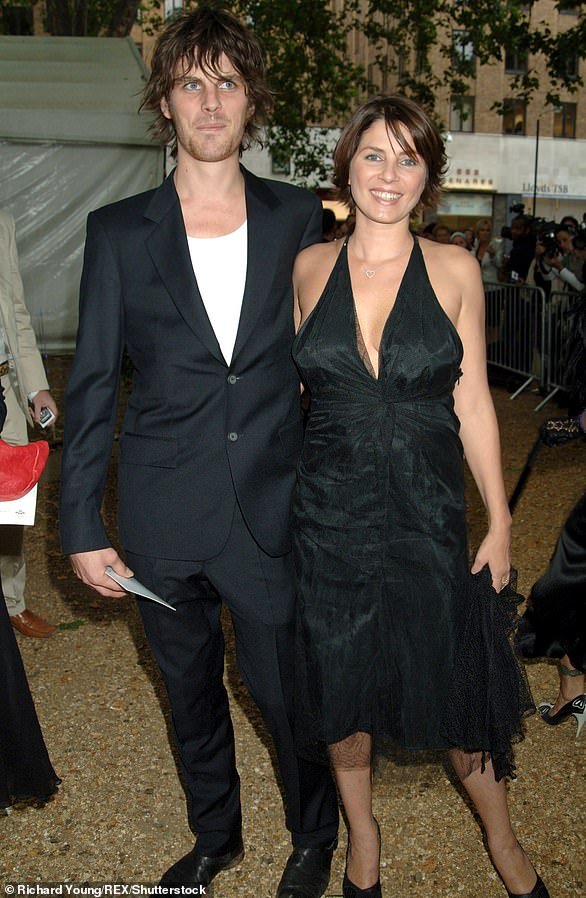

Frost met Jude Law in 1994 and they married in 1997. They divorced in 2003. Sadie later said that Law was the love of her life and that they had had a very successful marriage (pictured in June 2001).

She and Jude began a passionate relationship and had their first child, Rafferty, now 25, in 1996. They married in 1997.

Law and Frost had three children in total: Rafferty, their 20-year-old model daughter Iris, and their youngest son Rudy, whom they had shortly before they separated.

Frost cited Law’s “unreasonable behavior” as the reason for their separation in 2003, which was followed by their divorce the same year.

Later, in his book Crazy Days, Frost said that depression was the biggest factor behind the couple’s breakup.

He also said Law, with whom he lived in Primrose Hill, north London, was the “love of his life”.

THE COUPLE

After her divorce, she dated several men, including model James Gooding, Canadian comedian Andy Jones, and Jackson Scott. Several of Sadie’s classmates were called her ‘toys’ because they were younger than her.

Jackson Scott – 2003 – 2005

The mother of four dated flamenco guitarist Jackson Frost, who was 24 at the time, for two years after her divorce from Jude Law. They separated in 2005 (pictured from July of that year)

Immediately after divorcing Law, she dated Jackson Scott, 24 years old at the time, who was a flamenco guitarist.

At the time, a spokesperson for Sadie said that she was a mother of four children and that she and Jackson were at very different points in their lives.

The split was reportedly amicable.

Andy Jones – 2005 – 2009

The mother of four with her on-off boyfriend, Welsh actor Andy Jones, in November 2005, in the early days of their relationship.

From 2005 to 2009 she was in a relationship with Welsh actor Andy Jones.

The couple reportedly met on a blind date in 2005, and their relationship was very on-and-off, breaking up and getting back together several times.

The couple reportedly split because Jones, who was just 24, was “too green” to handle Sadie’s star-studded friend group, which includes Kate Moss and Jude Law.

James Gooding – 2012 – 2013

Pictured: Sadie with James Gooding, in February 2013. The couple dated between 2012 and 2013.

Frost and Gooding dated between 2012 and 2013, and had a rocky hit where Sadie was reprimanded for assaulting the model in October 2012.

Sources said Frost was convinced Gooding was still in love with his ex Kylie Minogue.

They split in 2013 and their split was a “painful” topic for Frost at the time.

Her last long-term relationship was with businessman Darren Strowger, who had two children.

The couple dated for six years, from 2015 to 2021, and recently split. They never lived together, and the independent Sadie said she liked having her own space.

They were neighbors and shared a house during the 2020 lockdown.

Adventure

Sadie is also credited with affairs that did not last long, including a two-month affair in 2007 with Kristian Karr, who left her for Pixie Gedolf, and she had an alleged affair with presenter Alex Zane in 2006.

Sadie was credited with several affairs, including a two-month affair with Kristian Karr, pictured left, and was rumored to have been cozy with host Alex Zane in 2006, right.