Two more major mortgage lenders have announced they will raise rates this week, in a blow to homeowners hoping for lower mortgage bills.

TSB has increased interest rates on its two-, three- and five-year fixed rate agreements by up to 35 basis points.

These changes will affect products aimed at first-time buyers, moving companies and anyone remortgaging.

As of April 26, Halifax raised mortgage rates by 20 basis points for the same groups.

Rate rises: TSB and Halifax are the latest major mortgage lenders to announce rate rises and others are expected to follow suit.

This could mean that some of the cheapest two-year fixed rates on the market will disappear.

Halifax currently offers a market-leading two-year fixed rate of 4.6 per cent with a fee of £1,099 to homebuyers with at least a 40 per cent deposit and a top rate of 4.65 per cent for someone who buys with a 25 percent deposit.

The moves by TSB and Halifax follow HSBC, Barclays and NatWest, which announced rate hikes earlier this week.

The main reason for the increase in fixed rate mortgages is swap rates, according to Nicholas Mendes, mortgage technical director at John Charcol.

Swap rates show what lenders believe the future holds for interest rates, and this governs their prices.

Since March 25, two-year swaps have increased from 4.36 percent to 4.56 percent, while five-year swaps have increased from 3.81 percent to 4.06 percent.

John Charcol’s Nicholas Mendes says lenders are changing their rates due to uncertainty about the future of markets

“There is typically a delay of up to two weeks between changes in swap rates and corresponding changes in mortgage rates,” Mendes says.

‘Recent increases in mortgage rates have reflected increases in bond yields, spurred by anticipated timing of market revisions and the magnitude of interest rate cuts by central banks, including reactions to the forecasts about the Federal Reserve.

‘In recent days, lenders have been quick to bring their prices in line with competitors to avoid being an outlier and impacting service levels.

“In addition, swaps are influenced by market sentiment; until we see a reduction in bank rates, we will likely see further periods of reversals.”

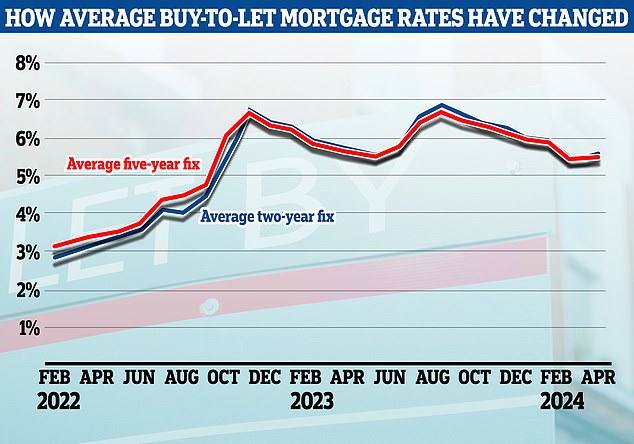

Buy to let is affected

Landlords are the recipients of rate rises this week, with rises announced by both TSB and BM Solutions, a buy-to-let arm of Lloyds Banking Group.

TSB increased its buying to two and five years to allow fixed rate agreements by up to 45 basis points.

It has also withdrawn its two-year monitoring agreements aimed at both rental home buyers and those remortgaging.

These included its tracker rate of 5.74 per cent best buy with a fee of £994 at 60 per cent of the loan value. This is the basic rate (5.25 percent) plus 0.49 percent.

The trackers follow the Bank of England base rate, plus or minus a set percentage.

For example, someone might pay the base rate plus an additional 0.75 percent with a tracker. With the base rate of 5.25 percent, they would currently pay 6 percent.

But if the base rate were reduced to 4.5 percent, for example, your rate would fall to 5.25 percent.

The main benefit of tracking offers is that they usually do not include early redemption charges.

BM Solutions also announced that it will increase its tracking fees by 20 basis points this week.

Chris Sykes, associate director at mortgage broker Private Finance, says it’s not all doom and gloom for homeowners despite mortgage rates rising.

But the lender is also raising rates on its fixed-rate deals by 20 basis points.

This could cause the market’s lowest five-year fix to also disappear overnight. BM Solutions is currently offering homeowners who buy with a 25 per cent deposit a five-year fix of 4.19 per cent.

However, while rates are rising, it’s not all bad news for homeowners, according to Chris Sykes, technical director at broker Private Finance.

“Some prospective owners may be looking at the market optimistically,” Sykes says.

‘Rents have increased and in some areas house prices have become reasonable, increasing rental yields.

«You could say that in 2022 the sellers had the advantage; 2023 favored buyers. Now, in 2024, we find ourselves in a balanced market.

‘In addition, a number of lenders have recently reduced buy-to-let stress rates, making it easier to require just a minimum 25 per cent deposit in many cases and possibly increasing the amount of mortgage you can get.

‘This will leave homeowners with more cash and liquidity to invest in investment property renovations or potentially purchase more properties.

“It is still a tougher market than before for homeowners requiring a mortgage, but it has gradually improved.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.