British housebuilders have suffered from difficult market conditions over the past year, but the tide may finally be turning for the sector.

New home completions, profits and share prices have slumped across much of the industry, as a difficult comparison with two strong previous years is compounded by a fragile British consumer.

But mortgage rates are falling, and the upcoming March Budget could provide the sector with the revitalization it needs as the impending general election spurs the Government to tackle Britain’s housing shortage.

Homebuilders built fewer homes last year as they seek to protect their profits from reduced demand.

The country’s 10 largest housebuilders completed just 71,000 homes in 2023, down from 85,000 the previous year, according to figures from Peel Hunt.

And the broker expects just 69,300 homes to be completed by 2024, which could jeopardize the Government’s target of building 300,000 homes a year by the mid-2020s, with the current annual average of just 235,000.

The current UK housing crisis, which has left Britain with a severe lack of affordable housing supply, has been compounded by cost of living pressures that weaken Britons’ purchasing power.

Meanwhile, house prices have continued their upward spiral for the fourth consecutive month, rising 1.3 percent in January.

A typical house now costs £291,029, almost £4,000 more than in December.

However, large lenders have started to cut mortgage rates, which is helping to revive demand for existing properties.

“Mortgage availability has improved, mortgage rates are falling and the number of successful mortgage applications is increasing,” said RBC Capital Markets CEO Anthony Codling.

“There remains a shortage of second-hand homes for sale and UK housebuilders are therefore in prime position to benefit from improving mortgage market trends.”

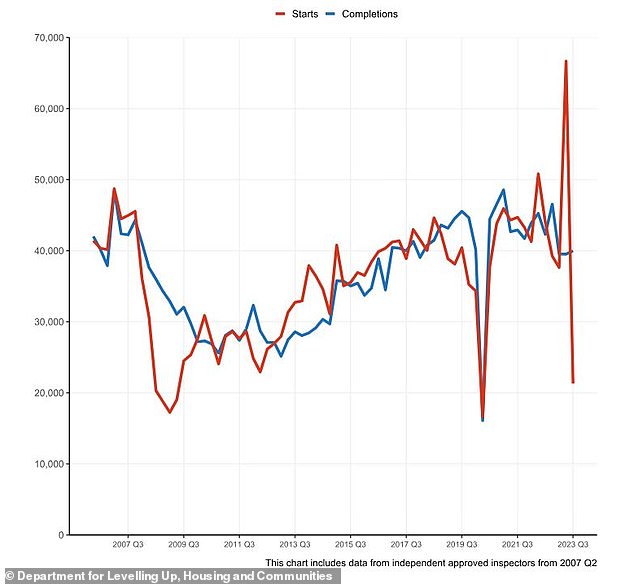

New construction housing starts plummeted in the third quarter of 2023

What do home builders say?

Homebuilders have protected their profits in 2023 by building fewer homes, managing the reduction in demand caused by multiple interest rate increases.

According to data from the Department for Levelling, Housing and Communities, led by Michael Gove, the number of sites where construction work had started was 21,300 as of September 30, down 68 per cent year-on-year in the quarter.

In the year to September 30, construction decreased from the previous year in six of nine regions. Completions decreased in seven of nine regions from a year earlier.

Taylor Wimpey, one of the UK’s largest housebuilders, said its prospects for the new year are uncertain as it warned it has entered 2024 with a reduced order book.

The FTSE 100-listed company said contracts awarded to UK builders in 2023 fell by £11.1bn to £69.2bn, with residential homebuild deals falling by 13 percent.

FTSE 250 peer Persimmon also warned that market conditions are expected to remain “highly uncertain”, especially with an election likely in 2024.

However, the York-based group said buyers are returning to the market amid speculation that the Bank of England could cut interest rates sooner than expected.

Persimmon also saw completions decline to their lowest level in more than a decade.

Redrow has been acquired by Barratt Developments for a whopping £2.5 billion, forming Barratt Redrow

Another FTSE 250 builder, Vistry, said the easing of mortgage rates “is encouraging” and the group is “optimistic that this will help stimulate demand in FY24”.

He added: “(And) the housing crisis is also expected to be high on the political agenda in the run-up to the general election, with Vistry very well positioned to play its part in increasing the delivery of affordable housing in all the country.’

Meanwhile, Barratt shocked the market on Wednesday by revealing a £2.5bn deal to acquire rival Redrow.

The merger will “speed up the delivery of the homes this country needs”, Barratt said.

Codling said: ‘If open market conditions improve… housebuilders are likely to do better from here.

‘Housebuilders have had a good start to the year. Mortgage rates are falling and house prices are stabilizing, so homebuyer confidence is rising.’

What could the Government do to reactivate the real estate market?

The UK property market could well come under the spotlight ahead of the election.

The likelihood of a general election in the autumn means that in the next spring budget, in March, the government will set out its plan for the economy as it seeks to woo voters.

Liberum analysts Sam Cullen and Clyde Lewis identified four routes the Government could take to stimulate the market and rejuvenate the property sector.

Chief among these options, analysts suggest that the “cleanest (but most politically challenging) measure” would be to plan to reform the system.

Chancellor Jeremy Hunt to set Government budget in March

According to housebuilders themselves, the UK’s broken planning system is to blame for the current housing shortage; Barratt chief executive David Thomas recently described it as “ineffective”.

Codling agrees, warning: “The wheels of the planning system turn very slowly.”

‘Planning departments need things. More staff and housing goals. Planning departments are short-staffed and, without targets to achieve, fewer permissions are granted to build the homes we need; A classic case of what you measure is what you get.

“I fear the budget will address housing demand rather than housing supply, but it is supply and not demand that needs to be driven by the budget.”

They claim the UK planning system has long hampered developers’ plans. Although critics of the sector in turn accuse the builders of creating an opportunistic land bank.

Planning departments’ budgets have been halved since 2009, and the number of plots with planning permission has fallen by 50,000, around 15 per cent, in the last five years.

‘In our opinion, no significant expenditure would be necessary to reverse this trend. We estimate that returning to the 2010 level of funding would cost around £500 million. “Based on the average size of previous sites, this could approximately double the number of approved sites, which in turn could lead to a 20 per cent increase in volumes each year,” Cullen and Lewis said.

Based on these calculations, there could be up to £12 billion in additional spending, which Peel Hunt says could result in an extra £2.2 billion in tax revenue, while also creating 125,000 jobs in the process.

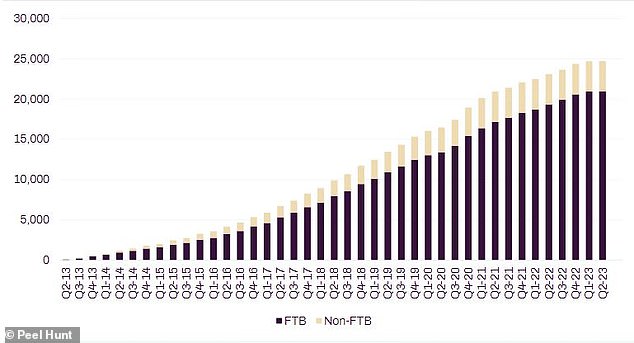

An alternative measure, analysts say, would be to institute a new scheme similar to Help to Buy, which was launched under the coalition government in 2013.

Only 10 to 15 per cent of buyers would have been able to make the same purchase without Help to Buy, according to Bank of England data analyzed by Peel Hunt.

Loans under Help to Buy (£ million)

A revamped £5bn scheme could finance the construction of 35,000 homes and generate £2bn in taxes, analysts say.

The original plan, however, has been criticized for having caused price inflation, preventing more people from buying homes than it helped.

Analysts suggest this is unlikely in a demand-driven scheme with a “relatively small number of loans”.

A stamp duty cut could also be on the cards for the upcoming March budget, although Peel Hunt points out that it is a major source of income for HMRC, generating £11.7bn in the last financial year.

Stamp duty is charged on the purchase price of a home and is leveled at different rates above thresholds.

Stamp duty on home purchases is charged at 5 per cent for homes valued between £250,001 and £925,000, and increases to 12 per cent for properties worth more than £1.5 million.

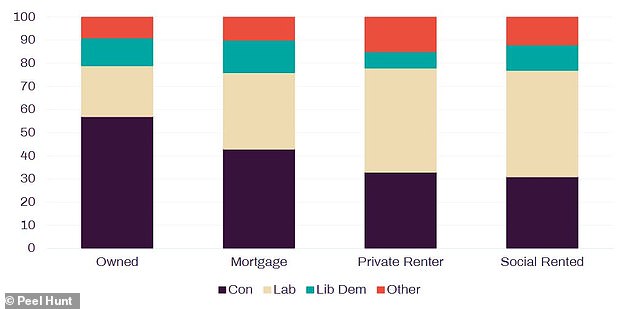

Voting intention in the United Kingdom by housing tenure in the 2019 general election

Removing stamp duty, analysts suggest, could lead to another 15,000 private home sales, which they add would generate an extra £800m in tax revenue, create 6,000 jobs and £11.25bn of economic activity.

The chancellor could also look to increase the number of apprentices joining the construction industry, either by increasing funding or removing barriers that small housebuilders face when it comes to taking on apprentices.

The UK construction workforce faces losing a quarter of its workforce within 10 to 15 years, says Peel Hunt, meaning 50,000 new workers need to be added each year, compared to just 15,000 in 2023.

To generate growth, analysts suggest the Government could increase funding for construction apprenticeships or reorganize the apprenticeship levy which currently sees the largest employers pay 0.5 per cent of their annual salary, while employers Younger children pay 5 percent of the cost of their learning. training.

Peel Hunt says the tax prevents larger businesses from “spending their funds as they see fit”, while the scheme remains too expensive for some smaller businesses.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.