Table of Contents

- The agreement allows employees to cash out some of their holdings by selling shares.

- UK banking licence paves way for IPO

- City minister wants business owners to list in London instead of New York

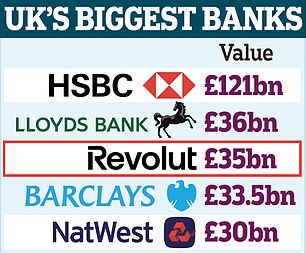

Revolut has been valued at £35bn – more than traditional banks Barclays and NatWest – in a share sale that cements its position as Europe’s most valuable startup.

The long-awaited deal allows employees to cash out part of their holdings by selling shares to new and existing investors.

A few weeks ago, the fintech company finally obtained a banking license in the UK after a three-year wait, paving the way for an IPO.

Yesterday, it also emerged that the new Labour City minister, Tulip Siddiq, will meet Revolut executives later this year to try to persuade them to list in London rather than New York (its founders had previously expressed a preference for the US).

The latest share sale raises Revolut’s valuation from a previous funding round in 2021, which put it at £26bn.

Banking majors: Nikolay Storonsky, co-founder of Revolut

This means the company, founded in 2015, is worth more than Barclays, which is valued at £33.5bn, Natwest (£30bn) and Standard Chartered (£19.5bn).

The firm is almost on a par with Lloyds Banking Group, valued at £36bn, although it is dwarfed by HSBC, Europe’s biggest lender, which is valued at £121bn.

The fintech firm’s share sale will see an undisclosed number of the company’s 10,000 global employees (who receive shares as part of their pay packages) sell shares worth just under £400m, representing around 11 per cent of their stock.

CEO and co-founder Nikolay Storonsky said: ‘We are delighted to provide our employees with the opportunity to reap the benefits of the company’s collective success.

“It is their hard work, innovation and dedication that has led us to become the most valuable private technology company in Europe.” The fundraising was led by existing investor Tiger Global and new investors Coatue and D1 Capital Partners.

Revolut said this reflected the company’s “strong financial performance” and its progress towards meeting its strategic objectives, adding that it remains on track to surpass 50 million global customers by the end of this year.

Earlier this year, the company announced pre-tax profits of £438m for 2023, up from a loss of £25m a year earlier, as revenues nearly doubled. Revolut said revenues in the first half of this year rose by more than 80 per cent and it was seeing improved profitability.

The share sale marks another positive step for the company after its protracted attempts to obtain a UK banking licence left investors impatient.

That process hit a snag when auditors said last year they could not verify the fintech firm’s delayed 2021 accounts.

The delays prompted Russia-born Storonsky, 40, to criticise regulators for the “long and drawn-out” saga and attack the UK as a place to do business.

But Revolut was able to put an end to the saga when it was granted a “restricted” banking licence last month from the Prudential Regulation Authority (PRA), the regulatory arm of the Bank of England. The licence will ultimately mean Revolut can hold customer deposits and offer new products such as credit cards, personal loans or mortgages. This will allow it to compete with more established banks.

However, nothing has changed for UK customers yet as the company needs to complete its “mobilisation” phase, which could take up to a year.

The company offers payment services and the ability to trade stocks and cryptocurrencies.

It has a banking license in Europe after being approved by the Lithuanian authorities.

The fintech group has 9 million customers in the UK and more than 45 million worldwide.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.