A top bird flu scientist has declared he no longer drinks cow’s milk amid the alarming outbreak in livestock on US farms.

Dr. Rick Bright, a virologist and former director of the Department of Health and Human Services, revealed his decision on X, warning that the virus, which has so far infected two Americans, could still be active in milk.

“A little inconvenience pausing my milk consumption while I wait for data,” he said. ‘The delay in transparency influenced my decision.

“Having worked with this virus for almost three decades, I have learned to respect it and its surprises.”

The concerning comments come days after the FDA revealed that traces of the virus had been detected in milk in grocery stores. including almost 40 percent sold in stores in Ohio.

Dr. Rick Bright, a virologist and former director of the Department of Health and Human Services, revealed the change online and said he needed “more data” before reaching for a glass of milk again.

Scientists are demanding more testing from officials to show that milk is safe after pasteurization, when it is heated and then quickly cooled to “kill” any viruses or bacteria.

Experts are especially tired of assurances from public health officials, as the FDA had previously said that the virus could not enter the milk supply due to pasteurization.

But Dr. Bright said, ‘I’ve spent 27 years studying H5N1 viruses. So I’m going to wait for the data that I hope will come soon from both the FDA (pasteurization) and the USDA (genomic data and handling of raw milk).’

And he added: “When H5N1 [the strain of bird flu] the news broke, [I said] “They would have to do a lot of testing before they could drink milk from one of these farms right now.”

Some experts have suggested that the traces detected in the milk represented dead viruses, meaning that heating the liquid had effectively killed the microbes.

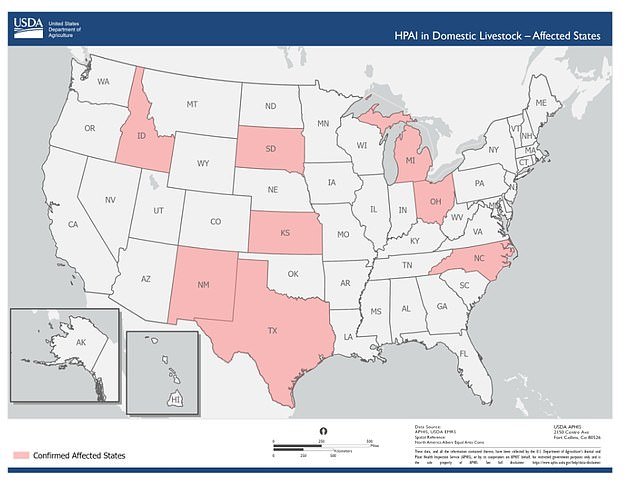

A total of 33 farms have reported cases of avian flu in cattle to date

Milk is a popular drink in the US, and the average person drinks about 15.75 gallons a year.

Jeanne Marrazzo, new director of the National Institute of Allergy and Infectious Diseases, said scientists demonstrated this by showing that H5N1 from store-bought milk samples did not grow in Petri dishes.

However, the work was done with only a small number of samples and the study has not been made public.

“While this is good news, the effort studied a small number of samples that are not necessarily representative of all retail milk,” he said, STAT reports.

“So to really understand the scope here, we have to wait for the FDA’s effort.”

There is also concern about the possibility of bird flu entering the meat supply, but so far the virus has only been detected in dairy cattle.

Readers of Dr. Bright’s post have also expressed concerns about milk consumption, including Karen Piper of Seattle, who said, “I think I’ll take a pause on milk consumption until they figure this out.”

A second said: ‘If you’re not drinking milk, I’m not drinking milk,’ and a third added: ‘I told my husband last week there was no milk. I’m not sounding the alarm yet, but I’m watching closely.’

The concern among scientists is that people could become infected by the virus hiding in the milk they drink.

But there is no evidence that this has happened at present, and the only case in a dairy farm worker in Texas is related to direct exposure to livestock.

However, authorities fear the outbreak in livestock is “much more widespread” than previously thought.

So far, a total of 33 dairy farms in eight states have detected the virus, although officials fear it is on other farms as well.

Some sick cows produce milk of a different color, but others that tested positive have no symptoms and their milk is likely still entering the human supply.

In Ohio testing, 58 of 150 commercial milks tested were found to contain virus RNA.

Dr Richard Webby, an influenza virologist at St Jude Children’s Hospital in Memphis, Tennessee, said: “The fact that you can go to a supermarket and 30 to 40 per cent of those samples come back positive suggests that “There are more viruses around than there are.” currently being recognized.’

Dr. Bright was director of the Biomedical Advanced Research and Development Authority (BARDA) from 2016 to 2020, but was later removed to a position at the National Institutes of Health.

At the time, he publicly suggested that hydroxychloroquine was not an effective treatment for Covid, contradicting the president.

He filed a whistleblowing complaint saying the administration had ignored his Covid warnings and illegally retaliated against him by ousting him from office.

The complaint was resolved in 2021 with a backlog and compensation for ’emotional stress and reputational damage’.

He is now the president of the Rockefeller Foundation’s Pandemic Prevention and Response center and is based in Washington, DC.