Table of Contents

Chris Iggo, Chief Investment Officer at Axa Investment Management

Everything in the United States is big: its market, its economy and the companies that are located there. It also continues to frustrate investor expectations.

Many anticipated that it would enter a recession in 2023, but this never happened.

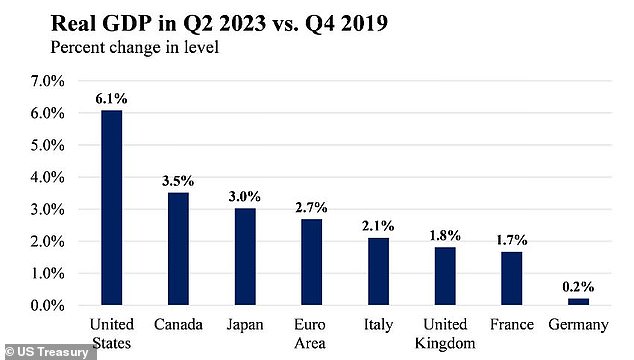

Instead, according to the U.S. Treasury, it achieved above-average economic growth over the 12 months due to “growing economic output, labor market resilience, and slowing inflation.”

The stronger-than-expected backdrop translated into strong stock market returns in 2023, with the S&P 500 up 26 percent, the Dow Jones up 17 percent, and the tech-heavy Nasdaq up a significant 45 percent. driven by the well-documented rise of generative artificial intelligence.

The momentum has also extended into 2024, with each of those indices soaring to new highs.

The US economy has recovered strongly from Covid-19

Economic power

Expect some market jitters before and possibly after the election. But despite the global importance of his presidential election, the United States has long been considered too big for investors to ignore.

And it’s easy to understand why. It is, by some margin, the largest economy in the world – a position it has held since the late 19th century – which also makes it the most powerful and, therefore, the most influential.

Its gross domestic product (GDP), which combines the goods and services produced there, is valued at almost $28 trillion (£22.4 trillion). To put this in perspective, the world’s second largest economy, China, has a GDP of $18.6 trillion, more than a third less.

Furthermore, the US dollar is the most used currency in the world and, therefore, any modification of US monetary policy by its central bank, the Federal Reserve, will have a significant impact on the global financial context.

But it is also home to some of the world’s leading companies in a number of different business sectors; from professional services, manufacturing and agriculture, to healthcare, real estate, as well as financial services and, of course, technology, the latter of which has been a major driver of recent stock market returns.

Market Drivers and Valuations

By market share, the United States accounts for about 60 percent of the global stock market and is valued at $50.8 trillion.

Most of the world’s 10 largest companies are headquartered there, including many of the world’s tech giants: Alphabet (Google), Amazon, Apple, Meta Platforms (Facebook), Microsoft and Nvidia, all of which are worth more than a trillion dollars. Also in the top 10 globally are Warren Buffett’s Berkshire Hathaway investment group and pharmaceutical company Eli Lilly.

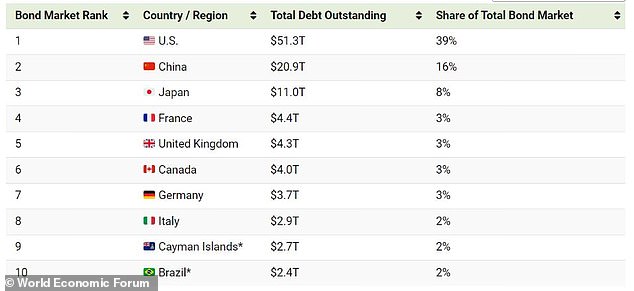

The global bond market is also dominated by the United States, with a size of about $51.3 trillion; China, the second-largest fixed income market, has less than half, at $20.9 trillion.

Of course, as both the US stock and bond markets have enjoyed a good run, valuations have continued to rise. Price-earnings ratios for US stocks – which measure a company’s share price relative to its earnings per share – are at two-year highs.

Not many things are cheap (in both stocks and bonds) and that means there are risks to current valuations that need to be taken into account. However, in our view, performance is being driven by a strong economy, healthy balance sheets and corporate profitability.

Earnings are also expected to grow in 2024 as US GDP growth continues to defy previous expectations. Additionally, interest rates should come down at some point. If this is due to falling inflation, then lower rates will be positive for stocks and bonds.

For now, any pullback in market levels is likely to translate into a “buy the dips” response.

The United States represents by far the largest bond market in the world.

The bottom line

Of course, as with any market, the United States does not move in a straight line: it can and will move both down and up. Aside from lower interest rates and more balanced global growth, secular drivers of stock market performance include automation, digitalization and the green transition.

But it’s also worth noting that, along with technology, the industrial and financial sectors have posted solid total returns so far this year.

Certainly, it would be reckless to believe that the strong performance of late will continue uninterrupted. Few would be surprised if the US stock market went through a period of adjustment, especially since much of the recent rally has been driven primarily by the technology sector.

But in the long term, given the diversity of sectors and the depth of innovation on offer, we believe that the United States is a market that should not be ignored. Not even the impending elections should dampen its long-term appeal.

Even Federal Reserve chief Jerome Powell has stated that while the central bank’s November policy meeting will take place the day after the election, it will not influence any interest rate decisions.

This is not to downplay the possibility of different political outcomes depending on who wins in November. We will return to this topic later this year.

However, businesses are resilient and in good shape and the US economy enters the election period in a very strong position. This should support returns for investors during any period of political uncertainty.

Chris Iggo is Chief Investment Officer at Axa Investment Management

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.