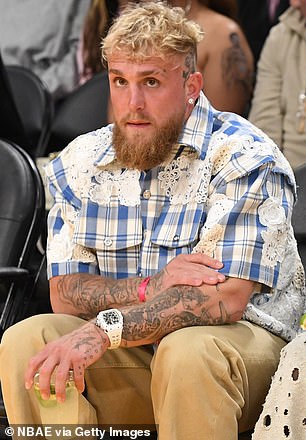

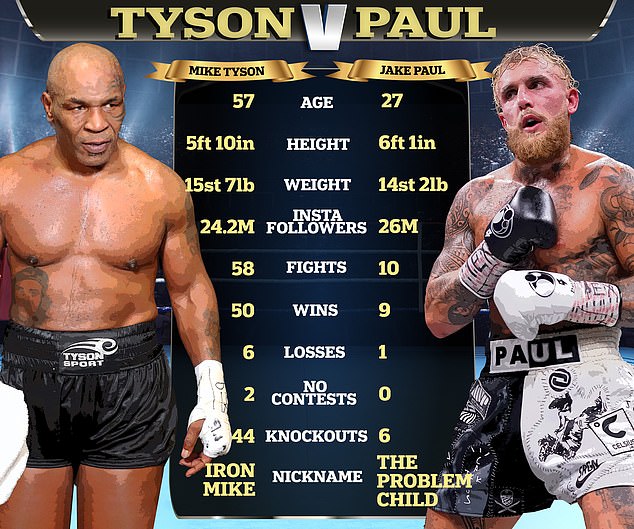

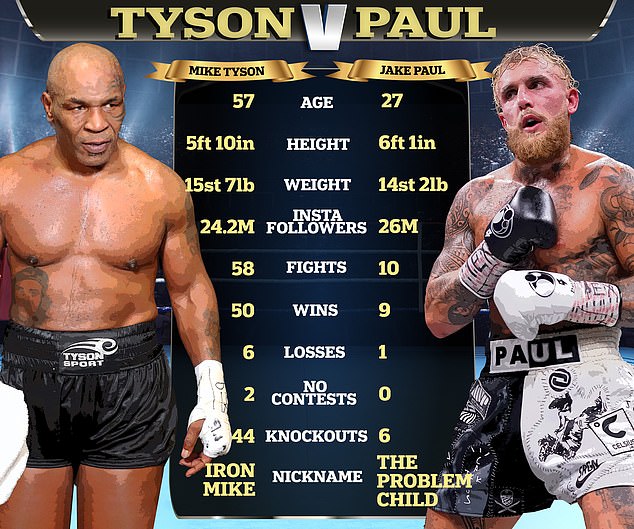

- Jake Paul and Mike Tyson announced shocking news that they will fight this summer

- Veteran fighter Tyson revealed that the fight will be an exhibition, not a professional fight.

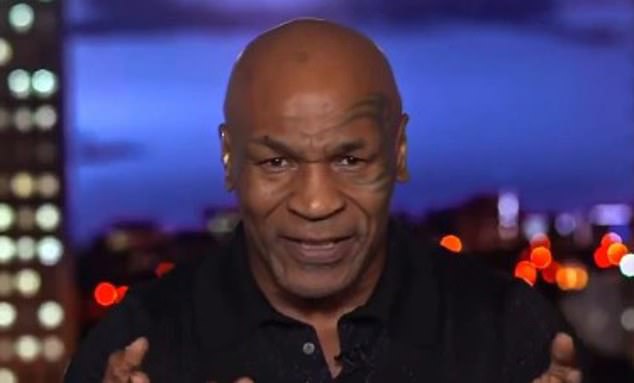

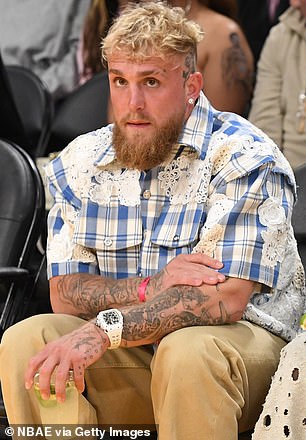

- Tyson said he was ‘scared to death’ ahead of long-awaited showdown

<!–

<!–

<!–

<!–

<!–

<!–

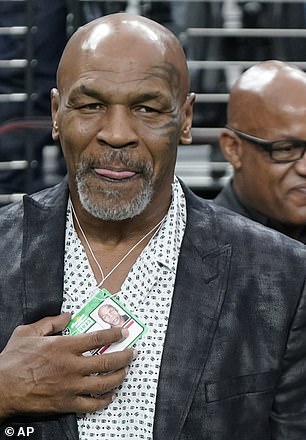

Mike Tyson has confirmed his summer showdown against Jake Paul will be classed as an exhibition rather than a professional fight.

The boxing world was stunned after the shocking news that YouTuber Paul and veteran fighter Tyson would meet in Texas on July 20 in a lucrative fight to be streamed live on Netflix, with fans and pundits widely criticizing the event. .

But one of the main questions was whether the fight would be officially sanctioned as a professional fight that would appear on both their records, or if it would simply be an exhibition with no winner declared.

Tyson, 57, has already fought in one exhibition since ending his career, facing Roy Jones Jr in 2020, while all of Paul’s fights have been on his professional record.

Revealing the fight’s official rating, Tyson defended it and insisted it would still be fought under “real fight” rules.

Mike Tyson has revealed that his summer showdown against Jake Paul will be an exhibition

Tyson and Paul announced they shocked the boxing world with the news that they will fight in Texas in July.

“This is called exposure, but if you look for exposure, you won’t see any of the laws we fought under,” he told Fox News.

‘This is a fight. I don’t think he’s faster than me. I’ve seen a YouTube video of him at 16 dancing weirdly. That’s not the guy I’m fighting. This is a guy who’s going to try to hurt me, like I’m used to, and he’s going to mess up a lot.’

When asked by the news anchor if Tyson would “kick his ass,” the hall of fame boxer was optimistic but said he was still “scared to death” ahead of the summer fight.

“Right now I’m scared to death,” he added. “As the fight gets closer, the less nervous I get because it’s reality, and I’m actually invincible.”

Tyson has admitted that he is “scared to death” before his fight against the YouTuber (right)

Tyson also said he was willing to teach Paul, 30 years his junior, a lesson, although he claimed there was no bad blood between them.

‘Will I do just that but I don’t like it? I don’t hold a grudge against him, he’s beautiful, not from that point of view.’

The fight between Paul and Tyson will take place at the 80,000-seat AT&T Stadium in Texas, home of the Dallas Cowboys NFL team.

In addition to announcing the fight as an exhibition, the rules of the fight have also been revealed.

Paul and Tyson will use 16-ounce boxing gloves instead of the traditional 10-ounce gloves used in professional fights.

Two-minute rounds will be implemented instead of the usual three-minute rounds and there will be no official judges ringside to score the fight.

Most of the rules, aside from glove weight, are the same as when Tyson faced Roy Jones Jr in an exhibition fight in November 2020.

The high-profile fight will take place without a helmet, and Tyson is the heavy favorite to win.

The only way Paul or Iron Mike could win the fight would be if there was a knockout that night.

It comes after Tyson hit back at “jealous” critics of his fight against Paul.

‘I’m 58 years old, so what? “I’m getting billions of views just talking about fighting,” he told Reuters.

‘Everyone, even most athletes, are jealous… You can’t sell out a stadium. Who at 58 years old can sell out an 80,000-seat stadium? Why do you think he wants to fight me and not anyone else?

‘All boxers want to fight him. But if he fought them, the only people who will come will be the people who like him. His parents may not even come to see them.