Gary Glitter kissed and “disappeared” with young children at a hotel in Cuba where staff turned a blind eye because he left “good tips”, a photographer has claimed.

In 1997, photographer Nick Ysenberg was working in Havana, Cuba, when he spotted the perverted pop star, 79, lounging by a pool with children, where he kissed them and then “disappeared” with them.

In a new ITV documentary, Nick explained how he met Gary Glitter, real name Paul Gadd, in the Cuban capital, where the disgraced singer moved in 2000 after serving two months in a British prison for possession of indecent photographs of children under 16 years of age.

He said: ‘As the afternoon progressed I noticed a man bringing three very small girls, probably aged eight, 12 or 13. One of them seemed to know him. This was not play behavior with children. That’s why he made me very suspicious in the first place.

‘The next day, three more [were there]. They appeared alone. Then I had my cameras on me so I decided to record this because it was getting a little awkward. He kept asking to be hugged. It didn’t seem right at all.

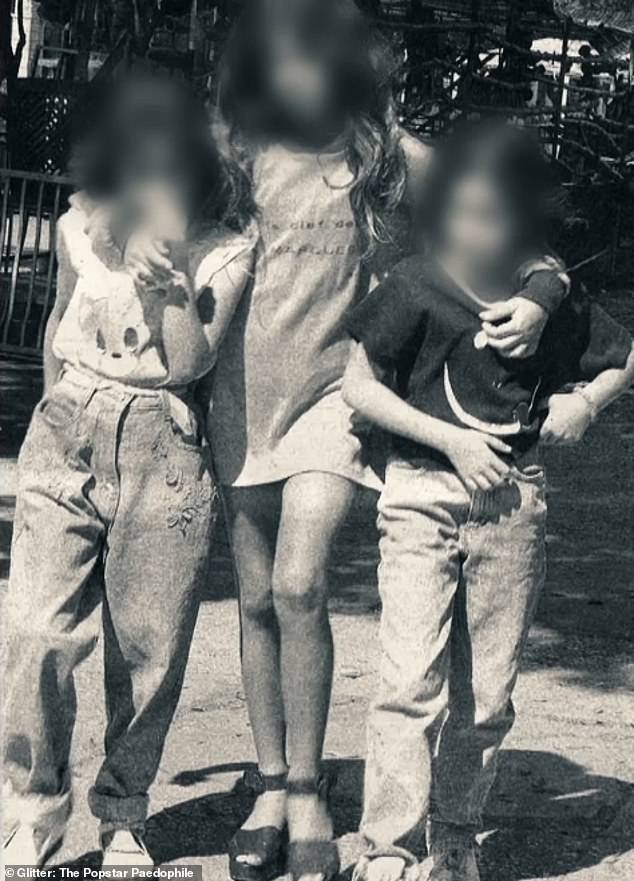

Photographer Nick Ysenberg (pictured) recalls his “awkward” experience with Gary Glitter in new ITV documentary – Glitter: The Popstar Pedophile

Revealing the photographs he took during his stay in Cuba, Nick added: ‘This is them arriving.

‘Just strange, a man of this age with these three children and all these kisses. Then he would disappear and one of them would disappear. He was awkward.’

It was Glitter’s extravagant outfit that first caught the photographer’s attention. Nick explained: ‘There was a man in a big wig and makeup and a purple velvet jumpsuit by the pool. And there he was.

And he took it off until he was in black boxers. And instead of the usual music around the pool it sounded: Do you want to be in my gang?

After witnessing a series of “uncomfortable” interactions between Glitter and several minors, Nick took it upon himself to complain to hotel staff.

He said: “I even said something to management and they said, ‘He’s fine, he’s well behaved, he tips well. He’s great with us.’ So nothing was really said.

“I would never have interfered with him or [taken] images if I hadn’t thought something pretty dark was going on. I think I did the right thing. The hunch was correct. Wow, was that right?’

Glitter was raised by a single mother in Banbury, Oxfordshire. At the height of her career, Glittermania helped him rack up 12 consecutive Top 10 singles and perform in front of sold-out crowds wearing sparkly silver jumpsuits and platform heels.

Taken in Cuba, Nick took images of Glitter interacting with girls by a pool (pictured).

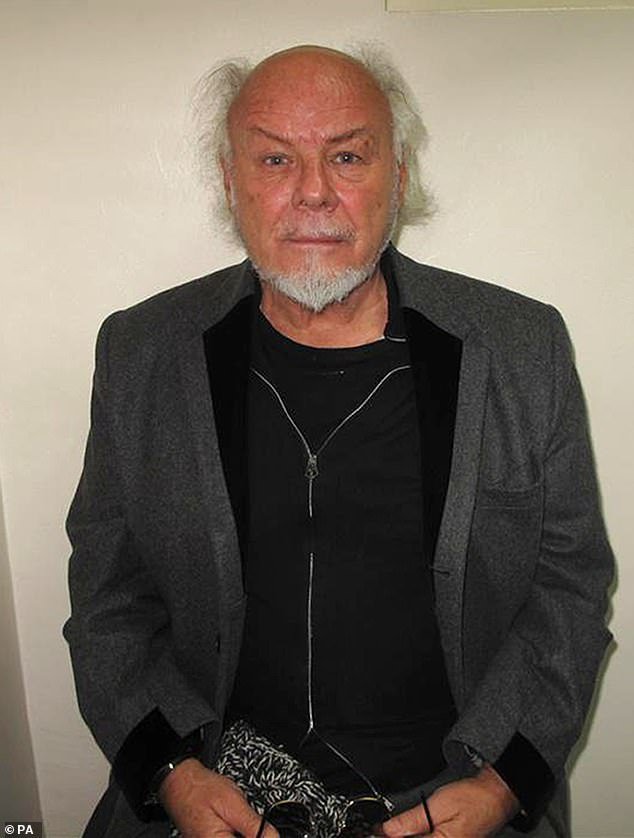

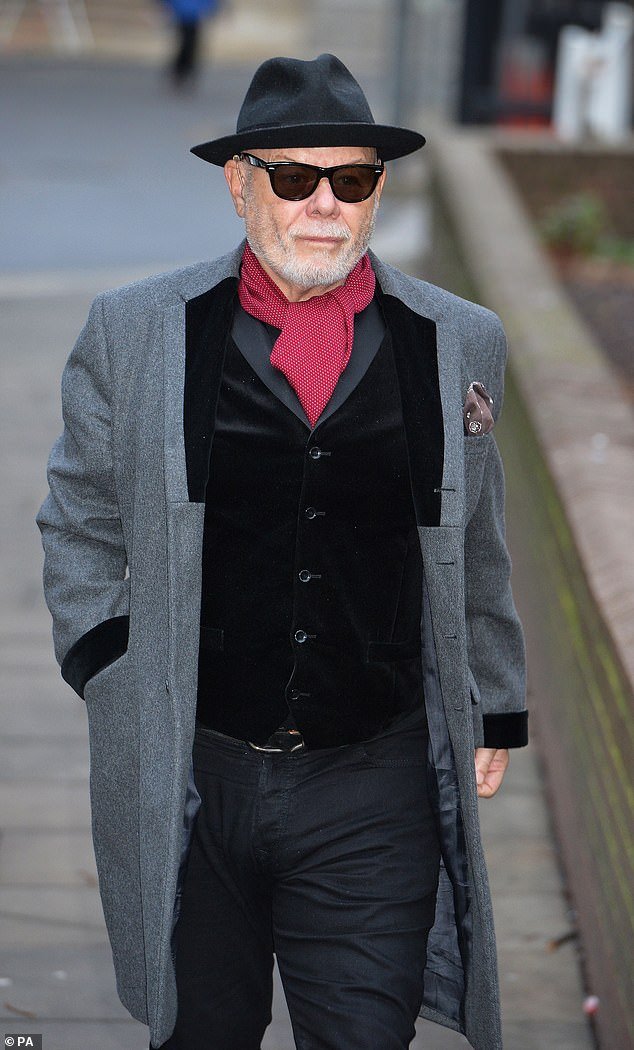

Glitter (pictured), real name Paul Gadd, racked up 12 Top 10 singles and performed at sold-out concerts during his heyday.

The photographer took images of three girls spending time with Glitter in Havana, Cuba (pictured)

Hits like ‘I’m the Leader of the Gang (I Am)’, released in 1972, still generate a fortune in royalties and are streamed on apps like Spotify, where it has more than 700,000 monthly listeners.

Glitter’s fall from grace first came to light in November 1997, when a technician discovered thousands of horrifying images of child abuse on the hard drive of a laptop he had taken for repair in Bristol.

In 1999, he was sentenced to four months in prison and placed on the sex offenders’ register. He was then found hiding on a yacht off Andalusia, Spain, where he was living under the pseudonym Larry Brilliante. Glitter then moved to Cuba in the Caribbean.

Six months after moving to Cambodia in 2002, he was expelled amid reports of sexual crime allegations.

In March 2006 he was convicted of sexually abusing two girls, ages 10 and 11, in Vietnam and spent two and a half years in prison.

After being denied entry by 19 other countries, he was deported back to the UK, where in 2015 he was jailed by Operation Yewtree detectives for abusing three girls aged between 10 and 13 between 1975 and 1980.

Earlier this month, the disgraced pedophile pop star lost a bid by the Parole Board to be released from jail.

The singer appeared at a private bail hearing last month as he fought to get out of prison after being locked up for violating his bail conditions.

The 79-year-old pervert was found surfing the dark web just 39 days after being automatically released halfway through his 16-year sentence for sexually abusing three schoolgirls between 1975 and 1980.

Revealing its decision last month, the Parole Board said Glitter remained a danger to society and a risk to children, in whom he had a “sexual interest”.

“After considering the circumstances of his offending, the lack of progress made while in custody and on licence, and the other evidence presented at the hearing, the panel was not convinced that release at this time was safe for the protection of the public.’ the board said.

‘Rather, the panel considered that Mr Gadd was appropriately placed in custody where outstanding risk levels could be addressed. He may request another review of his parole in due course.

Glitter was automatically released from HMP The Verne, a low-security prison in Portland, Dorset, in February last year after serving half of his 16-year determinate sentence.

But less than six weeks after his release, he was taken back to prison for violating the conditions of his license by allegedly viewing downloaded images of children.

At the time it was alleged that Glitter had used a smartphone to watch videos of young girls on the dark web while in a hostel on bail.

The disgraced pop star (pictured in 1972) was jailed in 2015 for sexually assaulting three girls in the 1970s.

Glitter spent two and a half years in Vietnam prisons after being convicted of sexually abusing two girls, ages 10 and 11.

The disgraced pop star performed in London in 1972 before being jailed for child sex offences.

It was discovered that he had been watching girls in leotards and short skirts at ballet shows and doing gymnastics exercises.

In October 2023, a request to publicly hold last month’s parole hearing was rejected, claiming it was too difficult to contact all of his victims.

A document leaked last year showed how the pedophile artist planned to plead his case to be freed.

In the draft, riddled with spelling errors, he ranted: “I don’t know anything about an onion (dark web) or an inscription (encryption). I’m not a tech savey (expert) and I’ve been away from computers and the phone for eight years.’

Referring to probation officers who ruled he had breached license conditions, he added: “The agenda is opinion and speculation, never real facts.” And most of the time they are not taken from articles.

Glitter attempted to persuade the Parole Board that returning him to prison was a disproportionate decision and that he did not breach the conditions of his licence.

But in a summary published last month, the Parole Board revealed that Glitter still had a perverted sexual interest in children that “could not be managed safely”.

ITV’s new documentary, Glitter: The Popstar Pedophile, documents the disgraced singer’s crimes, weaving together historical testimonies from victims and interviews with those who knew Glitter on the showbiz circuit.

Contributors include Glitter’s defense lawyer in Vietnam, a lawyer representing one of his victims and the former minister who fought to have him deported from Cambodia.

Glitter: The Popstar Pedophile ITV1 and ITVX on Tuesday at 9pm