The reason why women in Australia are allegedly murdered by their partners in record numbers has been revealed amid a domestic violence crisis.

Twenty-six women have reportedly been murdered in Australia by their partners or ex-partners so far this year, 12 more than this time last year.

The body of teacher Molly Ticehurst, 28, was found inside a house in Forbes, 370 kilometers west of Sydney, shortly before 2am on Monday.

Daniel Billings, 29, has been charged with murder with court documents revealing he was out on bail at the time on charges of stalking, sexual assault and harassment.

Just 36 hours later, the body of Emma Bates, 49, was found at her home in Cobram, on the Victoria-New South Wales border.

Her next-door neighbor, John Torney, appeared in court Friday on assault charges in her death.

Elise Phillips, deputy chief executive of Domestic Violence NSW, said gender inequality was driving a male violence crisis in Australia.

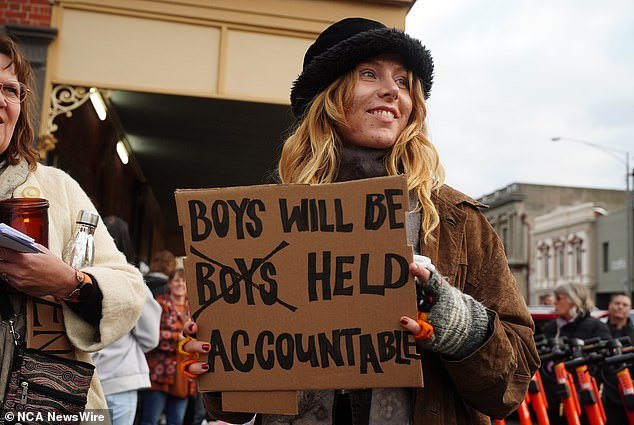

So far this year, 26 Australian women have been allegedly murdered by their partners or ex-partners (pictured, people taking part in an anti-violence march in Ballarat)

The body of teacher Molly Ticehurst, 28, was found inside a house in Forbes, 370 kilometers west of Sydney, shortly before 2am on Monday.

“It’s when we turn a blind eye that we see disrespectful behavior, it’s when we make excuses for violence,” he told WhatsNew2Day Australia.

‘It’s also the inequality we see in relation to salaries and the roles we play in our families, how we divide childcare and household care.

“This is about ensuring we have equity, representation and equal numbers of women in parliament and as CEOs and leaders of private sector companies.”

Phillips said all of the 26 women’s deaths were preventable.

“We often feel hopeless and helpless when we, as individuals, see stories of these horrible murders,” he said.

‘But each of us can play an active role in reducing violence and taking a stand against violence.

‘We need everyone to make this an election issue, let their local MPs know that their community cares about this issue and demand they do more.

“And if they don’t, they risk losing their seat in parliament because we are not going to tolerate this anymore.”

Phillips said social media figures, including Andrew Tate, a self-described misogynist, were only reinforcing attitudes already felt by some men.

“We know that social media provided a new platform to promote those kinds of gender stereotypes and misogynistic attitudes,” she said.

“But those attitudes were already present in some parts of the community.”

Cost-of-living pressures also contributed to exacerbating violence against women.

“We know that there are some factors that exacerbate violence, such as stress, including financial stress, but also issues such as drug and alcohol use,” he said.

Many people experienced domestic violence for the first time during the pandemic, she said.

“We saw that people who were already experiencing domestic and family violence noticed an increase in the severity, frequency and complexity of what they were facing,” she said.

Ms Phillips said the domestic and family violence sector is “grossly” underfunded and Domestic Violence NSW is calling for a 20 per cent increase in funding.

The body of Hannah McGuire, 23, was found near State Forest Road, near Scarsdale, south-west of Ballarat in Victoria, shortly before 1am on April 5.

A woman holds a sign reading ‘Say their names’ at a march against domestic violence in Ballarat.

Chaithanya ‘Swetha’ Madhagani’s body was found in a green wheelie bin on Mount Pollock Road in Buckley, west of Geelong, Victoria, at 12pm on March 8.

“That’s a minimum of $145 million a year needed just to have any hope of meeting current demand,” he said.

‘We are also asking for $100 million over four years in New South Wales for primary prevention. We suggest $40 million be spent over the next year and $20 million each year for the next three years to invest in prevention initiatives in New South Wales.

“We want to see grassroots community initiatives that combat the types of misogynistic gender stereotypes and attitudes that we see.”

He said it was time for politicians to stop talking about the problem and invest.

“The only way to turn the tide is for governments to stop talking about the magnitude of the problem and actually invest in a way that engages with the magnitude of the problem,” he said.

Pledge can be signed to end family and domestic violence in Australia here.

If you or someone you know is experiencing family violence, call 1800 RESPECT or the crisis helpline on 1800 199 008.