- Buffett’s Berkshire Hathaway fund revealed its $6.7 billion stake on Wednesday

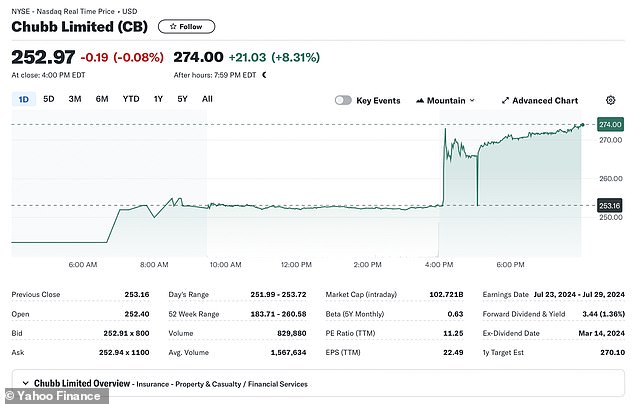

- The company’s shares rose eight percent on the news.

Warren Buffett’s Berkshire Hathaway revealed the name of the company in which they have a secret $6.7 billion stake, sending its shares up eight percent.

Berkshire disclosed the investment it has been building in insurer Chubb over the past nine months in a quarterly filing with the Securities and Exchange Commission.

They revealed that they owned nearly 26 million Chubb shares at the end of March, giving them a 6.4 percent stake in the company.

Chubb shares then immediately rose more than seven percent in after-hours trading, peaking more than eight percent to sell for $274.

Shares often soar when Berkshire reveals new holdings, as many investors closely follow its portfolio and trust companies with Buffett’s “seal of approval.”

Warren Buffett’s Berkshire Hathaway on Wednesday revealed a $6.7 billion investment in insurer Chubb.

Berkshire had received special permission from the SEC to keep Chubb’s investment secret.

Buffett has chosen to do this in the past to prevent other investors from copying him before he finishes buying.

He obtained similar permission from the SEC for Berkshire’s investment in Chevron and for previous investments in Exxon Mobil, IBM and Verizon in recent years.

The investment in Chubb is in line with typical Berkshire interests, as the conglomerate has always invested heavily in insurance companies such as Geico and General Reinsurance.

Some will now speculate that Berkshire could one day buy all of Chubb.

Berkshire owns many other companies, including the BNSF railroad, several utilities, and a variety of manufacturing and retail companies.

CFRA Research analyst Cathy Seifert said in a note to investors that Chubb is now one of the 10 largest holdings in Berkshire’s portfolio.

She wrote: “We cannot speculate whether Berkshire would pursue a full acquisition of CB, but we note that their business combinations are highly complementary.”

The quarterly filing does not clearly say whether Buffett or one of Berkshire’s two other investment managers made the investment in Chubb, but Buffett typically manages all holdings worth $1 billion or more.

Buffett already revealed some of Berkshire’s most notable moves in the company’s presentation annual meeting of shareholders earlier this month.

Following the announcement, Chubb shares immediately rose more than seven percent in after-hours trading, peaking more than eight percent to sell for $274.

Berkshire sold just over 116 million Apple shares in the quarter – representing about 13 percent of its stake – to trim its largest single investment.

But he still owns nearly 790 million Apple shares, and Buffett told shareholders he expected the iPhone maker to remain a long-term holding.

Buffett also revealed at the annual meeting that Berkshire had sold all of its investments in Paramount Global at a loss.

That happened after the first quarter ended because Wednesday’s report showed Berkshire still owns more than 7.5 million shares.

Berkshire has also been filing regular updates as it buys Liberty Media shares because it owns more than 10 percent of those shares. According to the latest reports, Berkshire owned 70 million shares of Liberty Media Series C and more than 35 million shares of Liberty Media Series A.

Those shares track shares of satellite radio provider Sirius XM and have been selling at what appears to be a discount to Sirius XM stock, according to Morningstar. Berkshire reduced its stake in Sirius XM during the quarter.

Wednesday’s filing revealed a number of other changes during the quarter, including the sale of all of Berkshire’s remaining 22.8 million shares of HP Inc. shares. He also reduced his holdings in shares of Chevron and Louisiana Pacific.

Berkshire ended March with $189 billion in cash and equivalents.