- The Switch successor was previously expected to launch in 2024.

- Nintendo is delaying the console because it lacks a solid lineup of new titles

- Bloomberg reported that the new console may not ship until March 2025

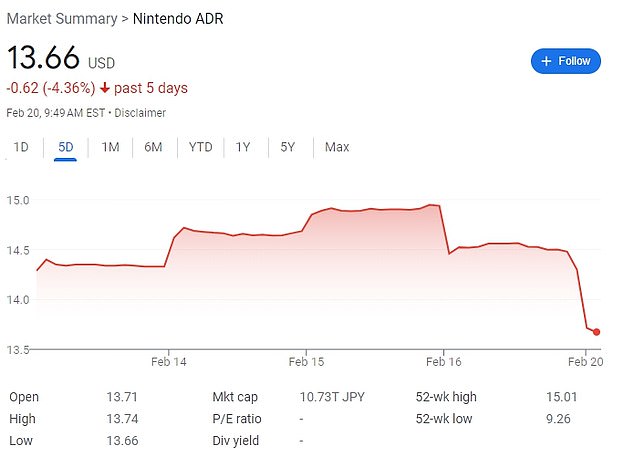

Nintendo shares fell on Monday when the video game maker announced that its latest console won’t ship until after Christmas.

The Japanese firm fell almost 10 percent after revealing that it would delay the launch of its Switch 2 console from the last quarter of 2024 to early 2025.

Investors are worried that the delay will translate into weak profits this year. Sales of the seven-year-old first-generation Switch have stalled and the delay means there will be no replacement ready to meet holiday demand.

The current Switch console costs around $300 plus tax. Analysts expect the new version to cost $400 or more, with games costing around $70 compared to $50.

An announcement for the new console, which has yet to receive an official name, is expected within six months.

Nintendo’s first-generation Switch launched in 2017, and after peaking in 2021, sales are now declining. Mario Kart has been a best-selling game

Company President Shuntaro Furukawa (pictured) did not address the delays directly during an earnings conference call.

Mario has been a star character in Nintendo games since the 80s.

Some of Nintendo’s publishing partners have been informed that the game won’t be released until March of next year at the earliest. Bloomberg reported.

The original Switch was announced in October 2016 and released in March 2017. Although sales didn’t peak until 2021, when Nintendo sold nearly 29 million units, they have been steadily declining since then.

This year they are expected to sell half for just over 15 million.

Company president Shuntaro Furukawa did not address the delays directly during an earnings call, but said Nintendo is looking to “maintain the momentum of the Switch business.”

The launch delay was due to a shortage of first-party games ready to ship with the new console, according to Video Games Chronicle.

Nintendo Co. fell nearly 10 percent after it told game makers it would delay the next generation of Switch until early 2025.

Nintendo Switch can be used as a portable device or connected to a television

Nintendo is behind famous video game series like Mario Bros and The Legend of Zelda, with decades-old titles now giving the company enormous value.

To boost sales of a new console, new games will need to be released alongside the new console.

Last year, Nintendo financed the hit movie Super Mario Bros, which had a massive global opening of $377 million in five days, the largest opening weekend in the history of an animated title globally.

The company was last week ranked as Japan’s richest company after filings revealed it had more than $11 billion in cash assets and no debt.