Billionaire James Dyson today launched a brutal attack on “short-sighted” and “stupid” bureaucracy and high taxes in the UK.

The tycoon said Britain was trapped in a state of “Covid inertia” which was slowing the economy.

Sir James, who backed Brexit and has an estimated net worth of £23bn, accused the Conservative government of “interfering” and “penalizing the private sector”.

He also complained that workers’ failure to return to the office after the pandemic has “severely damaged the country’s self-confidence and work ethic.”

The comments come amid growing pressure from Conservative ministers and MPs for Rishi Sunak and Jeremy Hunt to introduce tax cuts.

The Prime Minister and Chancellor have rushed to generate revenue, insisting their priority is stabilizing the government’s finances following the disastrous Liz Truss crisis.

However, there are concerns after the Treasury made clear there is no prospect of tax cuts in the March Budget.

MailOnline understands that there is instead pressure from the Cabinet for Hunt to ease the crushing burden on Britons by the autumn, with fears it may be the only “narrow path” for the Conservatives to win the next election.

Billionaire James Dyson (left) today launched a brutal attack on “short-sighted” and “stupid” bureaucracy and high taxes in the UK. The comments come amid growing pressure from Conservative ministers and MPs for Rishi Sunak and Jeremy Hunt (R) to introduce tax cuts.

Writing in The Daily Telegraph, Sir James also called on Chancellor Jeremy Hunt to use the spring budget to “incentivise private innovation and demonstrate his ambition for growth”.

‘The Government seems determined to move in the opposite direction by introducing stifling regulation, greater interference with business and thinking it can impose tax upon tax on business in the belief that penalizing the private sector is a free victory in the polls. ‘

Sir James warned: “This is as short-sighted as it is stupid.” In the global economy, companies will simply choose to transfer jobs and invest elsewhere.

“Our country has an illustrious history of enterprise and innovation, born of a culture that we are in the process of extinguishing.”

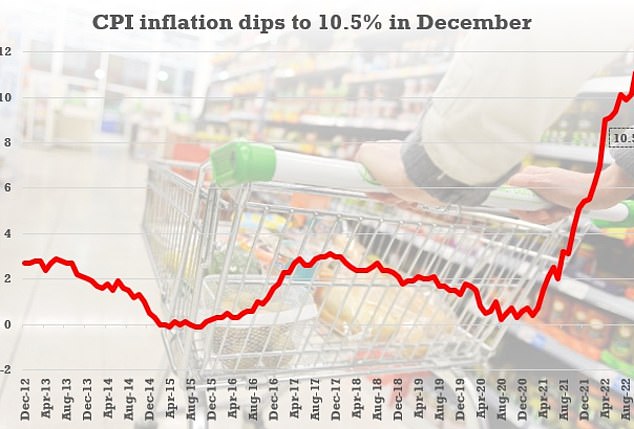

The negative assessment came despite glimmers of hope that inflation might be easing.

Yesterday’s figures showed headline CPI finally coming down from 40-year highs, with a rate of 10.5 per cent in the year to December.

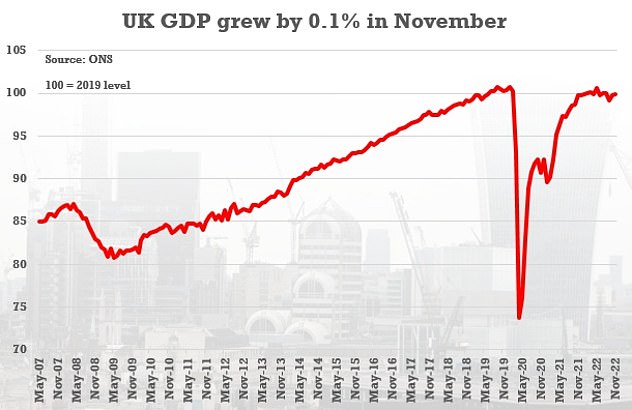

GDP data has also held up slightly better than analysts expected, and the UK could avoid a technical recession in the final quarter of 2022.

Conservatives believe the government should have a little more room to maneuver after energy costs fell, reducing liabilities for subsidies on household bills.

A senior minister told MailOnline that Rishi Sunak and Hunt would make the decision, but a likely election in the second half of next year should focus minds. Tax cuts could help improve Rishi Sunak’s standing and morale in the final year of parliament.

The minister said there was “some reason for hope as the economic data looks slightly better.”

Inflation fell slightly in December after hitting a 40-year high in October

GDP data has also held up slightly better than analysts expected, potentially avoiding a technical recession in the final quarter of 2022.

“Bills are starting to go down, inflation could be going down,” they said.

“If we can make some savings on things like the energy bill plan, if the economy is stronger because we’ve stabilized the government, we could get back to the issue of tax cuts soon.”

They added: ‘It’s a narrow road. We need a better economy, to persuade people to trust us with the NHS. Maybe we need to get lucky with Ukraine and hope Starmer makes mistakes.

‘But it’s all about impulse. “If we get to 2024 and put some money back in people’s pockets, everything will be at stake.”

A Treasury source insisted tackling inflation was the “priority” for Hunt.

‘We want low taxes and solid money. But sound money has to come first because inflation eats away at the pound in people’s pockets even more insidiously than taxes,” they said.

However, they acknowledged that the Bank of England anticipates that the prime minister’s goal of halving inflation could be achieved in the final quarter of the year.