Treasury Secretary Janet Yellen surprised an interviewer when she was asked if she herself had experienced “sticker shock” at the supermarket due to inflation.

A growing economy could inspire confidence in Biden’s leadership before the election, but the issue of persistent inflation could derail it.

Grocery prices have risen double-digit percent under Biden, as Americans are routinely shocked by the cost of a typical trip to the store.

Yellen- which is worth about 20 million dollars – said he goes to the supermarket “every week” and is not surprised by the prices.

‘It’s a surprise, isn’t it? “If you look at shipping costs, they’re down, global food prices are down, but food prices are still high,” said Jennifer Schonberger.

Treasury Secretary Janet Yellen surprised an interviewer when she was asked if she herself had experienced “sticker shock” at the supermarket due to inflation.

Without even letting her finish the question, Yellen responded bluntly: “No.”

“I think it largely reflects the cost increases, including increases in labor costs that grocery companies have experienced, although there may be some increases in margins,” Yellen added.

Yellen added that she expects inflation to come down and says she will “return to the Federal Reserve’s two percent target” early next year.

The Biden administration announced new measures to increase access to affordable housing, as still-high prices for food and other necessities and high interest rates have sharply raised the cost of living in the years since the pandemic.

Yellen touted the new investments Monday during a visit to Minneapolis.

The investments include providing $100 million through a new fund to support affordable housing financing over the next three years, boosting affordable housing financing from the Federal Financing Bank and other measures.

He blamed the continued slow decline in inflation on housing costs rather than the administration’s policies.

The question of inflation and the economy remains one of the main issues for voters ahead of the 2024 elections.

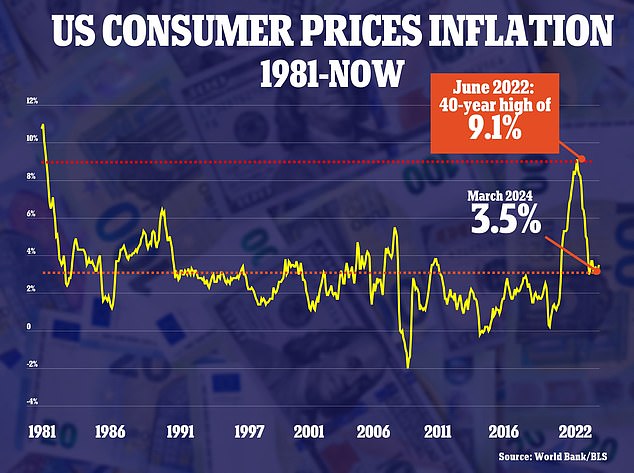

Inflation rose to 3.5 percent in March as prices rose due to the high cost of housing and gas.

The annual inflation rate fell slightly to 3.3 percent in May, down from the previous month.

This is below the 40-year high of 9.1 percent in June 2022, but still above the Federal Reserve’s 2 percent target.

Trump constantly talks about inflation during his presidential campaign.

Biden, in a May interview with CNN, claimed that polls are wrong and that Americans battling inflation have more cash in their pockets, saying, “They have money to spend.”

He admitted that inflation, one of the biggest factors that sank Biden’s popularity in the first half of his term, was real.

“It’s real, but the fact is that if you look at what people have, they have money to spend,” he said.

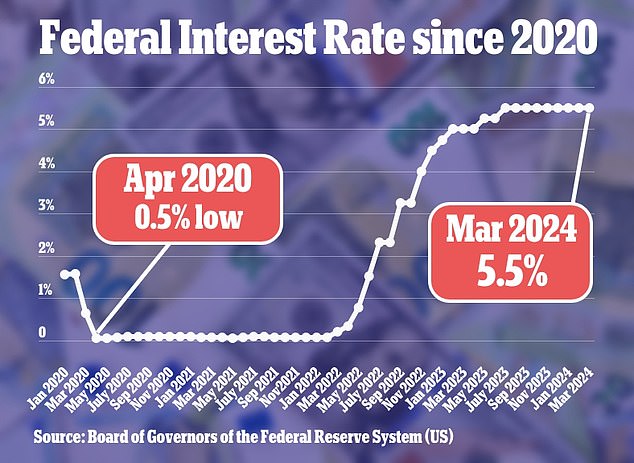

Investors had previously forecast around four rate cuts this year. However, the Federal Reserve chose to keep rates at their current level during its last meeting in March.

He blamed “greedy corporations” for a lack of consumer trust.

‘It makes them angry and it makes me angry that we have to spend more. For example, the whole idea that you have…inflationary contraction…it’s like 20% less for the same price, that’s corporate greed. “It’s corporate greed and we have to deal with it.”

Many were angered on social media by Biden’s comments, as Americans continue to struggle.

Since prices soared in 2022, the Biden administration has been defending the economy.

The president now wants to draw attention to former President Trump’s actual economic proposals, which are expected to be a key topic of the presidential debate later this week.

Trump’s top proposals include imposing a 10 percent tariff on all imports, a 60 percent tariff on Chinese imports, reducing corporate taxes and eliminating taxes on tipped wages.

Meanwhile, Biden plans to raise taxes on corporations. He has also kept his promise not to raise taxes on households earning less than $400,000, as families continue to feel the impact of rising prices.

However, historical trends relative to the broader economy could prove a winner for Biden over Donald Trump in November.

Historically, the state of the U.S. economy in the run-up to an election has been strongly correlated with how the country votes.

Investors often look for patterns of how markets have performed in the past to predict what might happen in the future.

Inflation is eroding the purchasing power of most Americans, which potentially bodes well for Donald Trump. He is shown leaving the White House with Melania in January 2021.

An analysis of the returns of the S&P 500 over the past 90 years reveals that in election years in which the incumbent president is re-elected, economic growth is strong beforehand.

On the contrary, when the current president loses, America’s largest companies appear to be losing steam, sowing seeds of doubt about the country’s economy and leadership.

The performance of the S&P 500 index this year may therefore shed some light on who will win the November election, when incumbent President Joe Biden will be challenged for a second term by Donald Trump.

It is currently pointing to a Biden victory as it remains consistently higher in the first half of the year.

Additionally, on Tuesday, a group of 16 Nobel Prize-winning economists issued a stark warning that inflation would be worse under Donald Trump.

The former president would reignite inflation and cause lasting damage to the US economy, the Nobel laureates said in a letter first obtained by axios.

“While each of us has different views on the details of various economic policies, we all agree that Joe Biden’s economic agenda is far superior to that of Donald Trump,” the letter said.

The warning was led by American economist Joseph Stiglitz, who won the prestigious economics honor in 2001.

However, the polls remain unfavorable for Biden: Trump is five points ahead of him heading into the first presidential debate on Thursday.

The winner of November’s presidential election faces a bleak fiscal outlook, with the national debt on track to reach a record share of the economy under the next administration.

Debt surpassed the $34 trillion mark earlier this year and is poised to surpass $56 trillion by 2034, according to projections earlier this month.

The Social Security trust fund is also headed toward depletion in 2033, when only 79 percent of scheduled benefits would be paid.

If Congress does not ensure that these programs have the resources to continue paying full benefits, this would mean that millions of Americans would see their monthly benefits cut.