Table of Contents

The products featured in this article are independently selected by This is Money’s specialist journalists. If you open an account using links marked with an asterisk, This is Money will earn an affiliate commission. We do not allow this to affect our editorial independence.

The infamous NS&I Premium Bond draw attracts millions of eager savers every month hoping to find out if they have won a big prize.

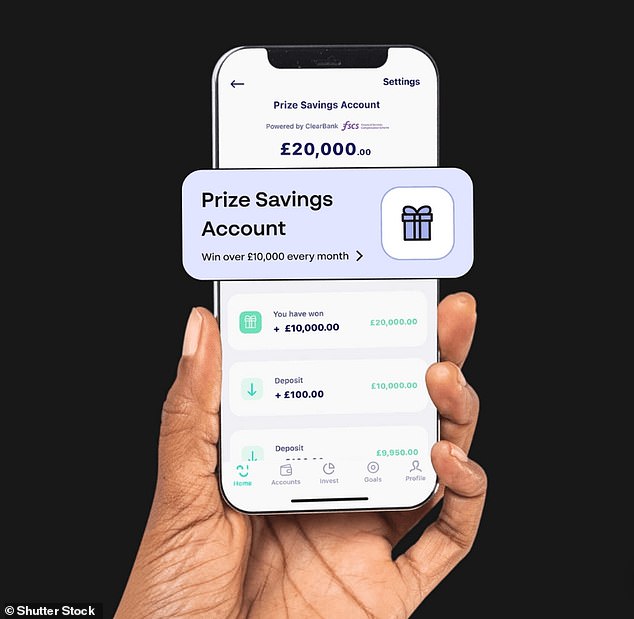

But savers who keep their money on the Chip* savings and investment platform also experience this anticipation.

That’s because Chip has a savings account that comes with a monthly prize draw where savers can win prizes of up to £75,000.

Many savers who have held Premium Bonds for many years regret never winning a big prize, even when they have the maximum of £50,000 or close to that amount.

We look at how the Chip draw prize works and whether it’s worth keeping large sums of money in this account for better chances of winning big.

Prize Alert: Chip’s Prize Account has a monthly draw with a prize of up to £75,000 on offer

How does the Chip Rewards Savings Account work?

The most important thing to note is that the Chip Rewards Savings Account does not pay any interest rates on deposits made into the account.

Instead, the average balance that savers maintain in the account allows the account holder to win a certain number of entries into the prize draw.

Savers must deposit and maintain at least £100 in the account throughout the month to be eligible to enter the draw. Every £10 held in the account equates to one entry into the draw.

Your average balance is calculated by dividing your daily balance by the number of days in the month.

For example, someone who deposits £1,000 at the start of the month and holds it throughout the month gets 1,000 entries, which could win a £75,000 prize, a £10,000 prize or £10 prizes, of which there are 250 in the draw.

For a saver who deposits £1,000 on the 20th of a 30-day month, the average balance will be calculated from 20 days of a £0 balance and 10 days of £1,000.

This would give you an average balance for the month of £354.84, which would give you 35 entries into the draw.

The drawing takes place during the first week of the month. The prize will be credited to the savers’ prize savings account within seven days of the drawing and Chip will contact the prize winners by email.

There is no need to register for a Prize account. Any Chip customer can participate if they deposit and maintain an average balance of £100 or more.

The number of participants fluctuates constantly throughout the month as members deposit and withdraw at different times and use it in the same way as any easy-access account.

The maximum you can deposit into the Prize Savings Account is £85,000 – you cannot deposit more than this.

Savings Guru founder Jamers Blower said: ‘Obviously what Chip is doing is using the money that would have funded the interest to pay out the prizes. Unlike Premium Bonds, where the prize pool is determined by the balances held, Chip bears the risk of the payout.

‘So it’s not clear whether this is a very attractive account that they are making a lot of money from or whether it is less popular and is used to try to attract customers to Chip who could then save or invest in other products.

‘The jackpot was changed from £50,000 to £75,000 in July, which could suggest that the account is performing very well for Chip and he is therefore sharing more of the returns with savers.’

Is it worth saving on the Chip account?

As with any lottery, there is a chance that you will win nothing at all. In addition, savers will not earn any interest on the money they have in the prize account.

If you would like to save money in one of Chip’s other accounts, such as your Easy Access account or Easy access isa*would obtain a guaranteed return of 4.84 percent.

If you want the chance of winning £75,000, it might be worth keeping a small portion of your savings in this account, but not all of it, as you could earn interest elsewhere.

It is a novel alternative to Premium Bonds, but 99% of savers will get better results if they earn interest on their savings.

Andrew Hagger, founder of MoneyComms, said: ‘The downside to the account is that you don’t get any interest, except for one £75,000 prize and one £10,000 prize. All the others are just £10 prizes (250 in total).

‘If you put £10,000 into the Chip Isa at 4.84 per cent, you’re guaranteed a return equivalent to £40.33 every month for the next 12 months. I know it’s a bit of fun and your money isn’t at risk, but I think I’d always go for the Chip Isa option.

Blower said: “It’s a novel alternative to Premium Bonds, but ultimately 99 per cent of savers will benefit more from earning interest on their savings. However, for those willing to forgo the interest, it’s a relatively risk-free opportunity to hope for a jackpot win.”

How is it different from the Premium Bond draw?

Savers can win one of two £1m prizes in the Premium Bond draw, and the top prize on offer in the Chip draw is £75,000.

With over 22 million customers, there are also many more prizes on offer in the Premium Bonus draw.

In the August Premium Bond draw, a total of 5.9 million prizes worth £457 million were paid out, including two £1 million prizes, 87 £100,000 prizes and 176 £50,000 prizes.

Currently, the underlying prize rate for Premium Bonds is 4.4 percent and each £1 has a 21,000 to 1 chance of winning each month.

In last month’s draw, Chip’s £75,000 winner won the prize with 296 entries and the £10,000 winner won the prize with 441 entries.

Premium Bonus prizes are completely tax-free. All prizes won in the Chip draw are also tax-free.

One of the key differences between NS&I savings accounts and other offerings is that because NS&I is backed by the Treasury, any money you invest is 100 per cent protected.

This means the bonds are attractive to people willing to pay more than the amount backed by the Financial Services Compensation Scheme (FSCS) – up to £85,000 per person or £170,000 for joint accounts.

Chip accounts are part of the FSCS and are covered by Clear Bank. The maximum you can deposit into a Chip Rewards account is £85,000, while the maximum you can deposit into Premium Bonuses is £100,000.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible ISA now accepting transfers

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.