Apple is the favorite in a tight three-way race to clear the $4 trillion hurdle for the first time. But with a current stock valuation of $3.6 trillion, the iPhone maker is closely watched by microchip pioneer Nvidia, whose stock has had a surprising run, fueled by booming artificial intelligence (AI) spending. .

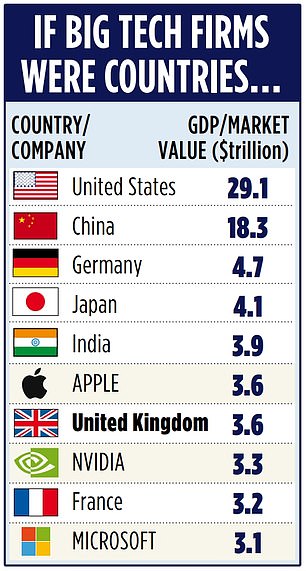

It is now worth $3.3 trillion. Software giant Microsoft is hot on its heels with $3.1 trillion. To put these huge figures into context, Apple is now as big as the entire annual output of the British economy, closely followed by Nvidia and Microsoft (see table below).

They have emerged from the group of the so-called “magnificent seven” stocks that increasingly dominate the US and global stock markets.

Between them, the seven – including Google parent Alphabet, online retailer Amazon, Facebook-owner Meta, and electric car giant Tesla – account for a third of the benchmark S&P 500 index of top US companies. .

But the big three have distanced themselves from the rest of the market – to such an extent that Alphabet, its closest rival – is lagging behind with a valuation of “only” $2.4 trillion.

Microchip pioneer Nvidia, whose stock has had an incredible run, has been boosted by the boom in artificial intelligence spending. In the photo: Nvidia boss Jensen Huand

All of this is important because even if you don’t own these stocks directly, UK savers are increasingly exposed to their fortunes, especially if they invest in tracker funds, which track indices such as the S&P 500, or in mutual funds. focused on technology.

So which of the trio will take home the $4 billion prize? Or could investors, who have enjoyed the ride, be headed for a slide?

Experts say it’s not a matter of “if” but “when” the milestone is reached, although there may be some heart-in-mouth moments along the way.

“The issue of the first $4 trillion company may only be a matter of time, but there are some emerging signs of fatigue among investors who have gotten caught up in the euphoria surrounding all things AI,” says Richard Hunter. , head of markets. on the Interactive Investor investment platform.

“Based on current sentiment and outlook, it appears that Apple is the favorite to reach the milestone first, followed by Nvidia and Microsoft as something of a dark horse.”

Of the three, Apple has experienced the slowest sales growth and has been the slowest to embrace the artificial intelligence revolution.

“Apple’s journey with AI is a bit like the tortoise and the hare,” says Susannah Streeter, head of money and markets at investment firm Hargreaves Lansdown.

Apple is the favorite in a tight three-way race to clear the $4 trillion hurdle for the first time. In the photo: Apple CEO Tim Cook.

Other companies have invested billions of dollars in AI with no clear path to monetize their huge investments. Therefore, Streeter believes that Apple’s caution may pay off in the long term.

“While Apple wasn’t the first to pass the race in the AI race, its cautious approach could end up being a shrewd move,” he adds.

For that to happen, Apple must continue to offer features that capture users’ imagination in its updates; Otherwise, its future growth could stagnate, Streeter warns.

Apple’s recent share price rise has been fueled by better-than-expected iPhone sales in the latest quarter, as the first phase of its artificial intelligence features is rolled out. This has not been without some embarrassing failures.

The artificial intelligence feature on Apple’s latest smartphone has generated inaccurate alerts or completely false claims when summarizing breaking news notifications.

This led to the BBC complaining to Apple after one of its highlights claimed that Luke Littler had won the World Darts Championship, hours before the final began. (The predictive power of Apple’s robot cannot be faulted, however, since Littler won the title.)

Many iPhone users have kept their older phones because innovations have been fewer and fewer in recent years, Streeter says.

She says that “the big hope” is that there is enough substance in the new AI features to drive customers to update them frequently over the next few years, and predicts: “If this is the case, it could lead the giant to this milestone of 4 trillion dollars”.

Dan Ives, an analyst at wealth manager Wedbush, says: “Rome wasn’t built in a day, nor will Apple’s AI strategy.” But the seeds of that strategy are forming now and will transform the consumer growth narrative for years to come.”

Apple has a solid track record. It became the first publicly traded company to reach a $1 trillion valuation in 2018, surpassing Amazon. The $2 trillion milestone was reached two years later and it became the first $3 trillion company in 2023.

But Nvidia is moving quickly amid seemingly insatiable demand for its next-generation AI chips.

It took Nvidia 24 years to reach $1 trillion, but only nine months to double its size and just 96 days to reach $3 trillion last year.

Microsoft, led by Satya Nadella (pictured), is seen as “kind of a dark horse” in the three-way race to reach a $4 trillion valuation.

It took Apple 718 days to go from $2 trillion to $3 trillion, and Microsoft 649 days. So Nvidia has valuable momentum.

“Nvidia has a technological advantage that makes it difficult to overcome,” Streeter says. “It’s not just about dominating the market in terms of chips used in AI systems, but it has also developed platforms that allow users to optimize the hardware.”

But he wonders if Nvidia can continue at a breakneck pace and warns: “It has to scale more than Apple.” Given its stratospheric growth in 2024 and the recent share price swing, it may be beset by increased volatility this year.

Interactive Investor’s Hunter agrees, saying: “There have been questions about whether the tens of billions of dollars invested so far in AI will be repaid and, even if they turn out to be as profitable as some have predicted, in what timeframe.” This could happen.’

Nvidia is the highest-rated tech titan, raising fears it could fall further if its performance doesn’t live up to investors’ hopes. Expectations are so high that there is little room for error.

“Investors assume that Nvidia will demonstrate perseverance,” says Howard Marks, billionaire co-founder of Oaktree Capital.

He notes that of today’s “magnificent seven,” Nvidia may be “the sexiest,” but only Microsoft was in the top 20 of the S&P 500 at the height of the dot-com bubble a quarter-century ago.

It is also one of the six companies that can boast about it, while other technology companies such as Intel, Qualcomm and Cisco disappeared.

Marks says that in bubbles, investors are willing to pay high prices for favored stocks and behave as if the companies “will surely remain leaders for decades.”

“Some do and some don’t,” he says. In other words, not all tech giants will stay the course.

You have been warned.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.