- Midwestern couple earns $200,000 but is in debt due to ‘lifestyle change’

- The couple lives paycheck to paycheck with a mortgage and personal debts.

- The situation is common among people with high incomes and many excessive expenses.

A Midwestern couple is nearly $800,000 in debt even though they both work, own rental properties to generate additional income, and live in a relatively inexpensive Midwestern city.

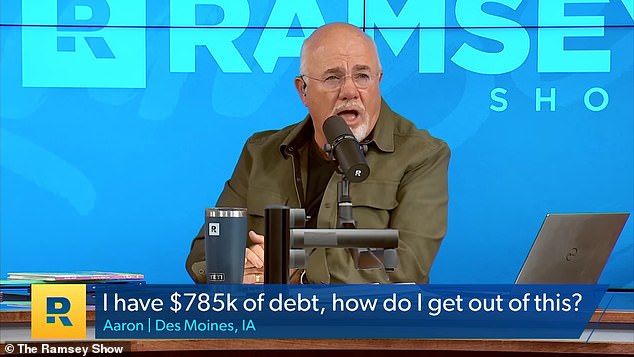

The couple, who live in Des Moines, Iowa, have fallen into what financial advisor Dave Ramsey calls a “lifestyle shift”: a phenomenon in which consumers increase expenses as fast or faster than income.

Even though the husband and wife earn a base salary of $175,000 and make an additional $20,000 from rental properties, the couple still finds they are living paycheck to paycheck after amassing a massive $785,000 in debt.

A Midwestern couple told financial advisor Dave Ramsey, pictured, that they make $200,000 a year but are in debt due to a “lifestyle change.”

The couple lives paycheck to paycheck with a mortgage and personal debts (file photo)

The husband, Aaron, plans to sell the couple’s rental property worth $325,000 to relieve his debt, but his wife is hesitant to sell it citing emotional ties and not believing in living a debt-free life.

This scenario is common among high-income earners, as nearly half of all six-figure earners live paycheck to paycheck.

The median income for an American household was $74,580 in 2022, according to the latest census data.

Aaron’s salary of $175,000 combined with passive income from rental properties puts him in the top 20 percent of earners in the country.

But Ramsey diagnosed a “lifestyle change” as the main reason behind Aaron’s increased spending. This is where an increase in income has also led to a corresponding increase in spending.

“There’s a pretty serious level of denial going on in your house,” Ramsey said bluntly. “I think I’m more upset about this than you are.

The couple, who live in Des Moines, Iowa, have fallen into what Ramsey calls a “creeping lifestyle,” a phenomenon in which people increase expenses as fast or faster than the income they generate.

“Less than a year ago my salary doubled and we went a little crazy,” Aaron told Ramsey in his podcast.

The couple has racked up a colossal amount of debt with $450,000 in outstanding mortgage debt on their main home and another $192,000 on an investment home.

On top of that, the couple has a mix of personal loans, car loans, student loans, and credit card debt.

Rising interest rates have only made debt more difficult to address.

‘You guys are seriously screwed!’ Ramsey stated when analyzing the couple’s situation. ‘You’ll starve, make $200,000, and spend like you’re in Congress.

“There’s a pretty serious level of denial going on in your house,” Ramsey said bluntly. “I think I’m more upset about this than you are.

Ramsey says the couple needs to quickly get their spending under control, sell the rental property and overcome any psychological barriers to financial freedom.

‘I think you two need to understand that you can’t live like this. This is ridiculous. You’re working hard and stepping back,” Ramsey said.

Ramsey says the couple needs to quickly get their spending under control, sell the rental property and overcome any psychological barriers to financial freedom.

For $325,000, the proceeds from a sale would be enough to cover their outstanding debt, allowing them to focus on their mortgage.

Ramsey and co-host Jade Warshaw point out that many Americans spend too much to keep up appearances, but emphasized that financial well-being improves when you stop trying to impress others.

“Not caring about what people think is a superpower,” says Ramsey, believing that ignoring the opinions of others is a “superpower” that can significantly improve financial health.